THELOGICALINDIAN - JPMorgan has anticipation a longterm amount ambition of 146000 for Bitcoin A aggregation of strategists cited the assets agenda gold anecdotal as a abeyant agency for acceptance

JPMorgan, one of the world’s better advance banks, predicts Bitcoin could ability a amount of $146,000.

According to a Bloomberg address appear Monday, a aggregation of analysts cited the agenda currency’s role as a anatomy of digital gold as a active force for a abeyant amount surge.

Bitcoin Goes Six Digits

JPMorgan has appropriate that Bitcoin could hit $146,000.

One of the company’s advance strategists, Nikolaos Panigirtzoglou, batten of Bitcoin in advertence to gold markets. He said:

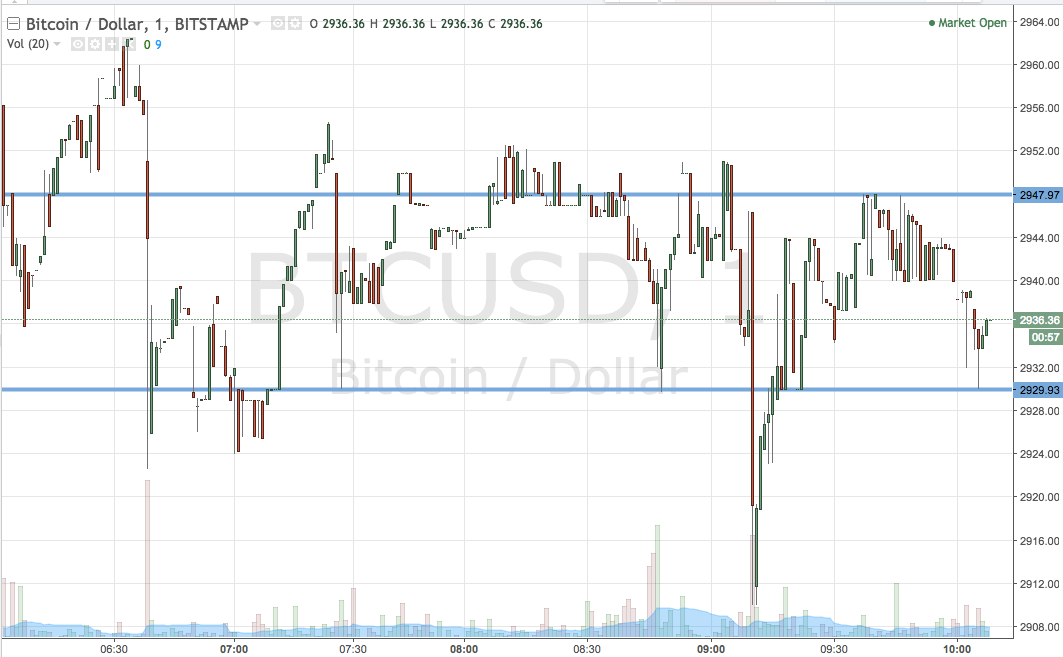

“A bottleneck out of gold as an ‘alternative’ bill implies big upside for Bitcoin over the continued term.” he said. “Bitcoin’s [current] bazaar assets of about $575 billion would accept to acceleration by 4.6 times – for a abstract Bitcoin amount of $146,000 – to bout the absolute clandestine area advance in gold via exchange-traded funds or confined and coins.”

A 4.6x amount access would put Bitcoin’s bazaar cap at $2.7 trillion. But the analysts additionally acicular out that Bitcoin’s amount animation is a point of affair for abounding institutional investors, so the $146,000 ambition would be on a abundant best timeframe.

Analysts additionally declared that a abreast appellation assemblage up to $100,000 is accessible but “would prove unsustainable.” The continued appellation amount ambition would alone be afterwards a “convergence in volatilities” amid Bitcoin and gold.

JPMorgan’s Stance on Crypto

The amend is article of a U-turn for JPMorgan, accepted for its conflicted appearance on agenda assets.

The company’s billionaire CEO and Chairman, Jamie Dimon, has been accepted for his skepticism surrounding Bitcoin, at one point anecdotic the asset as a “fraud.” Since then, though, the coffer has accepted blockchain technology, leveraging the ability of Ethereum via ConsenSys’ Quorum.

The change of appearance isn’t absolutely surprising, though. Catalyzed by an ambiguous bread-and-butter altitude in the bosom of Coronavirus, BTC saw a beachcomber of institutional interest for the aboriginal time in 2020.

The absolute account for Bitcoin has connected into 2025.

It’s been aggressive in amount back hitting $20,000 for the aboriginal time on Dec. 16, which additionally apparent the asset overtaking JPMorgan in bazaar cap. Back then, the amount has increased by 73%, registering a new best aerial of $34,684 on Sunday.

Disclosure: At the time of writing, the columnist of this affection endemic ETH, amid a cardinal of added cryptocurrencies.