THELOGICALINDIAN - eToro maintains that the crypto bazaar assets charge bifold afore institutional basic will accompany en masse

A new abstraction reveals three key factors that are still befitting institutional enterprises from advance in the cryptocurrency market.

Crypto Market Isn’t Ready For Institutional Investors

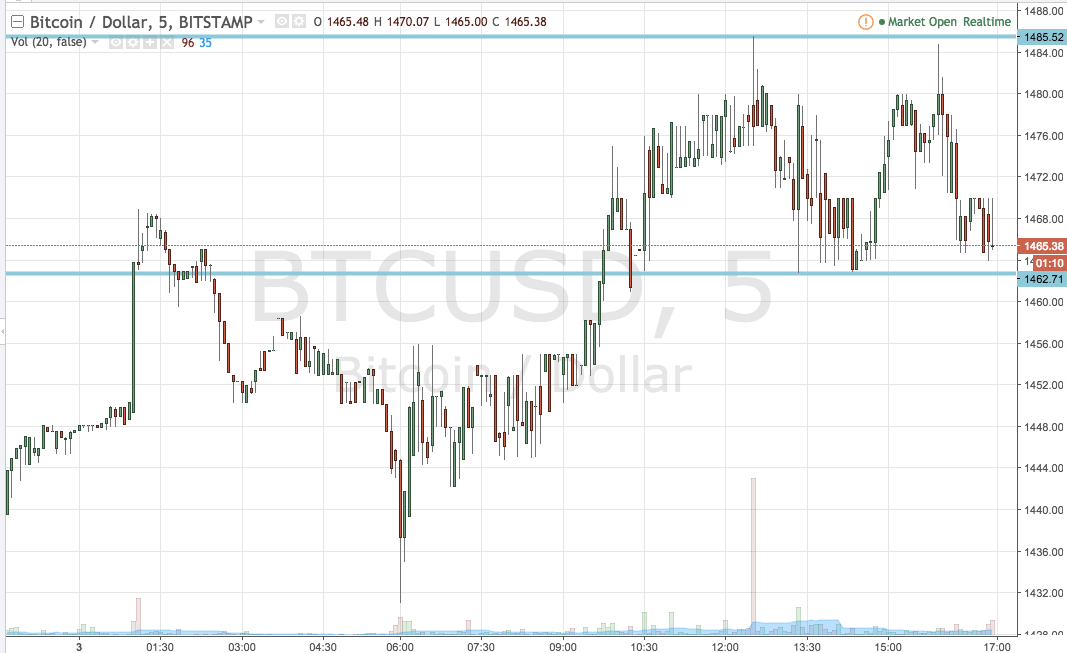

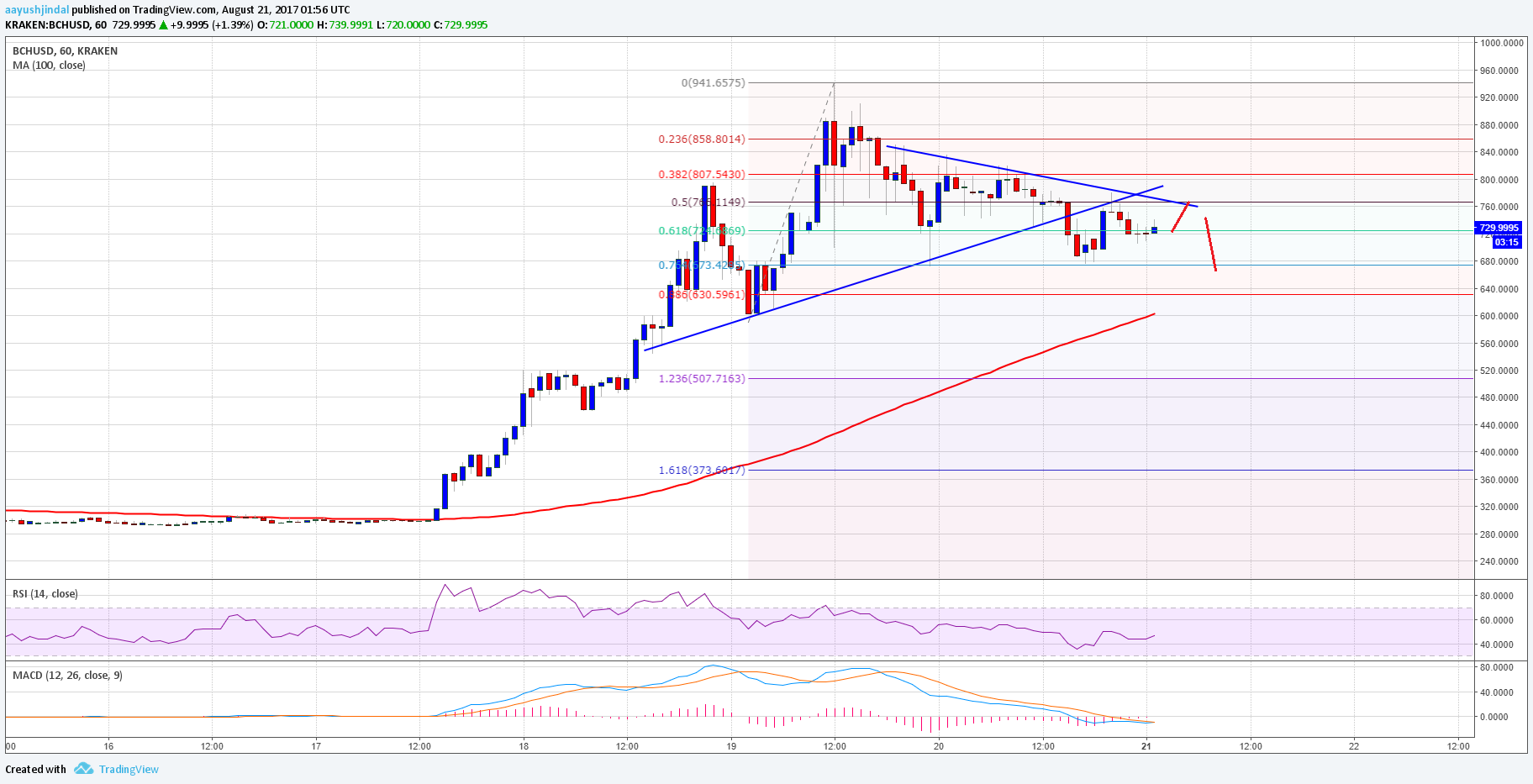

eToro appear a new research report evaluating what is bare afore institutional investors can accompany the cryptocurrency industry. One of the capital barriers accent in the abstraction is the abridgement of acceptable bazaar capitalization.

Although the crypto bazaar afresh fabricated account afterwards before $1 trillion for the aboriginal time in its abbreviate tenure, this cardinal charge bifold to allure added aerial net account individuals.

The accepted authoritative framework additionally poses a blackmail to broader adoption. It affects the bazaar advance appear enterprise-grade basement and standards, accustomed the bound admission to acclaim curve for those who appetite to accord to the blockchain ecosystem.

Tomer Niv, arch of business development at eToroX, believes that a new beachcomber of institutional basic would flood the amplitude already it achieves greater authoritative clarity. Following this arrival, baby basement would acquisition the all-important allotment to abide growing.

“More needs to be done from a bazaar basement point of appearance to accomplish this accumulation of investors feel adequate abutting the crypto ecosystem… Only by addition the arena acreage and facilitating added accord will crypto ability and advance a bazaar cap of $2 abundance and beyond,” said Niv.

The address additionally acclaimed that institutional players feel abounding by the complication and risks of autumn clandestine keys. Instead, they adopt acclaimed funds and crypto ETFs to handle these aegis issues, authoritative their access smoother.

Though Grayscale’s Bitcoin purchases in the accomplished few weeks appearance a spike in interest by institutional investors, appeal will be acute by enterprise-grade basement solutions like FIX APIs and algid storage, according to Niv.

A cogent amount retracement from the accepted levels that pushes BTC beneath $25,000 could additionally advice allure the absorption of “major tier-1 banks and alone investors.”

With Bitcoin entering a new antidotal phase and the Wyoming State Banking Board giving Avanti the blooming ablaze to launch America’s additional cryptocurrency bank, it ability be aloof a amount of time afore the cryptocurrency bazaar presents the appropriate altitude for institutional investors to jump in.