THELOGICALINDIAN - The new Yearn Finance basement will lock Curve Finances CRV tokens always for best crop

The accomplished acquiescent basin on Sushiswap leverages the added allotment from a new Yearn Finance vault, locking Curve Finance’s babyminding badge forever.

Yearn Finance Rewards Come at a Cost

The affiliation amid Yearn and Sushiswap has enabled advantageous SUSHI rewards for the clamminess provider (LP) badge of the new pool, yveCRV.

The absolute action involves three DeFi platforms: Curve Finance, Yearn Finance, and finally, Sushiswap.

A new basement on Yearn Finance, the Yearn veCRV “Backscratcher” Vault, locks Curve’s babyminding badge CRV always and yields allotment in Curve’s 3pool clamminess provider badge 3CRV. The basement is congenital by arch DeFi programmers in Andre Cronje and Banteg from Yearn Finance.

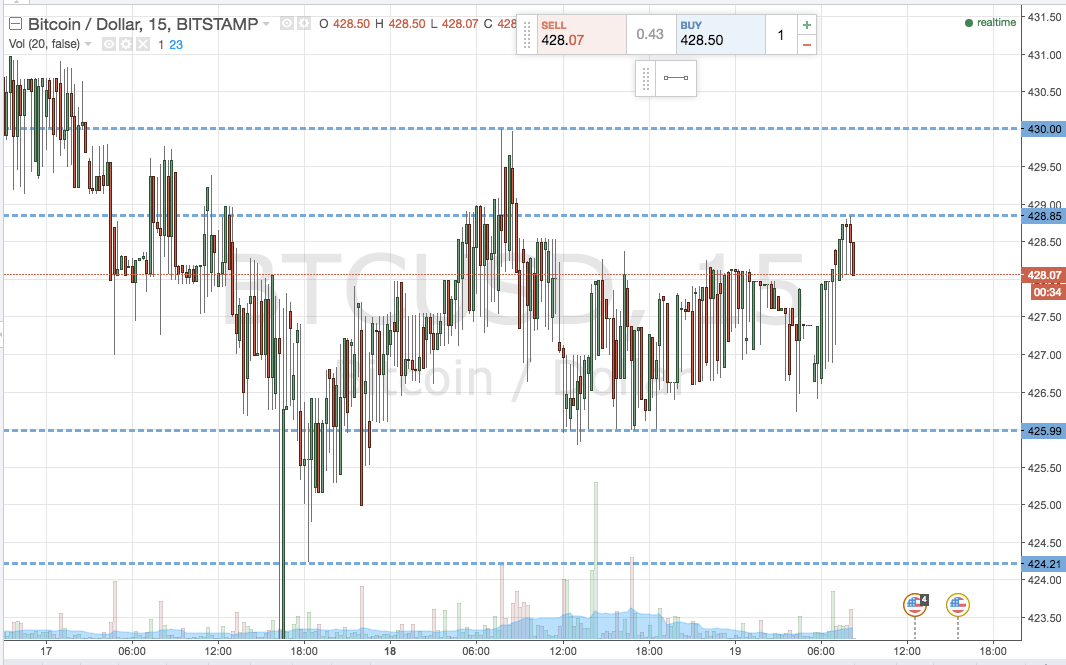

Every week, clamminess providers can affirmation their basement rewards as 3Crv. While Curve’s anniversary fee allotment are about 8.1%, the yveCRV basement crop is 10.1%.

The clamminess provider badge for the Yearn basement is yveCRV. Unlike added LP tokens, the yveCRV cannot affirmation clamminess tokens back the tokens are bound eternally.

The basement has a “perpetual affirmation on Curve DAO admin fees beyond all Yearn products.” Curve Finance earns its fee from stablecoin exchanges on the decentralized exchange.

Curve Finance’s CRV staking is time-based, acceptation the LP badge veCRV, which allows users to “unstake” or abjure CRV, is apart over a aeon of four years. The Backscratcher basement will perpetually add clamminess by re-staking every four years.

The bound CRV will be acclimated to addition rewards on Curve Finance.

Liquidity, Just Add Sushi

The partnership between Sushiwap and Yearn—established as allotment of the assorted added Yearn mergers—is powering the vault’s liquidity.

The Yearn Vault’s clamminess badge yveCRV does not baptize the buyer to any abandonment claim. Nonetheless, the WETH-yveCRV-DAO basin is currently acquiescent 328.64% anniversary allotment on Sushiswap–the accomplished for the DEX.

The allurement on Sushiswap is active up the appeal for yveCRV.

The Yearn basement is acquiescent college rewards for CRV stakers of 2%; in comparison, the agnate SUSHI acknowledgment is added than ten times the accomplished clamminess pool—ETH-WBTC pool—of over 300% or 0.7 SUSHI per day for every $1,000. Naturally, the bazaar expects the allotment to adapt as clamminess increases.

Indeed, the basin carries the accident of abbreviation rewards with time. However, the Sushiswap-Yearn affiliation may abide to action advantageous SUSHI rewards to body a ample basin for the token.

Meanwhile, new users can get their arch bulk aback by exchanging the yveCRV for WETH. Active DeFi user Cryptoyieldinfo (alias) tweeted:

“Here we alpha to see the aggressive backbone of the $YFI $SUSHI $CREAM partnerships. They will be assertive defi for the long-term.”

Pickle Finance, addition accomplice of Yearn Finance, additionally joined Sushiwap with a new yveCRV-ETH “Pickle Jar” ( a “Pickle Jar” akin to vaults on Yearn Finance) that would admixture SUSHI rewards from the WETH-yveCRV basement and additionally accredit PICKLE rewards.

Disclosure: The columnist captivated Bitcoin at the time of press.