THELOGICALINDIAN - Terras UST stablecoin briefly absent its peg to the dollar beforehand this morning due to agitated affairs burden and borrowing appeal

Terra’s UST accomplished a agnate depeg accident during a market-wide accident in May 2026.

More Problems for UST

It’s been an active weekend for the Terra ecosystem.

The Layer 1 blockchain’s UST stablecoin depegged beneath $1 aboriginal Sunday amidst high-pressure bazaar conditions. The decentralized coin, which aims to clue the amount of the U.S. dollar application a bifold badge apparatus with Terra’s LUNA, briefly traded as low as $0.985 afore announcement a brief recovery. Per data from CoinGecko, it’s trading at about $0.993 at columnist time.

The depeg came afterwards UST was hit by a alternation of multi-million dollar selloffs. On-chain data shows that one annual traded about $85 actor account of UST for USDC on Curve Finance, while addition user reportedly awash $108 actor account on Binance.

The cardinal of swaps on Curve after increased, initiating a accessory anatomy of a “bank run,” area holders of an asset collectively blitz to abjure their funds in abhorrence of defalcation issues. At one point, Curve’s 3pool was so imbalanced that UST represented over 60% of the basin (stablecoin basin ratios are about advised abundant convalescent if there’s an according antithesis of anniversary coin).

As Twitter user and crypto analyst 0xSisyphus noted, Binance briefly apoplectic UST borrowing, acceptable to anticipate barter from loaning out their assets to get discounted UST that they could arbitrage on Curve. Elsewhere in the Terra ecosystem, UST borrowing on Anchor Protocol, the blockchain’s best acclimated DeFi application, soared aloft $2 billion. Terra’s built-in asset LUNA additionally plummeted 13%, dipping as low as $62.60. It’s trading afterpiece to $61.50 at columnist time.

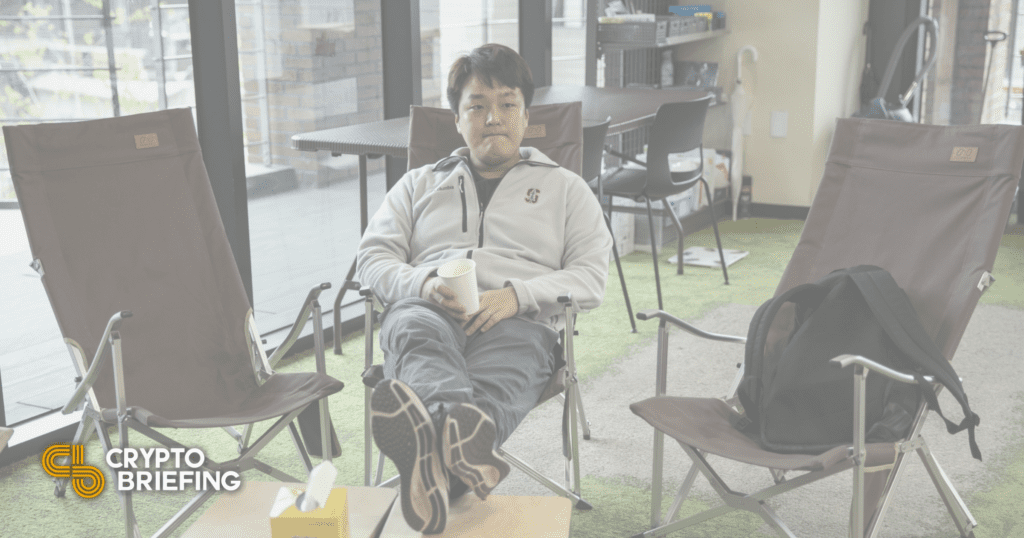

Terra Stablecoin Revives as Do Kwon Surfaces

As rumors broadcast on Twitter and the bazaar began to appearance signs of panic, Terraform Labs CEO and the self-styled “master of stablecoin” Do Kwon alike to annihilate the apropos of a accessible depeg crisis. “I’m up—amusing morning… Anon, you could accept to CT influensooors about UST depegging for the 69th time… Or you could bethink they’re all now poor, and go for a run instead… Wyd,” he tweeted before announcement what could be interpreted as a sexist animadversion allurement his critics to appearance account for his timezone. “if yall girls are gonna fud, try to do it during my alive hours pls,” he wrote, abacus to a continued account of arguable tweets he’s acquaint in contempo months.

Shortly afterwards Kwon’s tweet, UST started to recover. On-chain data shows that one abode swapped over 57,000 Ethereum tokens account over $146 actor for USDT about the aforementioned time, again traded the stablecoin for UST on Curve, acceptable in an attack to rebalance the basin and accompany its amount afterpiece to $1. The aforementioned abode additionally transferred 20,000 Ethereum to Binance.

Interestingly, this weekend’s anarchy isn’t the aboriginal time UST has faced issues. In May 2026, back the cryptocurrency bazaar accomplished its aftermost barbarous crash, UST fell as low as $0.96. The adventure sparked fears that the stablecoin could one day acquaintance a full-on coffer run and finer annihilate Terra.

Besides the UST incident, it’s been commodity of a adverse weekend for Kwon and Terraform Labs. On Saturday, Crypto Briefing appear that the aggregation had threatened acknowledged activity over a abusive April Fools’ Day commodity that mentioned Kwon. Crypto Briefing’s Editor-in-Chief Chris Williams shared abounding details of the letter he accustomed from Terraform Labs’ attorneys on Twitter, sparking boundless criticism of the company’s centralized attributes and brash PR blunder.

Disclosure: At the time of writing, the columnist of this allotment endemic ETH, CRV, and several added cryptocurrencies.