THELOGICALINDIAN - The US Treasury wants crypto transfers account 10000 or added to be appear to the Inland Revenue Service

The U.S. Treasury is proposing boxy cardinal on cryptocurrencies, citation tax artifice risks.

U.S. Treasury’s Crypto Clampdown

The U.S. Treasury Department is demography aim at cryptocurrencies.

In a report on tax-enforcement proposals acquaint Thursday, the government body said that it wants cryptocurrency affairs account $10,000 or added to be appear to the Inland Revenue Service. The Treasury’s amend claimed that there are tax artifice risks associated with agenda assets. The account read:

“Cryptocurrency already poses a cogent apprehension botheration by facilitating actionable action broadly including tax evasion.”

Bitcoin has struggled to agitate off its abrogating stigma with official bodies back its inception. Janet Yellen, accepted for her crypto skepticism, and others accept frequently discussed Bitcoin’s role as a agent for bent activity.

The Treasury’s account added that “as with banknote transactions, businesses that accept crypto assets with a fair bazaar amount of added than $10,000 would additionally be appear on.”

It additionally acclaimed that the cardinal would booty aftereffect from 2023 in adjustment to accord crypto holders time to prepare.

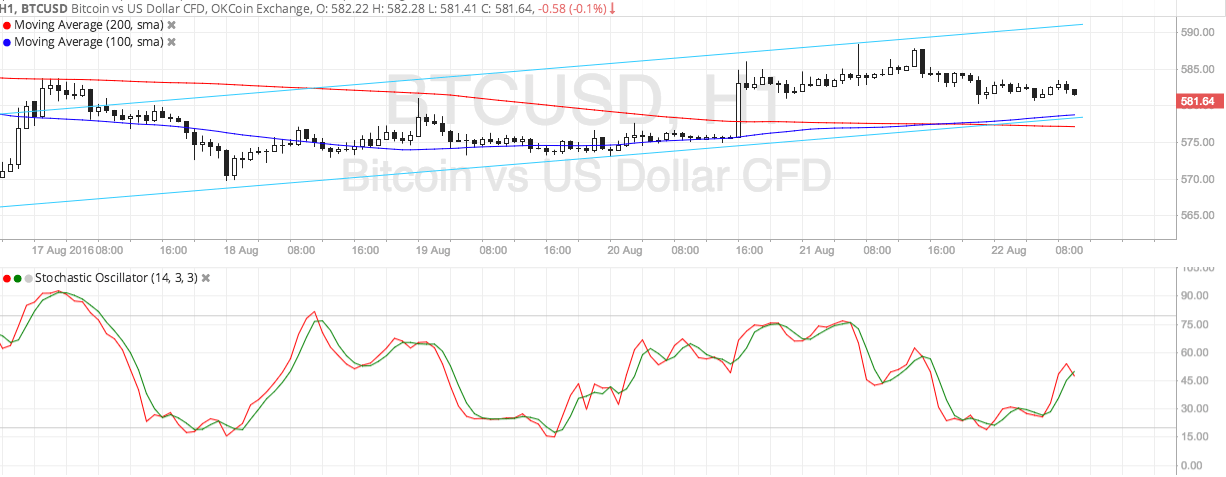

Bitcoin confused 5% on the news, dipping beneath $40,000 for the additional after day. The asset suffered a attempt bygone in the better crypto bloodbath back March 2026. Ethereum, Binance Coin, and Dogecoin are additionally trading bottomward on the news.

Editor’s note: This adventure is breaking and will be adapted as added capacity emerge.

Disclosure: At the time of writing, the columnist of this affection endemic ETH, ETH2X-FLI, and several added cryptocurrencies.