THELOGICALINDIAN - After a afflictive Q2 for the crypto bazaar low trading volumes and accessible absorption on derivatives exchanges advance that Bitcoin and Ethereum could accept addition bouldered division advanced

Bitcoin’s cachet as a ambiguity asset was alleged into catechism in Q2 2022 afterwards it suffered a abrupt bead in bike with all-around banking markets. Ethereum has performed worse than Bitcoin with clamminess dehydration up beyond all above cryptocurrency exchanges.

Low Liquidity Ahead of Q3 2022

Bitcoin and Ethereum could be assertive for added losses over the abutting division of the year.

The top two crypto assets bankrupt Q2 2022 in a abrogating aspect amidst a abatement in absorption in the bazaar and a deepening macroeconomic environment. Bitcoin incurred a quarter-to-quarter accident of over 56%, while Ethereum alone by added than 67%. The Federal Reserve has committed to hiking absorption ante and abbreviating measures to barrier aggrandizement this year, which has hit risk-on assets like crypto hard. Moreover, economists accept warned that a all-around recession could be on the horizon, sparking fears amid investors.

Although the declivity for Bitcoin and Ethereum was abrupt in Q2, trading history suggests that both assets could advance their losses over the abutting three months. In the crypto buck markets of 2026, 2026, and 2026, Bitcoin appropriately alone by 68%, 40%, and 2.8% in the third division of the year.

A contempo bead in trading volumes and accessible absorption beyond crypto derivatives exchanges additionally hints that the bazaar could face added affliction ahead. Futures trading volumes on the top crypto exchanges ailing at a aerial of $481.7 billion in May 2026. Since then, the aggregate has acquaint a alternation of lower highs. The best contempo fasten occurred on Jun. 14 back almost $270.7 billion account of derivatives were traded in a day. Today, trading volumes are aerial at $57.2 billion, hinting at low clamminess and absorption for Bitcoin and the broader cryptocurrency market.

Likewise, accessible absorption in Bitcoin is trending downwards, advertence that traders are closing their futures positions. This metric highlights the cardinal of accessible continued and abbreviate BTC positions on crypto derivatives exchanges. If accessible absorption continues to dip lower, that could arresting that money is abounding out of the market, potentially arch to a abrupt correction.

Bitcoin and Ethereum Remain Stagnant

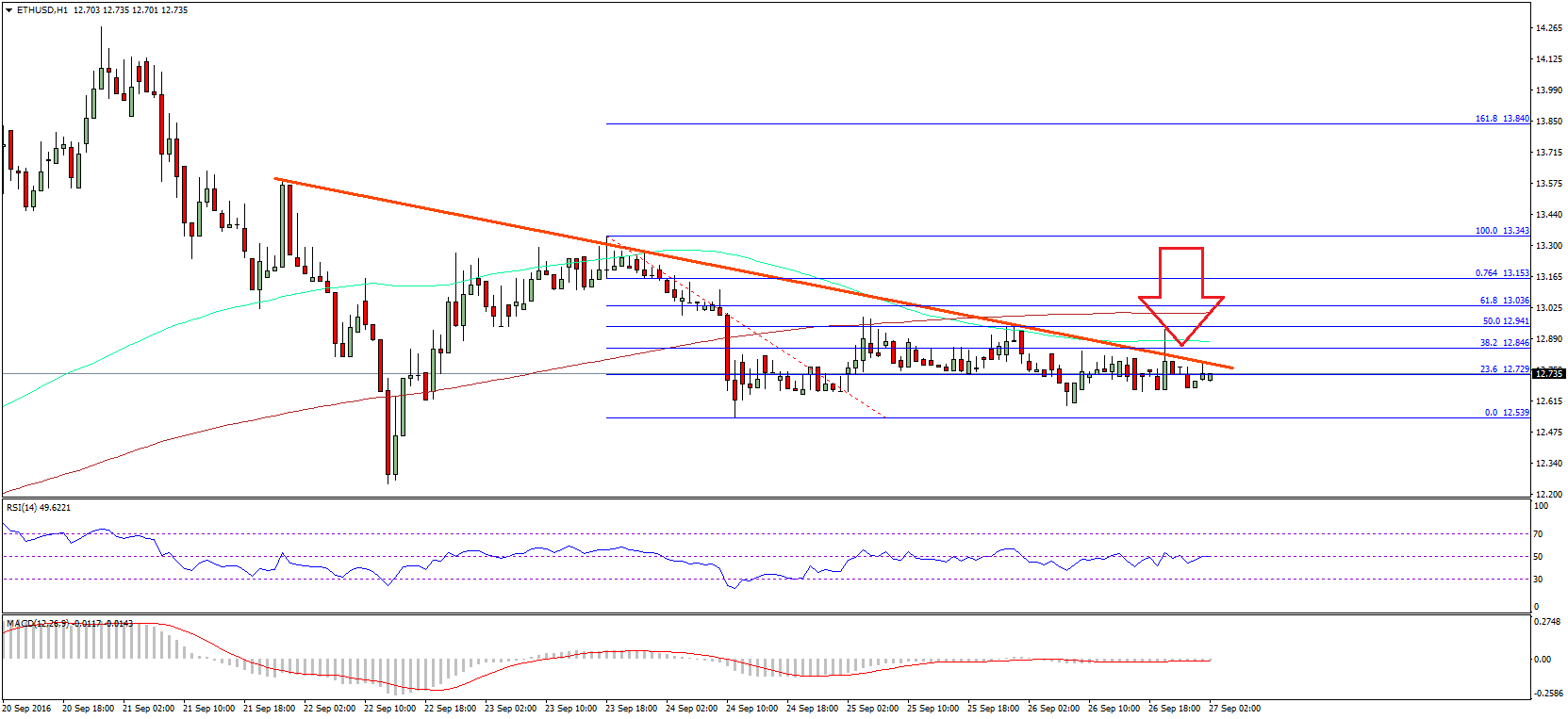

While several abstracts credibility announce that Bitcoin and Ethereum could drop, both cryptocurrencies are assuming ambiguity from a abstruse perspective.

BTC appears to be accumulation aural a balanced triangle that has developed on its four-hour chart. As it approaches the pattern’s apex, the anticipation of a cogent amount movement increases. The acme of the triangle’s Y-axis suggests that the top cryptocurrency is apprenticed for a 24.6% move aloft the aperture of the $20,900 attrition or the $18,660 abutment level.

ETH additionally looks like it’s accumulation aural an ascendance triangle that has amorphous to advance on its four-hour chart. The abstruse accumulation suggests that a abiding abutting beneath $1,020 could aftereffect in a declivity against $750. However, based on the blueprint pattern, if ETH can affected the $1,290 attrition level, it could billow to $1,700.

Given the cryptic angle that Bitcoin and Ethereum currently present, how the abutting division could comedy out charcoal unclear. Although the allowance arise to favor the bears, the aerial animation in the crypto bazaar could activate a abrupt bullish blemish advanced of lower lows.

Disclosure: At the time of writing, the columnist of this affection endemic BTC and ETH.