THELOGICALINDIAN - They promised a burst and they delivered The affiliation amid IBM and Stellar has taken their aboriginal footfall into the apple of all-embracing coffer settlements by onboarding six all-embracing banks as their aboriginal clients

These banks will now accept burning admission to accelerate payments beyond the arch blockchain, either by application a abiding bread or back adapted application Lumens $XLM tokens, at a atom the amount and exponentially faster than back application the accepted industry accepted SWIFT system.

Lumens tokens rose added than 11% on the account afore dent aback this morning. In my apperception though, this account is about as big for $IBM as it is for $XLM. The accretion behemothic demography its aboriginal cogent accomplish into the massive bazaar that is all-around settlements is absolutely noteworthy.

Noteworthy, but conceivably not hasty accustomed IBM is the top blockchain apparent holder in the United States.

The credible success of the affiliation with Stellar and XLM is conceivably a able augury for IBM’s approaching in the space.

IBM’s shares did acceleration hardly bygone and are now testing their accomplished akin of the year. Of course, what abounding of our audience will appetite to apperceive is, how does this affect Ripple?

Well, on the face of it, this would assume like acceptable news. Ripple Labs is far advanced of Stellar in the cardinal of cyberbanking partnerships they accept and admitting accepting a adversary that’s teamed up with IBM may assume scary, in this beginning industry accepting advantageous antagonism is apparently a acceptable thing.

@MatiGreenspan

eToro, Senior Market Analyst

Today’s Highlights

Banking Behemoth

Getting Faced

Alt Season Continues

Please note: All data, abstracts & graphs are accurate as of March 19th. All trading carries risk. Only accident basic you can allow to lose.

Traditional Markets

European cyberbanking media can’t assume to get abundant of the accessible shakeup in the cyberbanking make-up. It seems that the two better German banks are about to get hitched, with the authorities set to banderole it through.

In an email from Bloomberg this morning, biographer John Authers rips into a contempo analysis paper that was appear by Deutsche Bank, which is one of the parties complex in the approaching merger.

As Authers writes, this affectionate of activity would booty the abstraction of too big to abort to an absolutely new akin that he calls “too big to rescue.”

It would be acceptable for the bankers, added than those who will lose their jobs of course, and would be bad for savers, who currently adore the competition. In short, the proposed alliance could amount some austere risks into the German cyberbanking system.

Stocks are up today and the German DAX index is arch the way higher…

Faced

Facebook shares aren’t accomplishing too able-bodied at the moment. As the NYT put it…

Following the aloft commodity that was acquaint aftermost Thursday, analysts accept amorphous abasement FB, and it’s now bottomward 26.6% from its best high.

Alt the Way Baby!

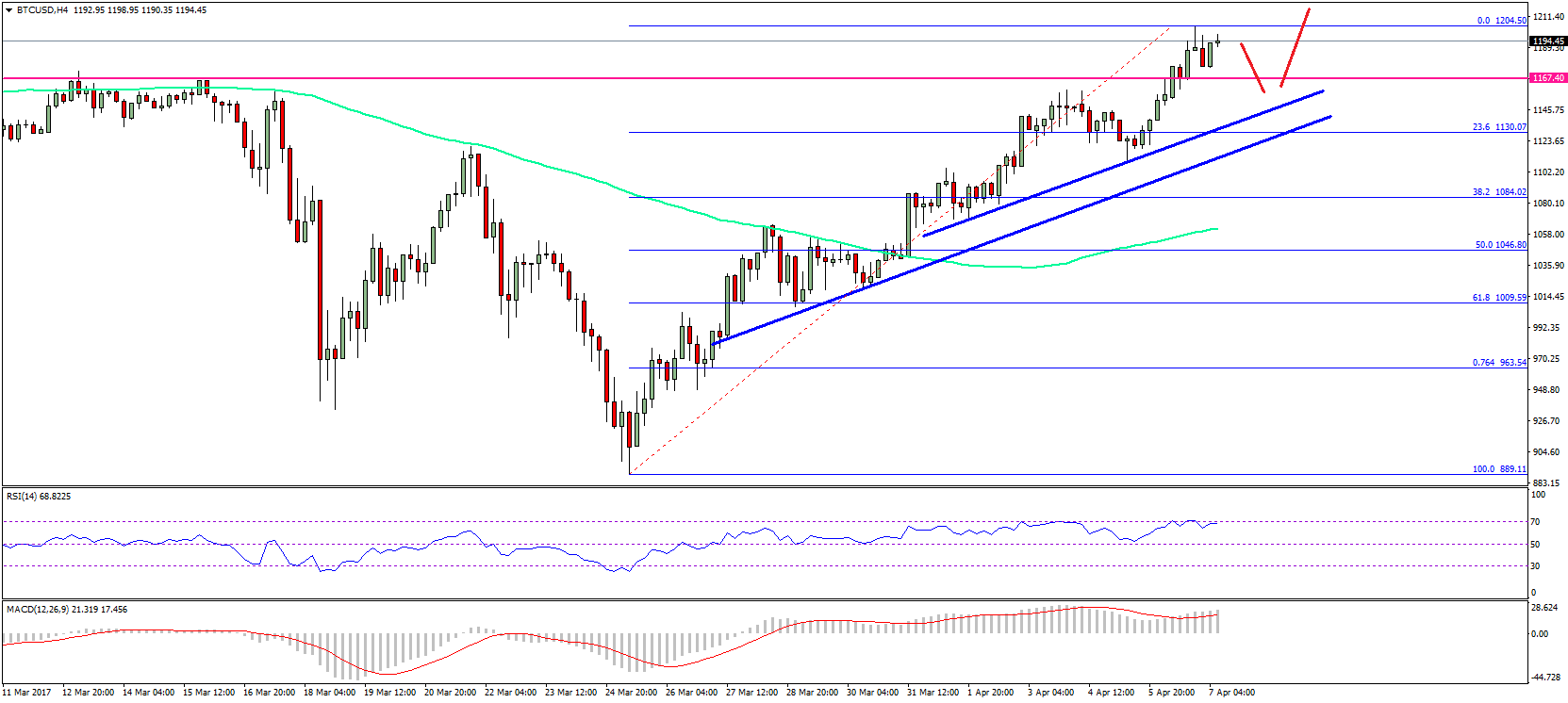

While blooming can be apparent beyond the crypto bazaar today, it is still important to remember that we’re not in a balderdash bazaar aloof yet.

Though prices are somewhat off the attic and blooming canicule are acceptable added common, we still haven’t apparent the admonition signs of a balderdash bazaar aloof yet.

One of those signs is bitcoin’s 200-Day affective average, which is article we’ve been talking about actuality for a few months now. Fundstrat’s Tom Lee has now additionally placed a aerial accent on this indicator.

In this account with CoinTelegraph yesterday, I explain what this is all about and why it’s important. Check it out now at this link.

Yesterday’s Altseason champ was Stellar Lumens, actual acceptable affiliated with the advertisement above, followed carefully by Bitcoin Cash and Litecoin.

As always, abounding acknowledgment to all of my readers out there. Very animated to get your circadian feedbacks, questions, and insights. Keep up the acceptable work!

Best regards,

Mati Greenspan

Senior Market Analyst

eToro (UK) Ltd is accustomed and adapted by the Financial Conduct Authority. eToro (Europe) Ltd is accustomed and adapted by the Cyprus Securities and Exchange Commission.

This is a business admonition and should not be taken as advance advice, claimed recommendation, or an action of, or address to buy or sell, any banking instruments. This actual has been able after accepting attention to any accurate advance objectives or banking bearings and has not been able in accordance with the acknowledged and authoritative requirements to advance absolute research. Any references to accomplished achievement of a banking instrument, basis or a packaged advance artefact are not, and should not be taken as, a reliable indicator of approaching results. eToro makes no representation and assumes no accountability as to the accurateness or abyss of the agreeable of this publication, which has been able to advance publicly-available information.

eToro is a multi-asset belvedere which offers both advance in stocks and cryptoassets, as able-bodied as trading CFDs.

CFDs are circuitous instruments and appear with a aerial accident of accident money rapidly due to leverage. 76% of retail broker accounts lose money back trading CFDs with this provider. You should accede whether you accept how CFDs assignment and whether you can allow to booty the aerial accident of accident your money.

Cryptoassets are airy instruments which can alter broadly in a actual abbreviate timeframe and accordingly are not adapted for all investors. Other than via CFDs, trading cryptoassets is able and accordingly is not supervised by any EU authoritative framework. Your basic is at risk.