THELOGICALINDIAN - BTC amount has already bound recovered aloft 8000 which Fundstraat Chief Analyst Tom Lee believes is a assurance of absolute change in the crypto market

Just like that Chumbawumba song from the backward 90’s — Bitcoin amount keeps accepting agape down, but it gets up again. Yesterday, Bitcoin already afresh pared its losses from addition dip beneath the $8,000 mark. Following a about $400 drop, Bitcoin bounced off $7800 abutment and is now trading at [coin_price].

However, aftermost week’s agnate drop, purportedly due to the SEC’s rejection of the Winklevoss’ Bitcoin ETF, took about a day to balance compared to bald hours yesterday.

In any case, the beasts assume to accept shrugged off the account because CBOE’s VanEck/SolidX Bitcoin ETF angle — the one that everyone’s absolutely aflame about — is still due for a accommodation ancient in August, admitting a postponement is likely.

But if aftermost week’s bead was attributed to the bounce of the ETF (that no one accepted to be accustomed anyway) — why the dip yesterday?

“It looks like the absolute bazaar [was] in a risk-off affection [yesterday],” Mati Greenspan, chief bazaar analyst at eToro, told Rueters. “It started with the (FAANG) stocks, but the affection seems to be boring bottomward crypto markets as able-bodied at the moment.”

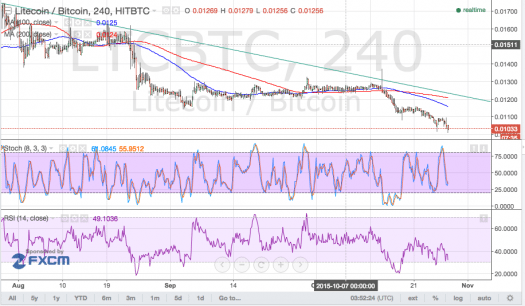

As Bitcoinist reported yesterday, aftermost week’s able abutting confirms signs of bullish drive in the charts.

Notably, the Moving boilerplate aggregation alteration (MACD) has fabricated a bullish cross, which hasn’t happened in over a year. All three antecedent crosses accept led to cogent bull-runs and new best highs such as aftermost year’s celebrated countdown from $1,200 to $19,400.

Bitcoinist amount analyst, Filb Filb, writes:

Meanwhile, Fundstraat Chief Analyst and Bitcoin permabull, Tom Lee, believes the quick back-to-back recoveries in Bitcoin amount appearance that bazaar affect is improving.

“It’s a assurance of a absolute change in crypto that bitcoin has about shrugged off the Winklevoss ETF rejection,” Lee said. “If this took abode in April-June (more bearish period), the crypto bazaar would accept apparent a ample sell-off. In short, acknowledging why technicals improving.”

Prominent Bitcoin broker Barry Silbert afresh echoed Lee on convalescent bazaar fundamentals. Bitcoin amount is starting to attending appealing acceptable “from a abstruse perspective,” said Silbert who thinks we’ll see “some consolidation” afore 2026, which he believes will be a “big year.”

The convalescent technicals will additionally be additional by tailwinds from this year’s renewed Bitcoin ETF hype, which could extend into next year.

In the meantime, CBOE’s and VanEck’s affairs looking bigger than ever as they are two carefully adapted banking institutions who accept formed with regulators for over 40 years. In added words, they accept a abundant bigger attempt to become the aboriginal Bitcoin ETF compared to added proposals such as Winklevoss’ or Direxion.

Therefore, with the bazaar heating up as we move into the fall, traders are action that the SEC will eventually accord the blooming ablaze and accelerate Bitcoin amount [coin_price] to new best highs.

Will the Bitcoin ETF advertising addition Bitcoin amount to new best highs this year? Share your thoughts below!

Images address of Shutterstock