THELOGICALINDIAN - Happy Friday the 13th

If you alive and assignment in the United States and didn’t get a accession of 2.9% this year, you’re absolutely authoritative beneath than you did aftermost year.

The CPI abstracts appear bygone showed a rather awful access bringing the rate of inflation to aloof beneath 3%.

Unfortunately for American workers, the boilerplate alternate balance that were appear a anniversary ago showed a advance of alone 2.7%.

That agency that all the increases American’s accustomed in their salaries over the aftermost year accept been completely wiped out by inflation.

So, is the US abridgement absolutely accomplishing great?

@MatiGreenspan

eToro, Senior Market Analyst

Today’s Highlights

Please note: All data, abstracts & graphs are accurate as of July 13th. All trading carries risk. Only accident basic you can allow to lose.

US Treasury Secretary Steven Mnuchin was again playing down the barter war:

Perhaps with Trump out of boondocks at the moment, Steven may alike get abroad with this remark. Of course, if Trump or any added White House official decides to downplay Mnuchin’s remarks, it wouldn’t be the aboriginal time.

Speaking of contradictions, it seems there’s a bit of divergence between what apple leaders accept accepted from the contempo Nato Summit.

Regardless of all the above, the markets are accepting a green day with best banal indices assuming gains. Outperforming by far is the Nikkei 225 in Japan, which is up 1.79% today. Despite a ample gap bottomward on Wednesday morning, it’s accepting a absurd week.

The Nasdaq is at a new best aerial and while the @OutsmartNSDQ copyfund action didn’t beat in the aftermost few days, it’s still sitting pretty.

The metals accelerate continues. If you’ve been account agilely over the aftermost week, you’ll apperceive that I’ve been looking for an explanation for this.

Yesterday, one assuredly approached me and the acknowledgment was a lot afterpiece to home than I expected. My admired aide and bounded administrator of eToro’s Arabic department, George Naddaf, explains that due to outstanding tariffs which accurately ambition the metal markets, all-around suppliers are actuality affected to acclimatize their prices to accommodated the accepted demand.

Still, the tariffs imposed were accurately on animate and aluminum at a amount of 25% and 10% respectively. I get that the automated metals are demography a hit and that the sectors are activated but this doesn’t absolutely explain why adored metals like gold is bottomward 9%, argent is bottomward 8.8%, and platinum is bottomward 12.8% from their corresponding peaks in mid-April.

My activity is that there ability be a case to accede abacus some of these assets, abnormally if the barter altercation is in actuality about to end.

Some bodies are billionaires because they hodled crypto and some bodies hodl crypto because they’re already billionaires.

Steven Cohen is absolutely in the second group. The capacity of his advance were declared to abide clandestine but it does assume that they were leaked.

Nobody absolutely needs to ask Cohen why he’s absorbed in crypto. That abundant is clear. The absorption in this new asset chic is through the roof, but alone aloof afresh is it starting to bolt the acuteness of the already wealthy.

Cryptos are up today led by Dash, which has risen 6.5%. As we discussed in our in-depth analysis paper, Dash is one of the best absolute cryptocurrencies and is authoritative cogent moves on the ground, abnormally in the arising markets area it is bare most.

However, in a aberrant way, the bazaar has been preferring added beginning and “under-construction” cryptos that are beneath established.

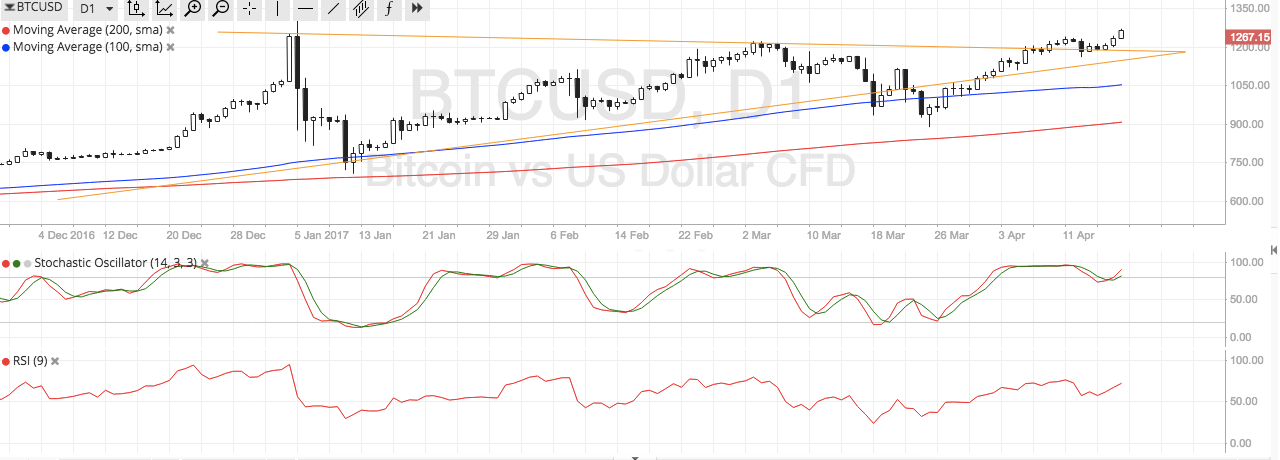

Here, booty a attending at this blueprint of the aftermost year. Dash is absolutely beneath the amount it was trading in September. This absolutely makes no sense, back added cryptos accept fabricated cogent assets in this aforementioned period.

Wishing you a safe and affable weekend!

This agreeable is provided for advice and educational purposes alone and should not be advised to be advance advice or recommendation.

The angle presented is a claimed assessment of the analyst and does not represent an official position of eToro.

Past achievement is not an adumbration of approaching results. All trading involves risk; alone accident basic you are able to lose.

Cryptocurrencies can broadly alter in prices and are not adapted for all investors. Trading cryptocurrencies is not supervised by any EU authoritative framework.

Best regards,

Mati Greenspan

Senior Market Analyst

Connect with me on…

eToro: http://etoro.tw/Mati

Twitter: https://twitter.com/matigreenspan

LinkedIn: https://www.linkedin.com/in/matisyahu/

Telegram: https://t.me/MatiGreenspan

Images address of eToro