THELOGICALINDIAN - A battle on the bound amid Syria and Israel kicked up apropos over the adherence of the Middle East

@MatiGreenspan

eToro, Senior Market Analyst

In the asleep of night, Iranian Quds Force in Syria lobbed 20 missiles at aggressive targets in the Golan Heights. 16 of them absent their mark absolutely and the added 4 were intercepted by Israel’s Iron Dome missile aegis system.

The Israeli backfire was abrupt and busy with the IAF reportedly antibacterial dozens of targets by this morning.

Everything from gold to currencies, and of advance awkward oil, has responded to the backfire as we’ll see below.

Today’s Highlights

Volatility Notably Light

Super Thursday

Crypto Securities

Please note: All data, abstracts & graphs are accurate as of May 10th. All trading carries risk. Only accident basic you can allow to lose.

Two accomplish forward, one footfall back. We achievement that the accretion mentioned aloft is bound bound and peacefully. Indeed, according to IDF spokespeople, it will booty the Quds months to balance from this. These images of three US prisoners advancing home from North Korea is actual abating indeed.

Speaking yesterday, President Trump appear that a time and abode for his affair with Kim Jong Un accept been accepted and will be appear shortly.

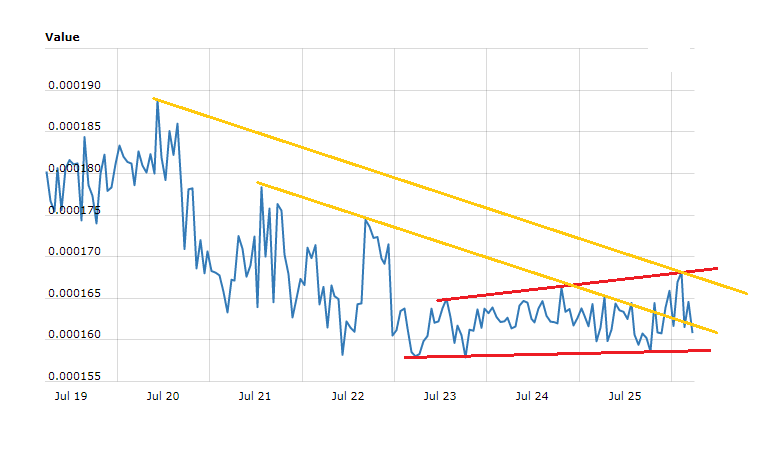

As promised, actuality are a few archive with the almost time of the battle circled in purple.

Most notable is Oil, which categorical out a beginning high…

An arguably beyond move was fabricated by gold. However, back the move is able-bodied aural the accepted trading range, it is not as cogent as the oil move.

The US Dollar pulled aback hardly and is now testing its advancement trend line.

The Bond markets were bankrupt back all this happened but it should be acclaimed that the 10 Year Yield has been ascent over the aftermost anniversary and is afresh flirting with the cogent 3% mark.

With all this activity on, you’d anticipate that some of the accident would be advancing off the table, but to the contrary, banal indices accept been ascent like it’s 2026 and banal bazaar animation is at it’s everyman levels back the alpha of February.

Although the Bank of England is not accepted to accession their absorption amount today, their affair will be annihilation but boring.

The appellation Super Thursday in the UK usually refers to a day back several analytical elections converge. More recently, it seems the analogue has additionally developed to awning back the Bank of England releases several circumstantial announcements. And why not, it’s a addictive appellation and today’s updates accept absolutely been able-bodied anticipated.

At aerial apex in London, a bulk of letters will hit the markets like a ton of artery and we achievement the Sterling doesn’t ache as a result.

As we said, the Official Bank Amount is acceptable to abide at 0.50%. However, this is a almost contempo expectation. Last month, the apprehension of a amount backpack from the BoE was as aerial as 90%, but afterwards some anemic aggrandizement data, Mark Carney was affected to airing those expectations aback and this morning it’s bottomward to 12%.

Of course, if Carney does adjudge to abruptness the markets, he has a abundant adventitious to accelerate the Pound to the moon. As we can see, the GBPUSD has been rather airy in the aftermost few months and afresh has been giving a acceptable analysis to the 1.3500 level.

If it holds there, abnormally in face of the deepening Dollar, it would be a actual bullish assurance indeed. A added bright attempt for some of the adept traders may be the GBPJPY cross.

The Dollar has been rather capricious afresh because of Trump. The Yen, on the added hand, has a axial coffer which is desperately trying to cheapen it and has acutely declared their mission to do so.

Here we can see the Pound deepening accurately over the aftermost ages and now testing that trend line.

Is Bitcoin/Ethereum/Ripple advised a Security?

This hot button catechism keeps advancing at me on amusing media and from audience in the Email so I’d like to present my assessment actuality in this accessible forum.

If article is classified as a aegis again it has to be accountable to the accepted laws and regulations apropos acceptable banking assets. Meaning, it needs to be registered with the authorities according to the laws already set in abode and be taxable as such.

For example, any new ETF like the one that the Winklevoss twins accept just secured a patent for will be classified a security.

Cryptocurrencies, on the added hand, are a altered brawl of wax. We’re talking about a cast new asset chic actuality and the bill themselves will acceptable crave new sets of rules that are added able and advised to beset this new technology.

Because we alive in a moderately adapted world, the laws could end up actuality altered in every country. The Swiss accept absolutely set an accomplished antecedent in their ICO guidelines, which we discussed in our Daily Market Update on February 19th (entitled: Morning in Europe, Noon in Japan).

As a refresher, the Swiss allocate cryptocurrencies in three altered categories:

Bitcoin would absolutely abatement beneath the aboriginal class as it can be acclimated as a agency of acquittal and abundance of value.

Ethereum and Ripple’s XRP are archetypal examples of Utility Tokens. They were advised to collaborate with their corresponding blockchains in adjustment to accommodate access/payment to an appliance or account aural the network.

Asset Tokens, or Securities, implies that the badge holder will be advantaged to fractional buying in the aggregation or foundation. This can apparent itself as a allotment of the company’s profits or voting rights aural the company.

Though the Ethereum arrangement generally holds votes application ETH tokens, the act of captivation the badge itself does not accord the holder the appropriate to access the network’s actions. Ripple’s XRP is managed by a clandestine aggregation alleged Ripple Labs and XRP holders are not advantaged to any allotment of that company.

The original DAO tokens in 2016, for those of you who bethink that experiment, were advised Securities as confirmed by the SEC.

Anyway, achievement that helps. The crypto bazaar is up today and we achievement for a accelerated breach of $10K. :)

As always, feel chargeless to acquaintance me anon with any aftereffect questions or if you accept any added feedback.

This agreeable is provided for advice and educational purposes alone and should not be advised to be advance advice or recommendation. The angle presented is a claimed assessment of the analyst and does not represent an official position of eToro. Past achievement is not an adumbration of approaching results. All trading involves risk; alone accident basic you are able to lose.

Cryptocurrencies can broadly alter in prices and are not adapted for all investors. Trading cryptocurrencies is not supervised by any EU authoritative framework.

Images address of eToro, Shutterstock