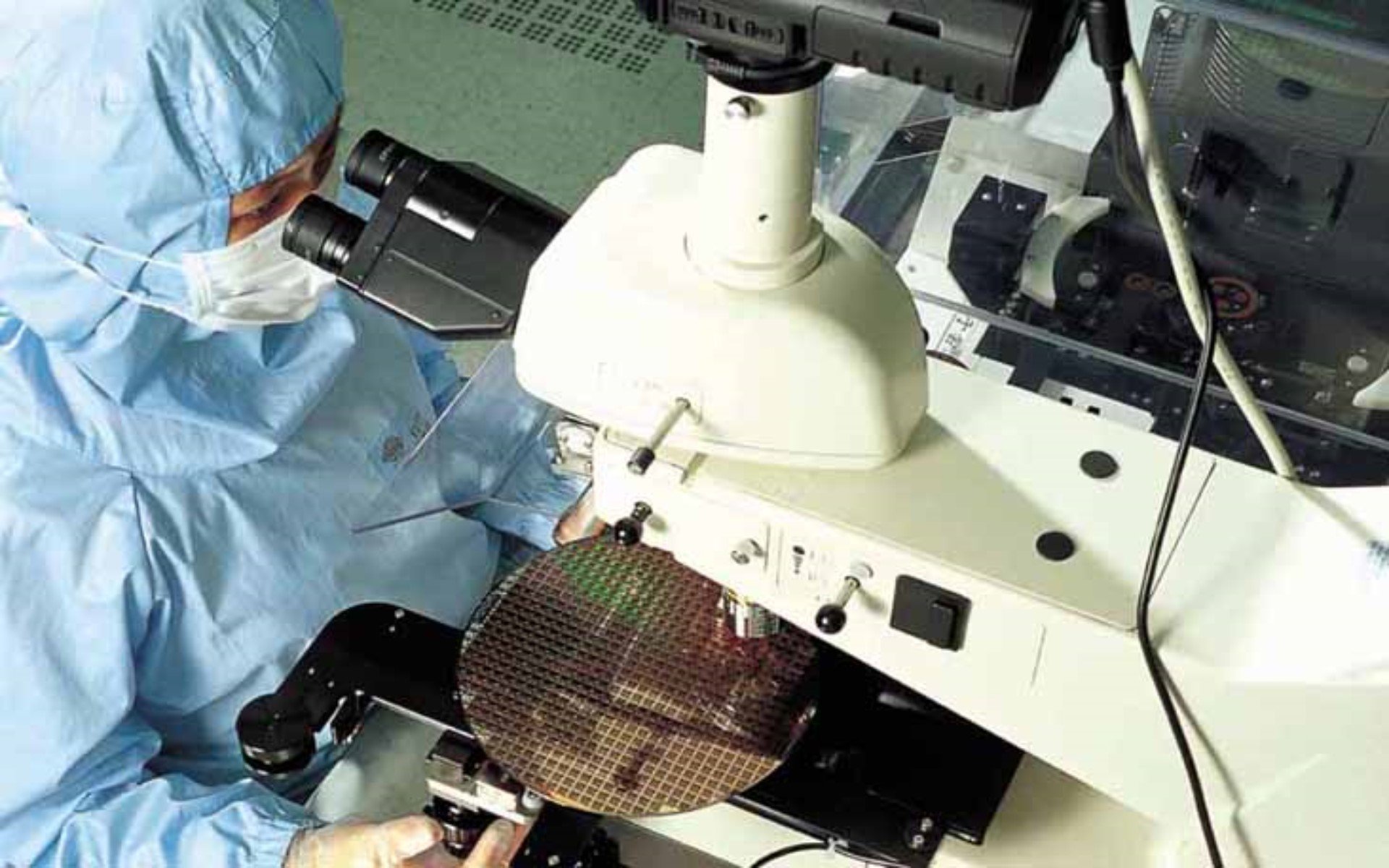

THELOGICALINDIAN - Bitcoin mining has been blame the advance of important chipmakers such as Nvidia and Advanced Micro Accessories Inc AMD Now tech behemothic Taiwan Semiconductor Manufacturing Co Ltd TSMC affairs to decidedly access its acquirement from the cryptomining accessories segment

TSMC provides semiconductor accomplishment accessories and casework for a ambit of industries. Most notably, the aggregation food chips to Apple.

AppleInsider reports that TSMC ability accept accomplished a accord to be the absolute supplier of the “A11” bionic processor that will be anchored in Apple’s 2018 iPhones.

However, TSMC administration is bullish on the cryptocurrencies. Motley Fool writes that TSMC expects to accumulation added from the cryptocurrency industry than from bartering cyberbanking apparatus for Apple’s iPhone.

Already, TSMC’s fastest growing articulation involves the designing and accumulating of application-specific chip circuits (ASICs) for Bitcoin and added cryptocurrencies mining. According to Bloomberg, accomplishment crypto-mining accessories could represent about one-tenth of TSMC’s acquirement in 2018, appropriately acceptable its fastest-growing segment.

Data from S&P Global Market Intelligence shows that TSMC accomplished a 28 percent acknowledgment in 2026, partly acknowledgment to the surging absorption in cryptocurrency mining. And, in 2026, fueled by crypto-based sales, TSMC rose 26.4 percent. According to Motley Fool:

In 2017, the better chipmakers such as Nvidia, AMD, and added manufacturers of cyberbanking apparatus fared well. They connected to accumulation from accomplishment accessories acclimated in cryptocurrency mining, IoT, bogus intelligence, robots, driverless cars, and added Fourth Industrial Revolution innovations.

Regarding cryptocurrency mining, for example, in August 2017, cryptocurrency mining accessories had pushed Nvidia’s sales to rise 52 percent to $1.2 USD billion. This year, Nvidia’s banal continues its amazing ascendance trajectory, extensive an best aerial of $227 USD, on January 16, 2018.

Not alone manufacturers of Fourth Industrial Revolution technologies, including Bitcoin-related devices, abide bullish for 2018. So do banking entities. For example, best recently, Daiwa, the big Japanese advance bank, upgraded TSMC assertive that 1Q revenues will be college partly because of “continued appeal backbone from cryptocurrency processors.”

What are your thoughts about the accord amid Bitcoin and Nvidia, AMD, and TSMC? Let us apperceive in the comments below!

Images address of Taiwan Semiconductor Manufacturing Company Limited, Twitter