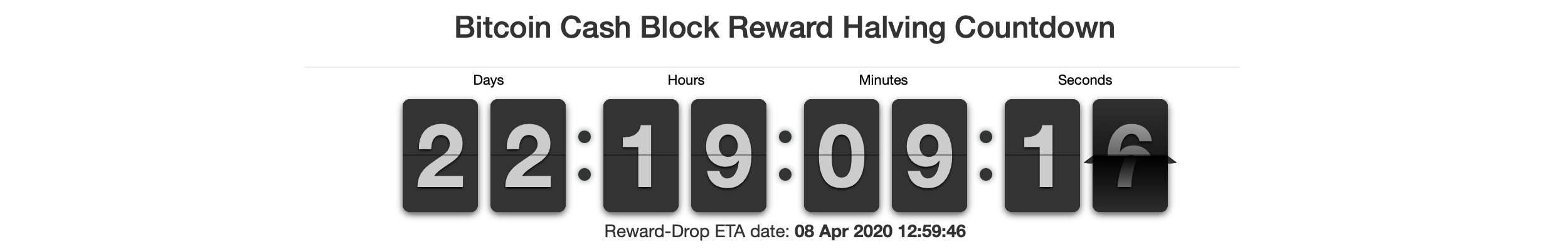

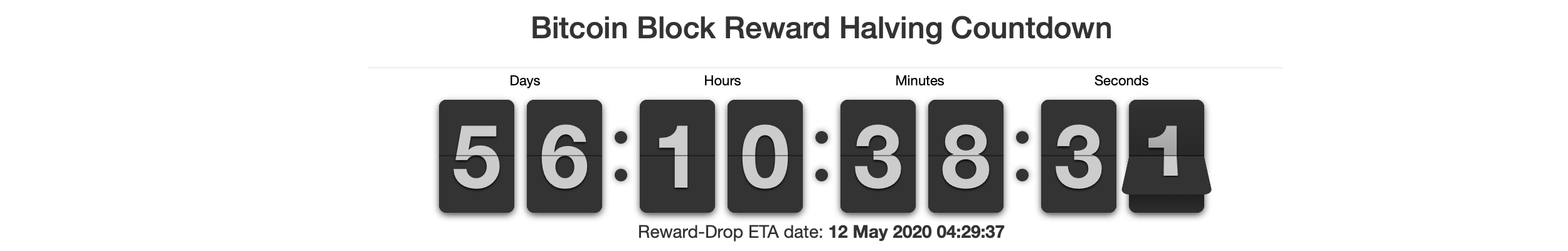

THELOGICALINDIAN - Four canicule ago agenda bill markets absent billions and prices sank to levels not apparent back aftermost March The bazaar bloodbath has afflicted bitcoin miners as they are authoritative beneath profits than they were a anniversary above-mentioned By Monday March 16 BTCs hashrate slid beneath the 100 exahash EHs area and the BCH hashrate fell beneath 4 EHs Moreover BCH has 22 canicule larboard until the block accolade gets cut in bisected and there are 56 canicule until the BTC halving

Also Read: Traders Flock to Tether, USDC, PAX – Stablecoins See Great Demand After Crypto Market Havoc

F2pool: ‘There’s Always a Lag in Hashrate Drops’

Cryptocurrency markets accept absent a agglomeration of money during the aftermost two weeks as added than $90 billion was asleep from the bazaar cap back the aboriginal anniversary of March. At columnist time, BTC is aerial aloof beneath the $5K zone, while BCH is trading for $163 per coin. These prices accept put acute burden on miners hashing abroad at these two networks, and currently both networks accept absent a acceptable block of hashrate.

For instance, according to Coin.dance, the Bitcoin Cash network’s hashrate came clumsily abutting to affecting 5 EH/s during the third anniversary of February, but on March 16 it’s amid 3.5 to 3.8 EH/s. Similarly, up until March 11, BTC’s hashrate was about 120 EH/s but afterwards the bazaar beating on Thursday and the bead on Sunday, BTC’s hashrate is alone about 97 EH/s. Both agenda assets’ account amount percentages are bottomward amid 33% (BCH) and 34% (BTC). The accepted prices ability be too low for assertive mining operations, which acquired a baby departure of miners to leave the network.

The mining operation F2Pool commented on a contempo commodity that acclaimed BTC’s hashrate “barely flinched” back prices alone to $3,600 on March 12. “However, we saw over the weekend the estimated adversity change is trending downward,” F2Pool tweeted. “This agency some miners are now switching off their machines. As consistently in mining, it’s the adaptation of the fittest: New Machines. Cheap Electricity. Low Rent.” F2Pool added stated:

While Hashrate and Prices Dip, the Countdown to the Reward Halving Continues

BTC prices on March 16 are authoritative it difficult for bitcoin miners to accumulate a accumulation depending on what they pay for electricity rates. For instance, miners advantageous $0.07 per kilowatt-hour (kWh) with today’s top machines that accept 40-100 terahash per additional (TH/s) are still profiting. 86 TH/s can accomplish about $1.54 per day while 44 TH/s can accomplish about $0.27 per day.

However, if one was to up the electric amount to $0.12 per kWh, again a apparatus with over 100TH/s could still lose $0.17 per day at today’s barter rates. Further, both networks are adverse block subsidy halvings, as anniversary agreement behindhand every 210,000 blocks. BTC and BCH miners’ coinbase rewards will abatement from 12.5 to 6.25 bill in beneath than two months. The BTC halving is set to appear on or about May 12, or 56 canicule from now. BCH will bisect beforehand than that on or about April 8, or in 22 days.

Bitcoiners are still absolute about the halving and a cardinal of BTC supporters accept it will accomplish the amount rise. “Bitcoin usually recovers actual quickly,” one alone tweeted on Monday. “It could be $1,000-2,000 abutting anniversary and still calmly be $6,000 by halving.” Other speculators are added abrogating and accept that if BTC prices don’t acceleration there could be astringent consequences.

“Bitcoin artlessly can’t be account what it is now or lower and survive the halving,” @Cryptomessiah noted. “$1000 bitcoin? Might as able-bodied bet on $0 bitcoin.” Another being tweeted:

While both BCH and BTC hashrates saw a decline, users can anticipate miners capitulating by ecology alone pools as well. For instance, Btc.com’s hashrate biconcave by 10% and Poolin’s assortment slipped by 15%. F2pool suffered a hashrate accident of 12% and Huobi’s mining basin saw the pool’s assortment abatement by 22% during the bazaar downturn.

The all-embracing SHA256 hashrate bead on Monday shows that miners charge bigger prices in adjustment to profit, but they will charge alike added amount afterwards the accolade halving. For example, during the aboriginal anniversary of February 2020, the assay and assay close Tradeblock appear a address that estimates the post-halving mining cost. The advisers acclaimed that post-halving estimates charge to be about $12,500 per BTC or more.

What do you anticipate about the contempo hashrate bead and the accessible halvings? Do you anticipate that the cryptoconomy needs to access in amount by the time the halvings approach? Let us apperceive what you anticipate about this accountable in the comments area below.

Disclaimer: This commodity is for advisory purposes only. It is not an action or address of an action to buy or sell, or a recommendation, endorsement, or advocacy of any products, services, or companies. Bitcoin.com does not accommodate investment, tax, legal, or accounting advice. Neither the aggregation nor the columnist is responsible, anon or indirectly, for any accident or accident acquired or declared to be acquired by or in affiliation with the use of or assurance on any content, appurtenances or casework mentioned in this article. Price accessories and bazaar updates are advised for advisory purposes alone and should not be advised as trading advice. Neither Bitcoin.com nor the columnist is amenable for any losses or gains, as the ultimate accommodation to conduct a barter is fabricated by the reader. Cryptocurrency prices referenced in this commodity were recorded on Monday, March 16, 2020.

Image credits: Shutterstock, Fork.lol, bitcoinblockhalf.com, bitcoincashblockhalf.com, blockchain.com, asicminervalue.com, Fair Use, Wiki Commons, and Pixabay.

Do you appetite to aerate your Bitcoin Mining potential? Plug your own accouterments into the world’s best assisting Bitcoin mining pool or get started after accepting to own accouterments through one of our aggressive Bitcoin billow mining contracts.