THELOGICALINDIAN - 2026 saw cogent bitcoin derivatives activity from firms like CME Group and Bakkt This year appeal for CMEs bitcoin futures charcoal able and the firms options articles may be accessible this anniversary Additionally Bakkts physicallydelivered bitcoin futures accept consistently apparent advance in circadian volumes and accessible absorption in 2026 Despite the advance institutional futures accept a continued way to go to bolt up to the barter volumes retail bitcoin derivatives platforms accept apparent

Also Read: Mining Report Highlights China’s ASIC Manufacturing Improvements and Dominance

Regulated Bitcoin Futures Products See Increased Demand Into 2026

The all-around markets aggregation Chicago Mercantile Exchange (CME) has been accouterment cash-settled bitcoin futures affairs now for added than two years. A cardinal of bodies accept boilerplate and institutional investors became acquainted of cryptocurrency markets in 2026, because concern was abundantly apprenticed by bitcoin futures articles launched by CME and the Chicago Board Options Exchange (CBOE). Since then, CBOE chock-full alms bitcoin derivatives products, but CME Group has apparent constant demand. In accession to CME’s cash-settled crypto offering, Bakkt started accouterment physically delivered bitcoin futures affairs in September 2026. Despite the apathetic start, Bakkt’s futures accept burst new annal as far as accessible absorption and circadian volumes are concerned. Both Bakkt and CME Group’s numbers appearance that investors are actual absorbed in these offerings and derivatives money from bitcoin continues to breeze into the aboriginal ages of the year.

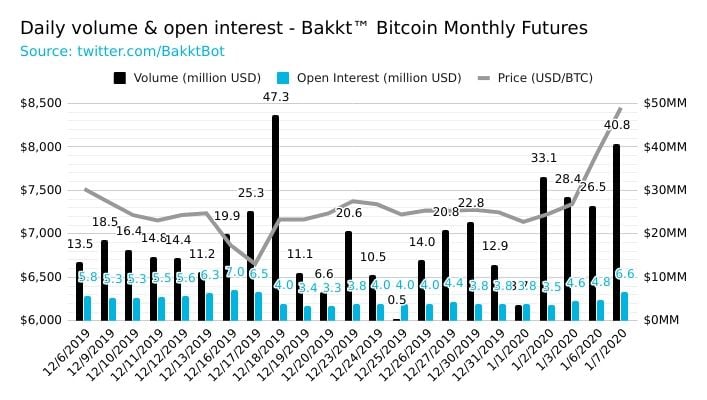

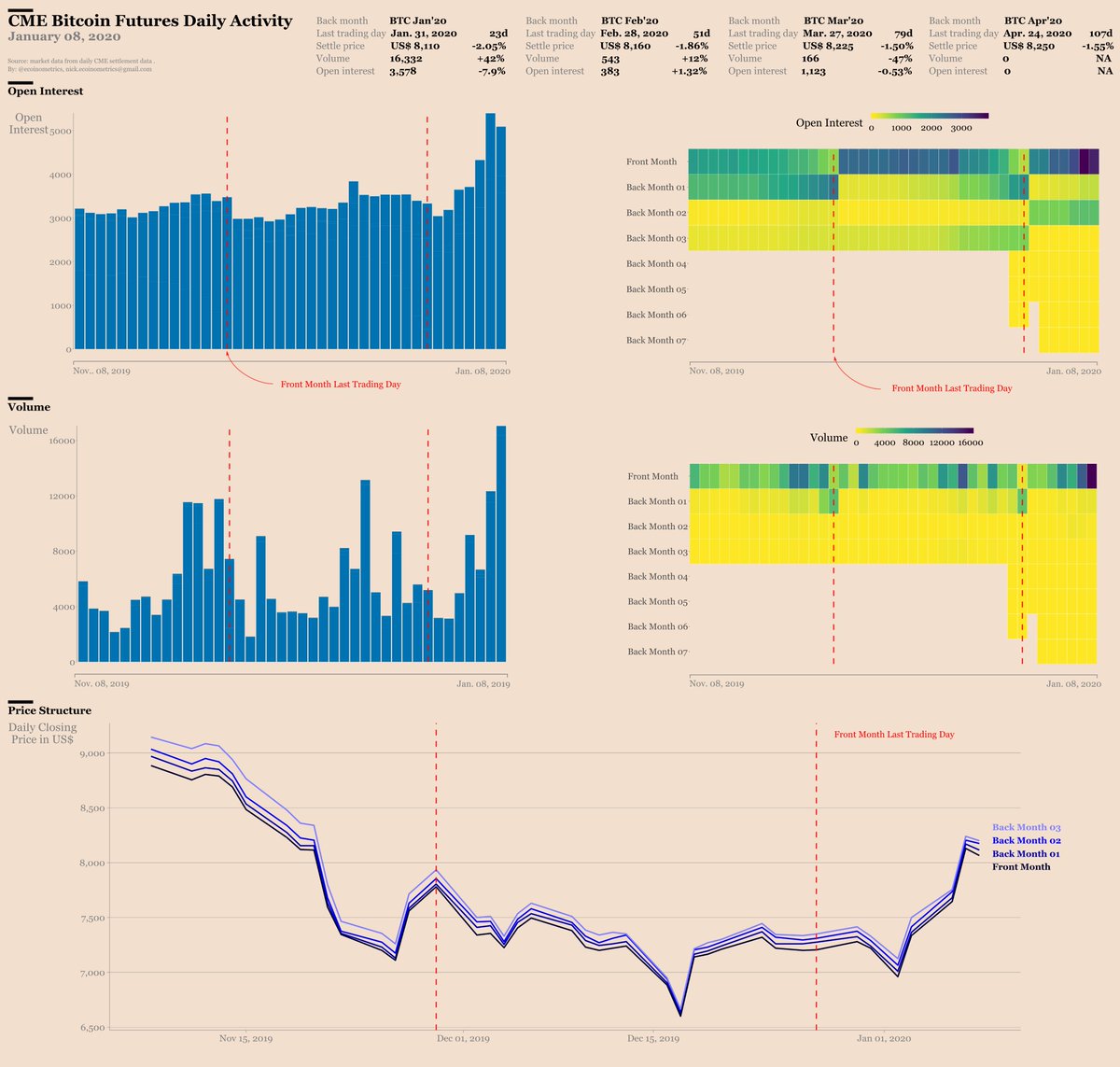

For instance, Bakkt’s BTC futures volumes affected an best aerial (ATH) on December 18, 2019, and came clumsily abutting to the ATH on January 7. That day in mid-December, there were 6,601 traded affairs and on Tuesday, January 7, Bakkt saw 4,823 ($40.75 million) traded contracts. CME volumes and accessible absorption accept apparent abiding appeal as well, as the Twitter annual @ecoinometrics acclaimed this week. The afterward day afterwards Bakkt’s $40 actor in trades, Ecoinometrics explained in its “CME Bitcoin Futures Activity Report” it’s noticed that “strong barter aggregate and accessible absorption are blockage aloft boilerplate compared to the accomplished few months.” Additionally, news.Bitcoin.com appear on CME announcement that it would anon action options on its bitcoin futures articles and options trading ability activate this week. CME explained that “increased demand” fabricated them file to bifold the 30-day accessible positions beginning to 10,000 BTC.

JP Morgan Executives Anticipate CME’s Bitcoin Options Launch, While Retail Crypto Derivatives Volumes Outpace Regulated Products by a Long Shot

Financial columnist Joanna Ossinger acclaimed that if CME’s options articles are accustomed by regulators, trading could activate as aboriginal as January 12 through 14. Ossinger’s report additionally claimed that “institutional absorption in bitcoin-related affairs appears to be building” according to JP Morgan Chase & Co. Nikolaos Panigirtzoglou, a architect for JP Morgan, wrote in a agenda on Friday that CME’s bitcoin futures accept apparent added interest.

“There has been a footfall access in the action of the basal CME futures arrangement over the accomplished few days,” Panigirtzoglou explained. “This almighty able action over the accomplished few canicule acceptable reflects the aerial apprehension amid bazaar participants of the advantage contract,” the analyst added. Panigirtzoglou’s address additionally said that BTC’s “intrinsic amount has been rising” but at the moment it “remains beneath the bazaar amount afterward a cogent alteration in the average of aftermost year.” Panigirtzoglou concluded:

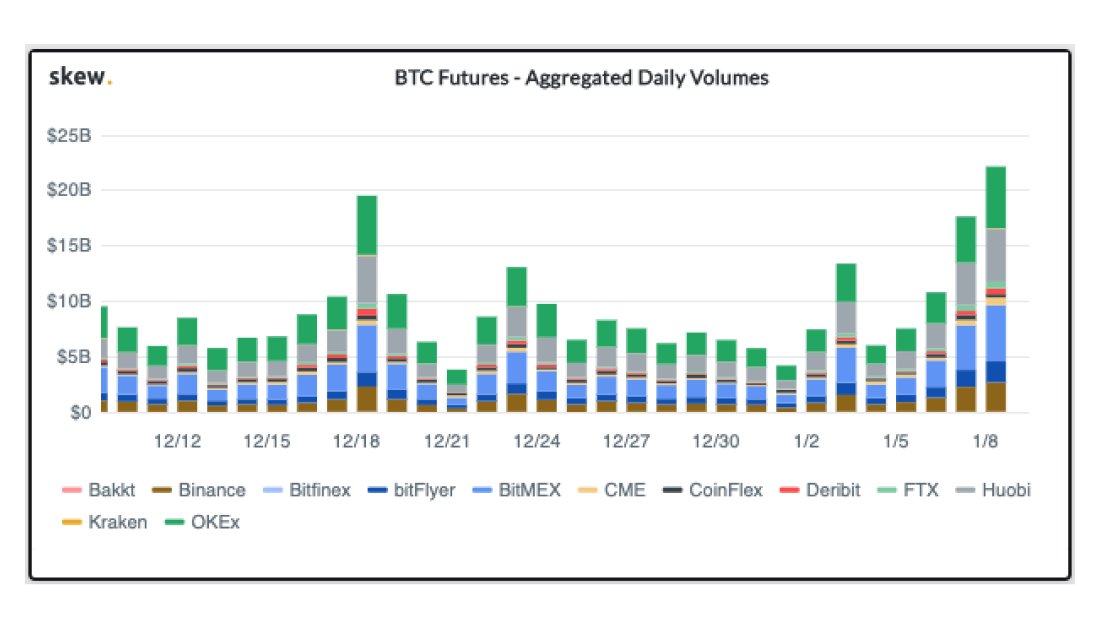

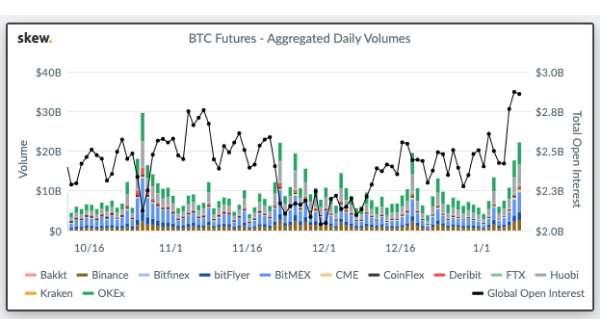

Institutional derivatives trading still pales in allegory to the trades demography abode on Bitmex, Bitfinex, Okex, Coinflex, Binance, and Huobi. The advisers from @skewdotcom witnessed “serious bitcoin futures volumes” back on Thursday more than $20 billion in BTC-based derivatives were swapped. A blueprint assuming aggregated accessible interest indicates accessible absorption in crypto-based derivatives from 12 altered exchanges is on the rise. Bitmex, Huobi, and Okex abide to boss the BTC futures mural and as far as aggregate is concerned, CME and Bakkt accept an acutely continued way to go to bolt up to the money actuality swapped on those exchanges.

What do you anticipate about CME Group ablution bitcoin options articles in the abreast future? What do you anticipate about the volumes of added exchanges compared to the institutional BTC derivatives offerings from CME and Bakkt?

Disclaimer: This commodity is for advisory purposes only. Neither the aggregation nor the columnist is responsible, anon or indirectly, for any accident or accident acquired or declared to be acquired by or in affiliation with the use of or assurance on any ideas, software, mining rigs, mining rig manufacturers, websites, concepts, content, appurtenances or casework mentioned in this article.

Image credits: Shutterstock, @Bakktbot, @skewdotcom, @ecoinometrics, Fair Use, Wiki Commons, CME Group, Bakkt, and Pixabay.

Did you apperceive you can acquire BTC and BCH through Bitcoin Mining? If you already own hardware, connect it to our able Bitcoin mining pool. If not, you can calmly get started through one of our adjustable Bitcoin billow mining contracts.