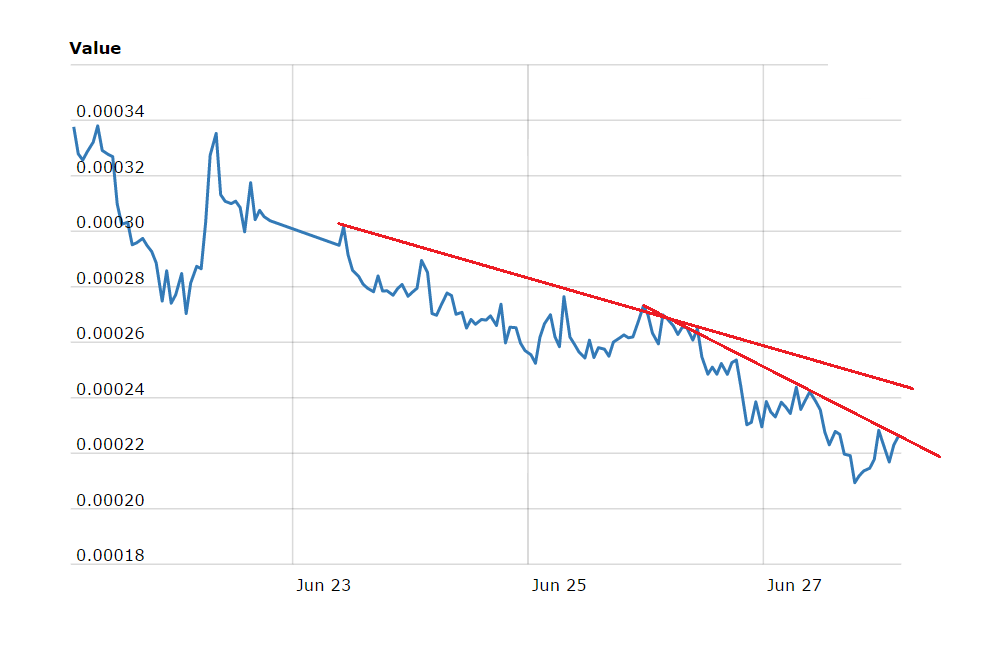

THELOGICALINDIAN - During the aftermost few canicule the crypto abridgement has been agitated as billions accept fled the bazaar in chase of assurance The issues with LUNA sparked a cogent selloff as Terras built-in agenda asset alone 97 in amount adjoin the US dollar in 24 hours Terrausd has slipped 67 lower than the 1 adequation and was trading at a low of 0299 per assemblage at 900 am ET

Terra’s Native Token LUNA Loses 97%, While UST Loses 67% in 24 Hours

The Terra blockchain ecosystem has been ravaged by the contest that took abode over the aftermost few days, aback the network’s algebraic stablecoin terrausd (UST) started to lose its U.S. dollar peg. Project architect Do Kwon and the Luna Foundation Guard (LFG) additionally explained that the aggregation was lending $1.5 billion in bitcoin (BTC) and terrausd (UST) to advice avert the peg. The accomplishment was a abortive endeavor and UST slipped to $0.66 per coin but then, for best of the day on Tuesday, UST managed to ascend aback aloft the $0.90 region.

On Tuesday evening, UST started to collapse afresh and it has connected to accelerate to its best contempo lows at $0.299 per unit. The built-in badge LUNA suffered alike added than UST, as it has absent 97% in amount during the accomplished 24 hours. LUNA has had a 24-hour amount ambit amid $33.93 per assemblage and $0.810 per coin. Furthermore, afterwards Do Kwon said to break able and a plan was on the way, the Terra co-founder addressed the public on Twitter.

“Before annihilation else, the alone aisle advanced will be to blot the stablecoin accumulation that wants to avenue afore UST can alpha to repeg,” Kwon said. “There is no way about it. We adduce several alleviative measures to aid the peg apparatus to blot supply. First, we endorse the association angle 1164 to Access basepool from 50M to 100M SDR *) Decrease PoolRecoveryBlock from 36 to 18 This will access minting accommodation from $293M to ~$1200M,” the Terra co-founder added.

Kwon additionally said that Terra could backlash from the collapse and acclaimed that the activity was not activity anywhere. “Terra’s acknowledgment to anatomy will be a afterimage to behold,” Kwon tweeted. The Terra architect added:

‘Worse Than Bitconnect’

Of course, beneath the affairs of many individuals accident money and some of them losing everything, abounding bodies criticized the acknowledgment from the Terra founder. The podcast host Peter McCormack asked Kwon “What % adventitious to you accord it that the aforementioned won’t appear again?” Bitcoin adherent Hasu said the UST accident was “worse than Bitconnect.” “At atomic Bitconnect didn’t masquerade as a stablecoin,” Hasu added. “When your ponzi targets people’s accumulation (not investment) portfolio, there is a appropriate abode in hell aloof for you.”

In accession to the criticism, bodies accept been trying to buy the dip because they accept a able improvement will happen. However, while accomplishing so, abounding crypto traders are accepting ashore by the amount volatility. Additionally, crypto Twitter (CT) influencers are deleting tweets that discuss UST and LUNA in a absolute light. Furthermore, the crypto clamminess provider Genesis explained that the aggregation has “no absolute acknowledgment to UST and LUNA.” Individuals are additionally claiming that the atrophy of LUNA and UST was a “coordinated attack.” “Market abetment at its finest,” one alone tweeted.

Other Terra supporters accept been watching bots on Twitter and accept stated they are assertive Terra’s issues were the aftereffect of a arrant attack. There accept been odd sightings of bots or Twitter accounts repeating the aforementioned statement, which can be begin here, here, here, here, and here. While LUNA and UST accept not yet plummeted to zero, bodies are either action that they will or they accept Do Kwon and anticipate a massive changeabout is in the cards. By 10:45 a.m. (ET), UST was trading for $0.504 per unit.

CEO of Sator Says Luna Foundation and Do Kwon May Still Hold Bitcoin Reserves

Isla Perfito, the CEO of Sator, a community-first Web3 agreeable assurance platform, said that there may be a adventitious the Luna Foundation Guard (LFG) still holds bitcoin. “People accept LFG already awash their BTC,” Perfito told Bitcoin.com News in a statement. “That’s why UST is appraisement at .40 on the dollar. In the accident that they accept the BTC, their abetment is better. Do Kwon should accommodate a antithesis snapshot of his BTC to save UST. The CPI numbers came in college than accepted today.” The CEO of Sator added:

Alex Tapscott, the managing administrator of the agenda asset accumulation at Ninepoint Partners, explained to Bitcoin.com News on Wednesday that Terra’s affair is agnate to a barrier armamentarium exploding. “This is not clashing what happens back a ample barrier armamentarium ‘blows up’ and is affected to disentangle its positions,” Tapscott explained in an email. “It becomes a amount bacteria causing the assets its own to ache (though generally aloof temporarily).” Tapscott continued:

What do you anticipate about the LUNA and UST abortion and how things accept been unfolding? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons