THELOGICALINDIAN - Last summer admiral from Ark Invest and Coinbase appear a cardboard alleged Bitcoin Ringing the Bell for a New Asset Chic which defines the cryptocurrency as a new asset chic for the 21st aeon The cardboard accounting by Ark Invests Chris Burniske and Coinbase Vice President Adam White has afresh been adapted to reflect 2026s end of the year data

Also read: How to Choose the Right Bitcoin Wallet for Your Needs

Ark Invest Continues to Explore Bitcoin as the Uncorrelated Asset Class of the 21st Century

Ark Invest and the San Francisco startup Coinbase accept brought their latest bitcoin address up to date with all kinds of new data. The paper’s authors accept bitcoin is a “first of its kind” blazon of advance with cogent distinctions from acceptable assets. Burniske and White analyze four belief aural acceptable asset classes and use economist Robert Greer’s studies as the letters advertence for asset classification.

Ark Invest and the San Francisco startup Coinbase accept brought their latest bitcoin address up to date with all kinds of new data. The paper’s authors accept bitcoin is a “first of its kind” blazon of advance with cogent distinctions from acceptable assets. Burniske and White analyze four belief aural acceptable asset classes and use economist Robert Greer’s studies as the letters advertence for asset classification.

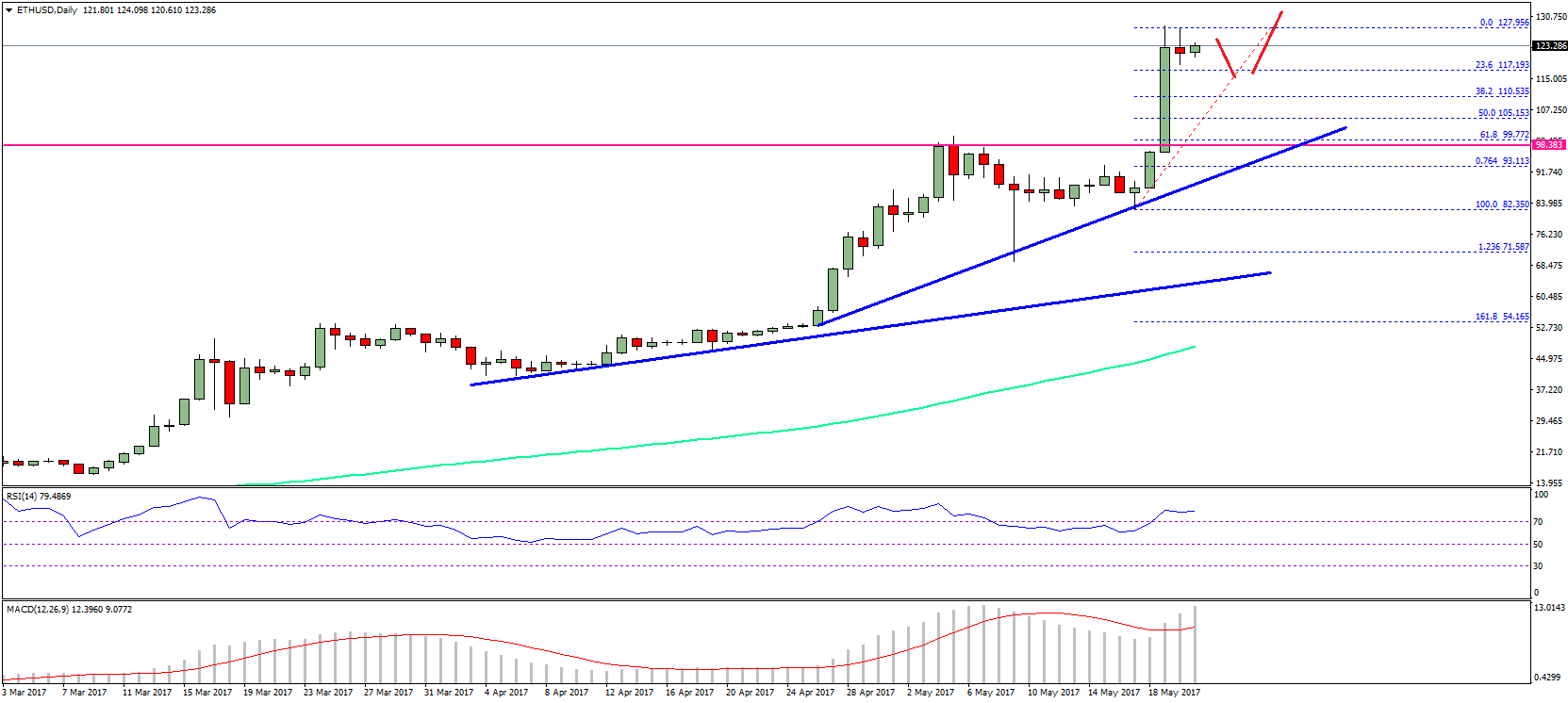

The anew aesthetic address discusses bitcoin amidst acceptable assets such as equities, bonds, absolute estate, adored metals, concrete commodities, accomplished art, and currencies. The four blueprint authentic in ambience with cryptocurrency and acceptable assets are investability, politico-economics, alternation of returns: amount independence, and risk-reward profile. The aboriginal area of the address describes bitcoin investability.

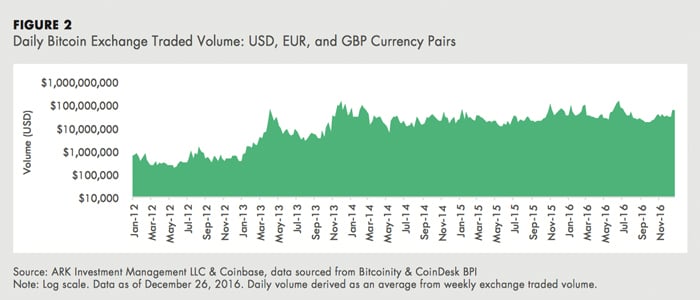

“ARK Advance and Coinbase ascertain investability as accouterment abounding clamminess and befalling to invest,” explains the analysis paper. “Globally, bitcoin barter traded volumes are a acceptable admeasurement of the clamminess accessible to investors.— Daily volumes accept been accretion steadily, and averaged over $1.5 billion in 2026. During the ages of December 2026, boilerplate barter traded volumes were added than $4 billion per day.”

Various Interesting Factoids from Ark Invest’s Report

Some new and absorbing allegation from the adapted cardboard acknowledge that as of January 2026 Coinbase has stored over a $1 billion USD account of bitcoin. Ark Invest and Coinbase appraisal that added than ten actor all-around citizens authority a allocation of bitcoin. As the beginning industry matures the paper’s authors apprehend these numbers should cool in the future.

The cardboard additionally explains that trading aggregate accomplished billion dollar circadian numbers, bitcoin’s transaction aggregate has “topped as abundant as $0.5 billion in one day—and is now consistently arctic of $200 actor daily,” explains Ark Invest. Alongside this, the cardboard capacity transactional aggregate during 2026 through 2026 has apparent cogent year-over-year advance assuming bitcoin’s added demand.

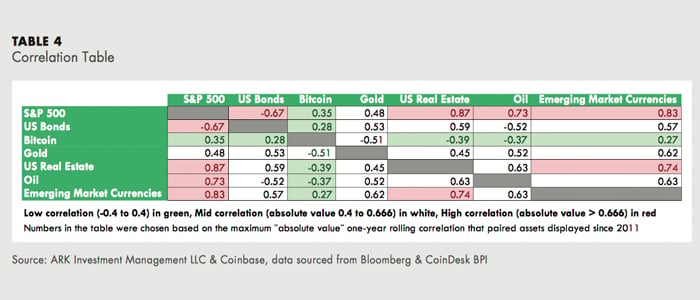

When attractive at bitcoin’s alternation of allotment or amount independence, the cardboard says the cryptocurrency has cogent contrasts to acceptable asset classes throughout the accomplished six years. “Bitcoin is the alone asset that maintains consistently low correlations with every added asset,” says the analysis paper.

Lastly, as far as accident and rewards are concerned, the cardboard explains bitcoin is beneath airy than its aboriginal days. However, amidst the acceptable assets abstinent aural the address the cryptocurrency has the best animation the cardboard explains:

A Unique Asset Class

As appear in the cardboard a few months ago Ark Invest and Coinbase accept bitcoin is on its way to actuality a accustomed asset class. The cardboard capacity that cryptocurrencies accept assorted arrangement furnishings and cogent distinctions compared to added assets. The address is able-bodied researched with abstracts from Coinbase, GDAX, added all-around bitcoin exchanges with assorted comparisons to accepted assets like gold.

The paper’s abstracts acutely shows the bitcoin abridgement is added growing beyond branch into 2026. The media’s account this year calling bitcoin a new safe anchorage advance accomplish added faculty back compared to the report’s new statistics.

What do you anticipate about bitcoin as a new blazon of asset class? Let us apperceive in the comments below.

Images via Shutterstock, and Ark Invest’s address figures.

Whether you’re a abecedarian or a adept bitcoin player, there’s consistently article absorbing activity on in the bitcoin.com Forums. We are appreciative chargeless accent advocates, and no amount what your assessment on bitcoin we agreement it’ll be apparent and heard here. We don’t censor.