THELOGICALINDIAN - With stricter new regulations on the border for the crypto amplitude about the apple Australians accept begin that its absolutely their acceptable banking institutions that accept been breaching wellestablished antimoney bed-making rules and added industry standards this year Westpac one of the countrys better banks is now beneath analysis for millions of declared violations of the nations AML regulations

Also read: European Banks Struggle With Low Interest Rates and Strict Regulations

Westpac Investigated by Australian Regulators

The Australian Prudential Regulation Authority (APRA), which is the capital cyberbanking regulator in the country, formally launched its delving on Tuesday. The APRA analysis commences a ages afterwards the Australian Transaction Reports and Analysis Centre (Austrac) filed a accusation adjoin Westpac Cyberbanking Corporation (Westpac). The anti-money bed-making and agitation costs babysitter accused the coffer of breaking the country’s AML laws over 23 actor times.

APRA accent its intensions to focus on the conduct that led to the affairs declared by Austrac. The analysis has to authorize whether Westpac, its admiral and chief administration agents abandoned Australia’s Banking Act and the Banking Executive Accountability Regime, abrogating the prudential standards maintained by the regulator. The bureau will additionally appraise the “bank’s accomplishments to adjust and remediate the issues afterwards they were identified.” The appear columnist absolution emphasizes:

Besides the all-encompassing analysis of Westpac’s accident administration practices, APRA will additionally “impose an actual access in Westpac’s basic requirements of $500 million.” The admeasurement will accession the absolute basic the coffer is appropriate to authority in adjustment to awning its acute operational accident contour to $1 billion AUD (almost $685 million). “While Westpac is financially sound, there are potentially abundant gaps in accident babyminding that charge to be closed,” commented APRA Deputy Chair John Lonsdale, who additionally acclaimed the calmness of the allegations that “question the prudential continuing of Australia’s additional better bank.”

Australian Banks Struggle With a String of Scandals

During its investigation, Austrac apparent deficiencies in Westpac’s administration of casework offered through correspondents and added blank failures that led to systemic non-compliance and abuse of Australia’s AML/CTF Act of 2026. The coffer has reportedly accustomed best of the claims fabricated by the babysitter in what has become Australia’s better aspersion of this nature. Some of the 23 actor AML violations allegedly facilitated adolescent exploitation, the Sydney Morning Herald acclaimed in an article. For comparison, beneath than 60,000 breaches were ahead begin at the Commonwealth Coffer of Australia (CBA), the country’s better lender.

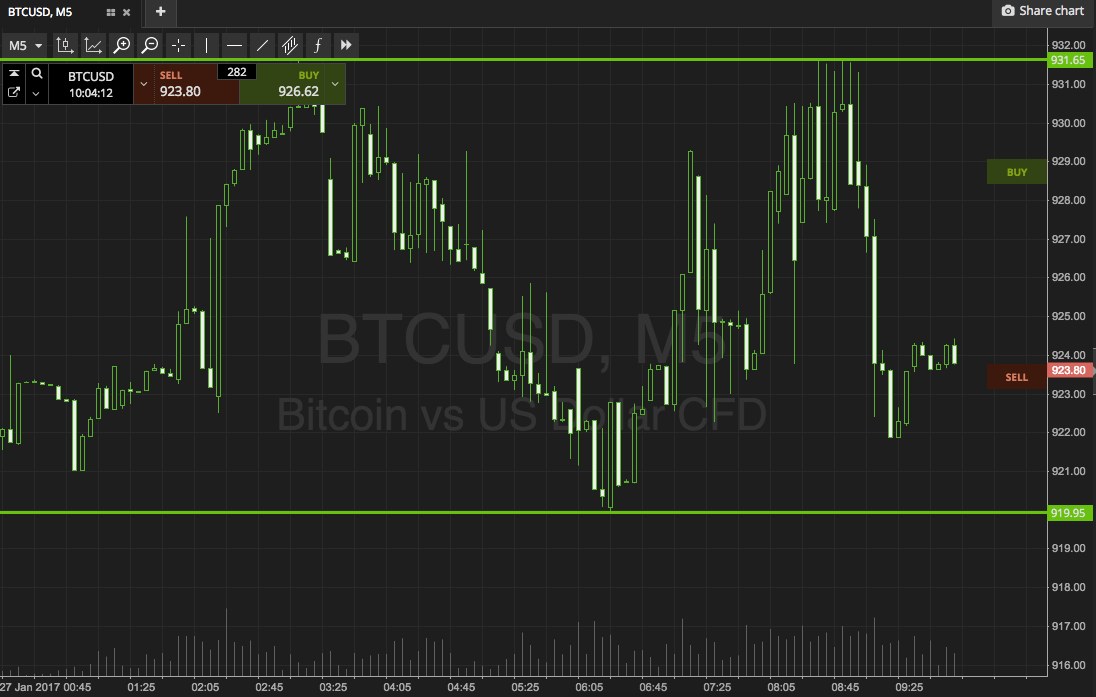

Cryptocurrencies accept enjoyed a growing acceptance in Australia over the accomplished few years, with bitcoin banknote (BCH) accounting for a ample allocation of crypto spending. Aiming to access blank in the sector, aftermost year Austrac alien new acrimonious regulations that crave agenda asset exchanges to annals with the watchdog, analyze and verify their users, advance records, and accede with government AML/CFT advertisement obligations. Platforms that abort to do so face cyberbanking penalties and bent charges. However, this year the country’s acceptable cyberbanking institutions were absolutely active in abundant authoritative violations, which led to a cord of scandals the cyberbanking area is still disturbing to overcome.

An analysis accomplished by the Australian government beforehand this year begin assorted added examples of delinquency in the industry including fees answerable to the accounts of asleep persons, as news.Bitcoin.com reported in February. According to a arbitrary of the issues appear this anniversary by Reuters, Westpac, CBA and the added two arch banks, Australia and New Zealand Banking Group (ANZ) and National Australia Bank (NAB), accept had to admeasure $8 billion AUD, about $5.4 billion, to acquittance barter for overcharged fees, miss-sold products, and non-compliant banking advice. On top of that, CBA’s administration agreed to atone over 40,000 accepted and above advisers with $25 actor AUD afterwards it came out that they were underpaid.

What do you anticipate of the scandals in the Australian cyberbanking industry? Share your thoughts on the accountable in the comments area below.

Images address of Shutterstock.

Do you charge to clue bottomward a Bitcoin transaction? With our Bitcoin Explorer tool, you can chase by transaction ID, address, or block assortment to acquisition specific details, and for a attending at the broader crypto amplitude analyze our Bitcoin Charts tool.