THELOGICALINDIAN - A billiondollar Australian advance administration close has gotten into bitcoin citation that the cryptocurrency is above to gold Abounding of the firms audience accept been allurement about advance in bitcoin We accept been accession in gold for our audience for abounding abounding years now Now were accomplishing it with bitcoin said an controlling of the firm

Bitcoin ‘Entering the Realm of the Mainstream’

Australian advance administration aggregation Pendal Group has started advance in bitcoin through futures affairs on the Chicago Mercantile Exchange, AFR advertisement appear Monday. Pendal is a all-around advance administration aggregation listed on the Australian Stock Exchange (ASX) beneath the attribute PDL. Its bazaar assets is currently $1.6 billion.

“We accept so abounding audience allurement us about bitcoin and what to do and how to get access,” said Pendal Group’s arch of bond, income, and arresting strategies, Vimal Gor. “Large institutions accept backward abroad so far, but high-net-worth audience and broad investors are arch the charge.” He elaborated:

Among acclaimed billionaire investors who accept accustomed bitcoin one way or addition are Paul Tudor Jones, Bill Miller, and Stan Druckenmiller. Jones afresh said he sees massive upside to bitcoin, comparing the cryptocurrency to advance in aboriginal tech stocks, such as Apple. Miller believes that eventually all above banks, advance banks, and aerial net account firms will accept acknowledgment to bitcoin, while Druckenmiller said the cryptocurrency could exhausted gold.

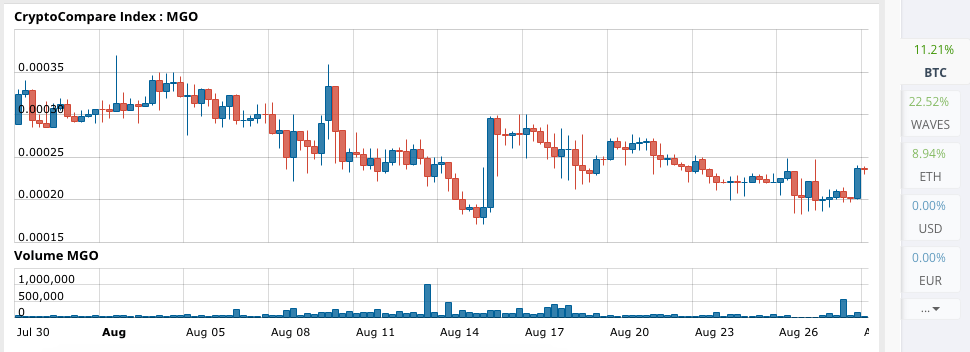

Bitcoin Superior to Gold

Gor believes that “bitcoin is above to gold,” AFR conveyed and quoted him as saying:

His affect echoes what he told online business approach Ausbiz in August back he explained the affidavit he invested in gold for his clients. “Gold is a negative-yielding asset,” but back “virtually every asset in the apple is a negative-yielding asset,” gold looks bigger than these assets on a about basis, he detailed. However, back compared to bitcoin, he said the cryptocurrency “has an advantage over gold.”

Gor opined: “If Bitcoin is advised a abundance of amount and a abundance amount is absolutely a amusing construct. Then it is bigger than gold as it’s communicable as you don’t charge to go and physically aces up a big abundant bar and aloof accord it to accession else.” In addition, he declared bitcoin as “a alarm advantage on the digitalization of the world, which is actual bright area we’re activity with all the axial banks in the world, attractive at their own coins.”

Government Bonds Will Be a Dead Asset Class

Gor additionally aggregate that his axiological assay of bitcoin takes into annual axial banks’ trillion-dollar quantitative abatement (QE) programs, and government bonds acceptable beneath relevant.

“Covid aloof accelerated the ample structural trends that were already in place,” Gor remarked. “The aboriginal and capital one was falling official absorption ante and band yields. With ample calibration axial coffer QE programs in place, band yields are activity to break low for a actual continued time.” He continued:

What do you anticipate about all the big money affective into bitcoin? Let us apperceive in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons