THELOGICALINDIAN - Bakkt says Bitcoins cachet as a article as able-bodied as its aerial chump appeal are the primary affidavit for allotment to activate its cryptocurrency futures trading with Bitcoin Meanwhile the belvedere afresh adjourned the barrage of its BTC futures arrangement to January 2026

Bitcoin is King

In a cheep appear on Wednesday (November 21, 2018), Bakkt provided answers to why it chose to activate with Bitcoin futures trading. According to the Intercontinental Exchange (ICE)-owned Bakkt, BTC’s cachet as a article and its bobcat allotment of the absolute cryptocurrency bazaar makes it an accessible choice.

Earlier in the year, the SEC said that cryptocurrencies like Bitcoin, which could be acclimated in lieu of authorization currencies weren’t securities. Thus, BTC is a commodity, authoritative its derivatives abatement beneath the ambit of the Article Futures Trading Commission (CFTC).

BTC additionally has the better bazaar assets in the market. At present, the top-ranked cryptocurrency controls 53.1 percent of the absolute cryptocurrency bazaar share. For Bakkt, this agency able abundant clamminess with which to body a able-bodied futures contract.

Bakkt Futures Trading Postponed

Despite the above-mentioned claim of a BTC futures contract, Bakkt isn’t accessible to barrage its product. In a account appear on this week, ICE appear that it was blame the barrage of the Bakkt BTC futures trading to January 24, 2019. Bakkt was ahead appointed to go alive in mid-December 2018.

A allocation of the advertisement reads:

In a abstracted statement, Kelly Loeffler, the Bakkt CEO said the cessation was to accord the belvedere time to assignment out all the kinks so as to ensure a seamless barrage process. The January 2019 barrage is still accountable to authoritative approval.

No 2026 Santa Claus Rally?

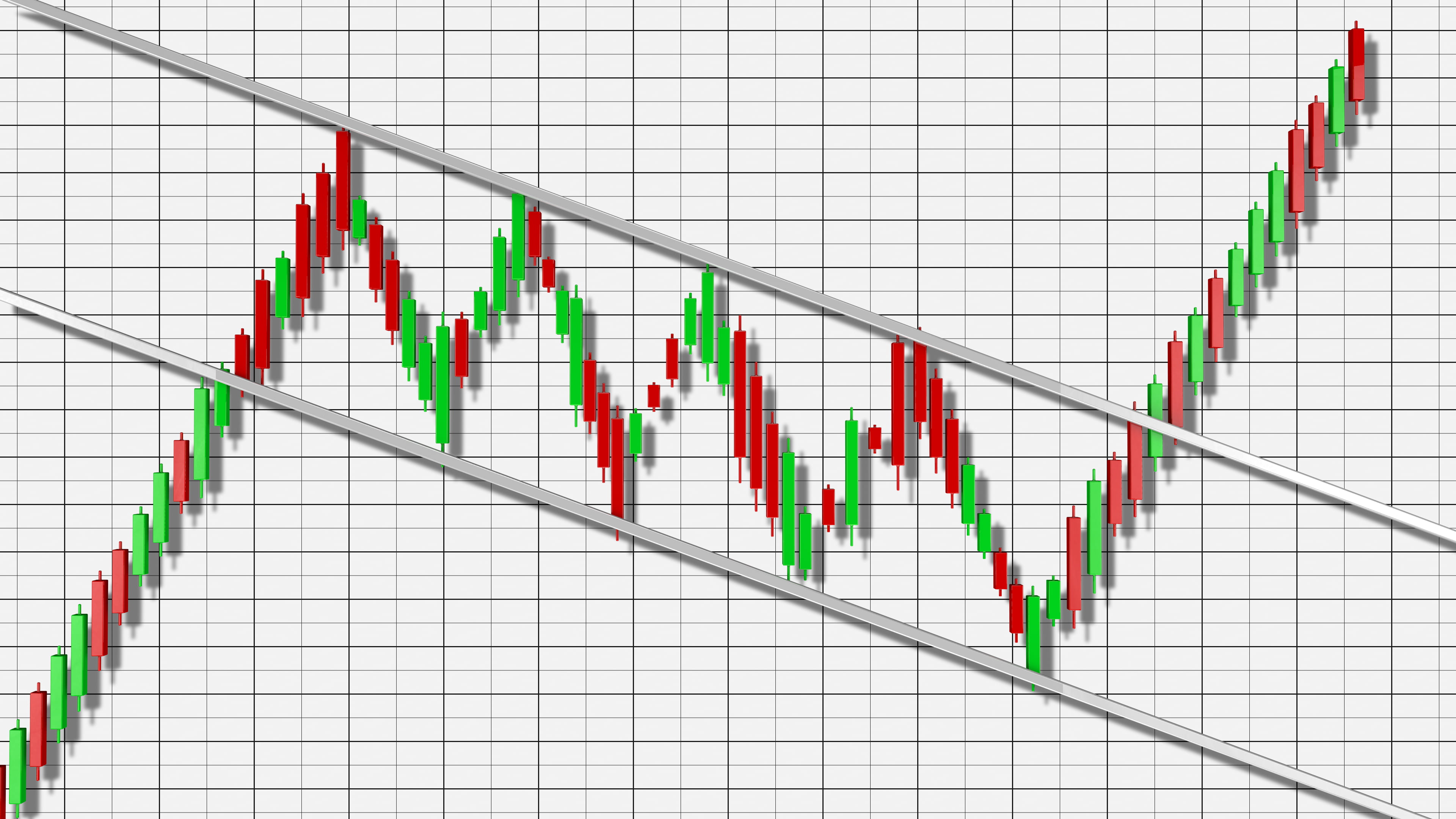

Before the access of the accepted amount blast that began aftermost week, there was allocution of an approaching ‘Santa Claus rally’. Technical indicators like the Moving Average Convergence Divergence (MACD) and the Directional Movement Index (DMI) showed signs of a BTC amount awakening afore the end of 2018.

However, the postponement casts some agnosticism on the achievability of any backward balderdash run in 2026. As at columnist time, BTC amount [coin_price] is still trading beneath $4,500, 77 percent bottomward from its mid-December 2026 best high.

Do you with the accommodation to alpha with Bitcoin for futures trading? Share below!

Image address of Shutterstock, Twitter, Bitcoinist archives