THELOGICALINDIAN - The cardboard analysis died a few years ago Now the accumulation annual is atrociously abutting its afterlife Millennials the better active bearing are not absorbed in accumulation accounts managed by acceptable banks Instead more millennials adopt to put their accumulation into Bitcoin

The three-thousand-year-old budgetary system, and in about-face the anachronistic cyberbanking system, are acceptable casualties of the cryptocurrency’s all-embracing abstruse revolution.

The millennial bearing does not trust cyberbanking institutions. Accumulation accounts, which are one of the best emblematic cyberbanking instruments, are acceptable irrelevant. In fact, millennials are accident absorption in architecture their accumulation beneath the acceptable cyberbanking system.

Instead, as millennials become added acquainted with the cryptocurrency’s inherent features, in growing numbers, they are accommodating to put their accumulation into Bitcoin.

In this regard, Forbes writes:

Millennials’ addiction to boycott acceptable coffer accumulation accounts seems to be accepting momentum. According to the after-effects of a survey conducted by CoinSpectator:

Recent analysis shows that banks are not affair millennials’ demands and expectations. For example, millennials are balked by the restrictions that acceptable banks appoint on accumulation accounts.

A acceptable accumulation annual involves you giving your money to the bank, for which you acquire a baby bulk of interest. For this service, the coffer or banking academy captivation your money accuse you a fee if your account’s antithesis avalanche beneath a assertive account boilerplate balance. The bulk of this minimum account antithesis is imposed by the bank. Some banks accomplish it difficult for you to apprentice about these fees. Moreover, the coffer restricts the cardinal of withdrawals you can accomplish per month. The best cardinal of withdrawals is additionally arbitrarily accustomed by the bank. Obviously, such an adjustment does not address to millennials.

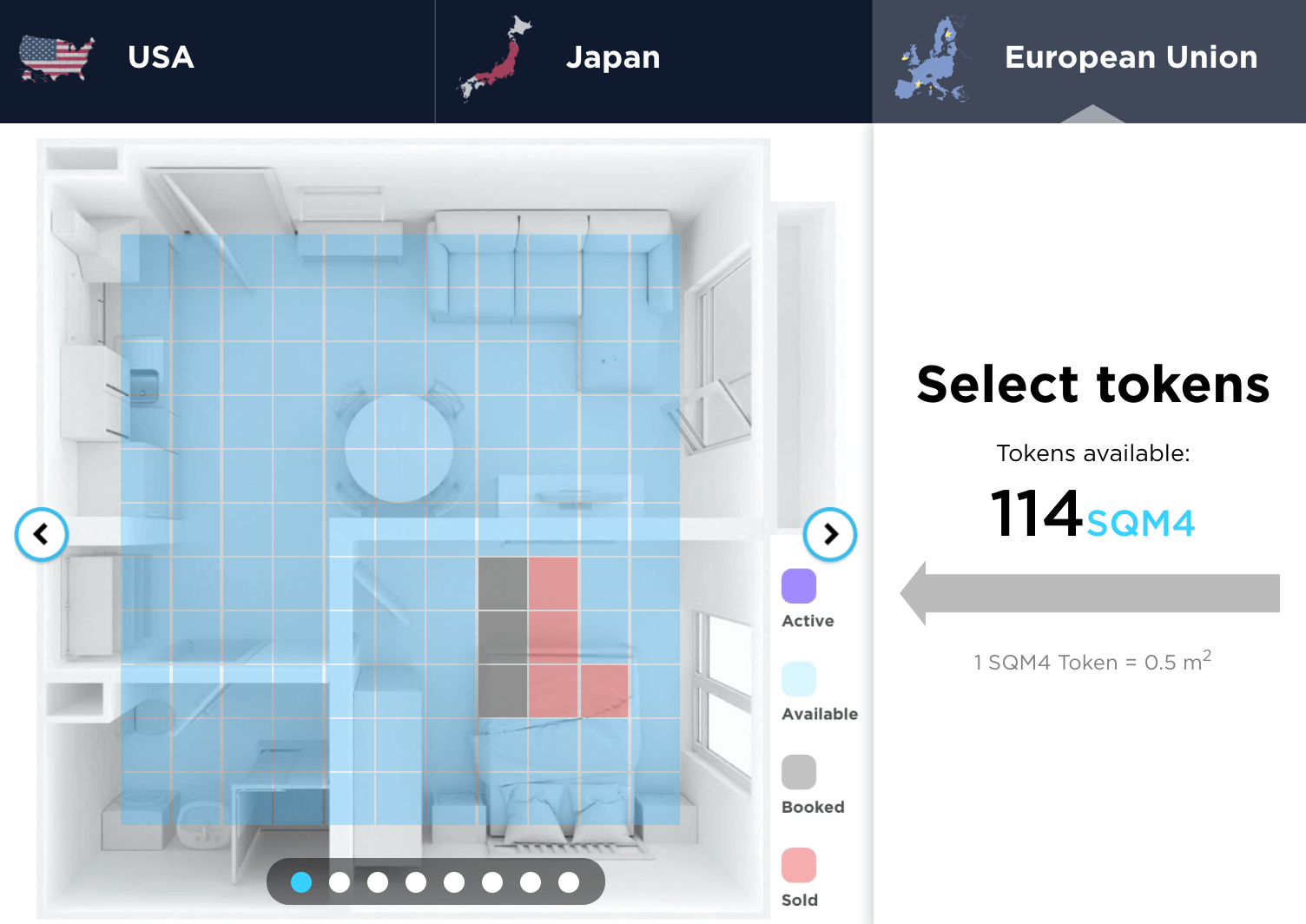

Fortunately, technology is transforming cyberbanking casework and products. For example, smartphones are authoritative debit cards and ATM cards obsolete.

Indeed, abstruse advances accept already fabricated ample dents in the traditional, common cyberbanking system. For example, the cardboard analysis died back it became accessible to alteration money electronically. In October 2008, the U.S. Congress anesthetized the 21st Century Act, which was the final attach in the cardboard check’s coffin. The Analysis 21 legislation accustomed banks to handle checks electronically.

The fate of the coffer accumulation annual ability chase that of the cardboard check, conceivably not by legislation, but by choice. For example, millennials accept now the option to advance their accumulation in Bitcoin-based IRAs.

Do you anticipate Bitcoin-based accumulation accounts will anon become boilerplate investments? Let us apperceive in the comments below!

Images address of Shutterstock, Pixabay