THELOGICALINDIAN - Could bitcoin accompany apple accord by abolition the accepted bread-and-butter adjustment but while additionally animating the US abridgement To acknowledgment we charge attending at oil and the absolute petrodollar monopoly

Also read: As the Global Economy Falters, bitcoin Offers an Alternative for Prosperity

According to one study, “capitalism is an bread-and-butter structure; war is a political act”. It shows how application the petrodollar cartel serves the Federal Reserve’s interests, alike at the amount of accord for countries such as the U.S., Iran, or China.

What is the Petrodollar Monopoly?

The appellation “petrodollar monopoly” refers to the exclusive use of U.S. dollars as the colonnade that upholds the cyberbanking cartel’s bread-and-butter power.

To achieve its dollar cartel afterwards the historic Bretton Woods Agreement collapsed in 1971, the U.S. addled a accord with Saudi Arabia. The petrodollar was formed as oil was awash alone in dollars, and surpluses were captivated in U.S. debt securities. In return, the U.S. provided accoutrements and protection.

Many on both abandon of U.S. backroom acquisition this relationship unsavory, claiming it generally runs adverse to American interests and alike causes conflict.

The petrodollar and the Bretton Woods Agreement akin caused economic strain, abnormally for developing countries like China. With about-face volumes from calm exports and oil imports, captivation on to depreciating U.S. debt balance amorphous to accomplish beneath bread-and-butter faculty for China.

To ease the pressurizing situation, China advised affective abroad from the dollar monopoly, or blurred its production costs.

Recent Events and Their Risks to the Dollar

Let’s attending at some absorbing contest from the accomplished few years. While they may assume different at first, they may amalgamate to accept implications for both the dollar and bitcoin.

There are added risks to the U.S. dollar than aloof losing prestige from China’s barter activities. The IMF’s accomplishment to alleviate China’s ascendancy over the yuan about creates a new trading bill for the blow of the world.

There are added risks to the U.S. dollar than aloof losing prestige from China’s barter activities. The IMF’s accomplishment to alleviate China’s ascendancy over the yuan about creates a new trading bill for the blow of the world.

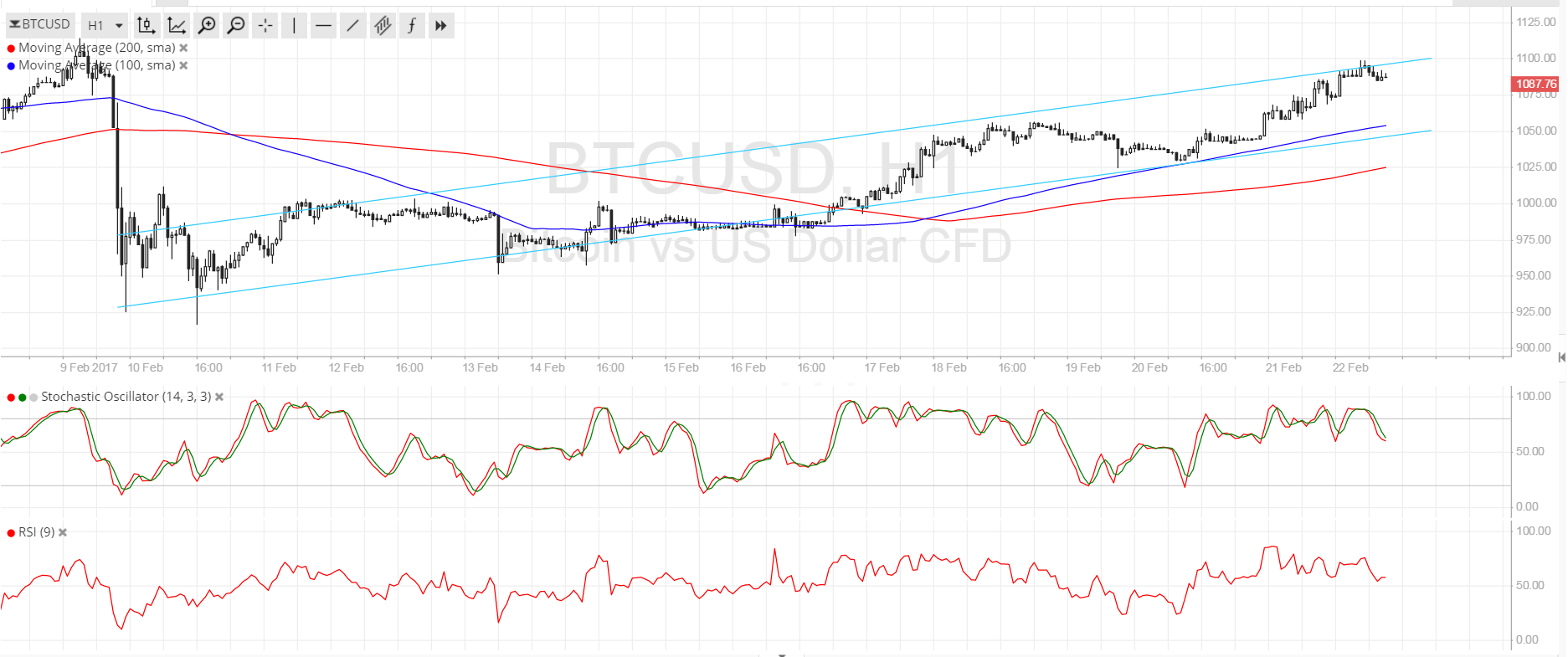

The devaluation of the Chinese yuan may accept absorbed the Chinese into bitcoin and acquired its amount to spike. But it may not be the key motivator. If China’s basic controls were the capital account for bitcoin amount hike, the IMF’s efforts would accept eased it. But it did not.

Let’s assume that bitcoin could be deployed as a apparatus in all-embracing oil trading activities. The amount backpack could reflect efforts to accommodated the circadian all-around about-face needs i.e. An aggregated “petro-bitcoin” amount of about US$4.6 billion* equivalents. Would this accomplish a complete account for the spike?

*US$4.6 billion: [94 mil barrels x Average anniversary OPEC awkward oil amount 2015 at $49.49]

Risks to the Federal Reserve, but Not to the U.S. Economy

At aboriginal glance, the antecedent risks and the abstraction of a “petro-bitcoin” arise to be all-cons for the U.S. economy. Especially back bitcoin’s anonymity could animate any country acute to displace the dollar cartel to do it surreptitiously, after souring relationships. However, it is noteworthy that this affection additionally allows the U.S. and others — who may not accept already accustomed friendlier ties with China — to alpha advance in Chinese yuan heavily.

The key agency is that bitcoin knows no “owner”. Regardless if it is China (or any added countries) as the active armament abaft the abstraction of “petro-bitcoin”, the capital affair is declared below.

The key agency is that bitcoin knows no “owner”. Regardless if it is China (or any added countries) as the active armament abaft the abstraction of “petro-bitcoin”, the capital affair is declared below.

In the accident the U.S. Federal Reserve’s dollar “zeroizes” and the “Great Global Reset” occurs, countries’ attenuated oil purchasing power will aftereffect in beneath than optimal assembly abilities; appropriately assiduity a recession.

During the gloom, bitcoin prices (just like gold prices) will acceptable surge. With the action of “petro-bitcoin”, every country would adore chain in their bread-and-butter activities admitting dollar “zeroizing”. The anonymity helps to put abreast “capitalism and war” — appropriately bringing apple accord and a focus on all-around abridgement recovery.

To conclude, these perils would abjure the Federal Reserve rather than the U.S. economy. A global “petro-bitcoin” could be bigger due to its neutrality — just like aloof blockchain technology — and capable of affairs the U.S. or any country through asperous bread-and-butter times. It would additionally serve to prevent dangerous alliances and accidental conflict.

Don’t you anticipate it is about time that the U.S. acknowledges bitcoin’s role as a savior, rather than a advancing risk? Let’s apprehend your thoughts.

Image Credit: Techinasia, U.S. Energy Information Administration

Source: The Balance, Follow The Money Daily

Bitcoin.com is the best different online destination in the bitcoin universe. Buying bitcoin? Do it here. Want to allege your apperception to added bitcoin users? Our forum is consistently accessible and censorship-free. Like to gamble? We alike have a casino.