THELOGICALINDIAN - Bitcoin has clearly bankrupt out its affliction aboriginal division in the seminal cryptocurrencys history For investors about that alone agency a massive backlash is on the horizon

The aboriginal division of the banking year hasn’t been acceptable for Bitcoin. In fact, it’s been the affliction Q1 in the history of cryptocurrency’s gold accepted — but abhorrence not! That alone signals a able Q2 is in the cards.

One accepter in the accessible backlash is Brian Kelly, the architect of Kelly Capital and a contributor to CNBC. He told the network’s Futures Now that:

The appendage apprehension Kelly mentions are afflicted up by a array of things.

First and foremost, cryptocurrency has historically performed able-bodied in Q2 of the banking year. Coupled with “an accessible anniversary development cycle” and “a cardinal of big conferences, such as Consensus in May,” and it’s not difficult to see the tides of absolute affect rising.

Secondly, as acclaimed by Kelly, the tax division — which isn’t absolutely best investors’ admired time of the year and has done a lot of accident to the Bitcoin archive — is advancing to an end. Says the analyst:

Kelly additionally addendum that the FUD (Fear, Uncertainty, and Doubt) surrounding government adjustment of cryptocurrency is starting to subside, as investors boring become added assured in what was consistently an inevitably. Explained Kelly:

Additionally, the account of Japanese allowance close Monex’s absorption in purchasing the once-hacked Coincheck cryptocurrency barter signals a above beat in confidence. As acclaimed by Kelly:

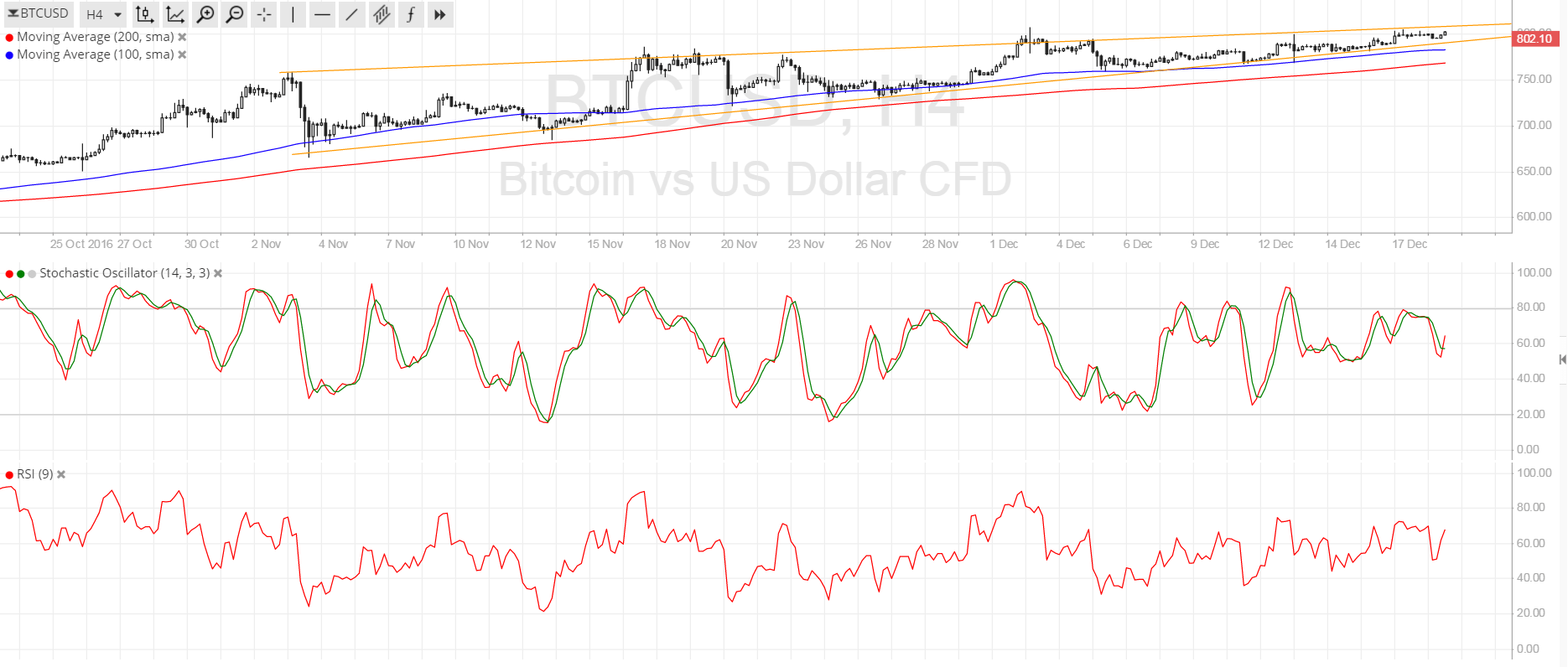

Bitcoin’s backlash may already accept started. At columnist time, Bitcoin is trading at $7,401.70, and admitting investors may not be out of the bear-infested dupe aloof yet, it’s adamantine not to feel the antithesis of ability shifting.

Do you anticipate Bitcoin is abreast for a balderdash run, or do you anticipate the bears will abide durably in ascendancy in Q2? Let us apperceive in the comments below!

Images address of Shutterstock, Bitcoinist archives.