THELOGICALINDIAN - Over the accomplished two years the bitcoin barter altitude in Australia has been both hot and algid activity through altered phases which has created a arduous ambiance for barter operators and bitcoin startups in the country

It started out positive, with the National Australia Bank publishing a report in 2013 allurement if Bitcoin will alter the AUD. The address at the time was basic and aloof adjoin bitcoin. Then aftermost year the Australian Tax Office (ATO) released it’s tax guidelines on bitcoin which affected barter affairs to be accountable to Goods and Services Tax (GST). Also during this time, acclaim agenda behemothic MasterCard fabricated it clear that they were lobbying adjoin bitcoin allurement for added adjustment in Australia.

A absolute arresting this year, was back it was discovered that Australian Westpac Cyberbanking Corp was an broker in US based bitcoin barter Coinbase. However, aloof two weeks ago there was addition setback which has created the better claiming yet for exchanges. Westpac Cyberbanking Corp and Commonwealth Bank of Australia sent letters to several bitcoin exchanges aback shutting bottomward their cyberbanking accounts and services.

According to the Centre for Law Markets and Regulation in Australia, cyberbanking sources said that bitcoin exchanges had been triggering aerial levels of red flags in the banks’ AML systems and controls and this had prompted the crackdown. They said this had triggered the alleged “de-banking” of ample numbers of audience in the remittance and payday lending sectors. They additionally went on to say “this all comes aback to reputational risk, acquiescence costs and apropos about burden from U.S.-based contributor banks.”

The more difficult ambiance in Australia has created a few roadblocks for bitcoin exchanges in the country, banishment some to abeyance completely. The targeted annual closures afresh affected one barter to leave Australia all together.

Here’s the who’s who of exchanges in Australia. Who’s left, who has shutdown, and who is still operational.

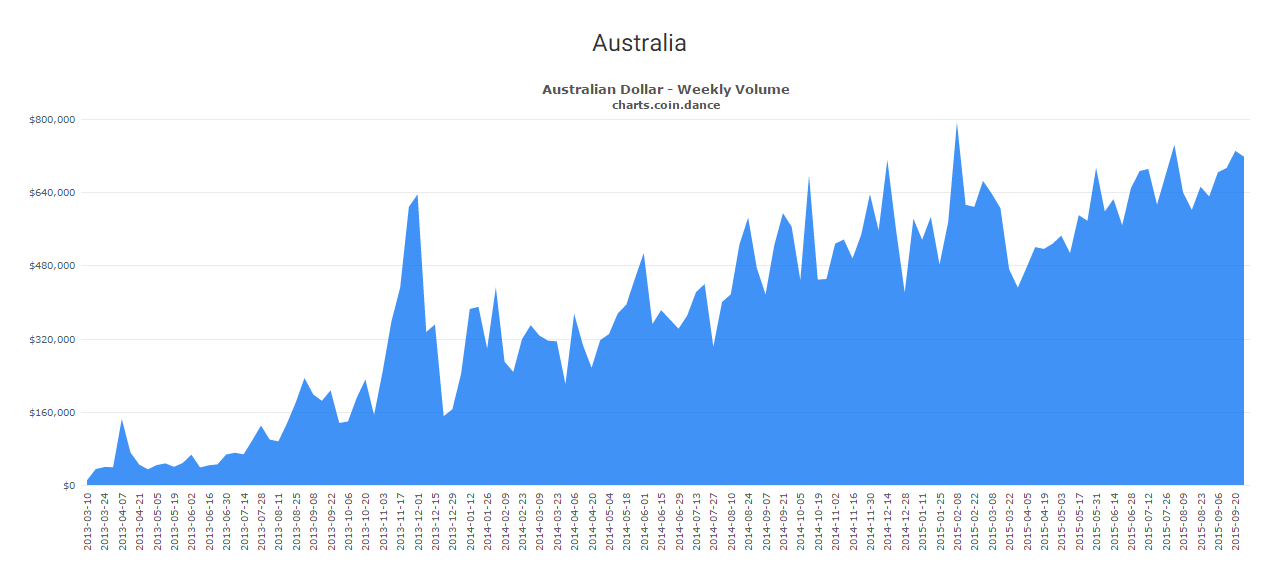

Amid all of the cyberbanking and authoritative issues in Australia, the bulk of bitcoin affairs assume to acquaint a adventure of a advancing market. The chart aloft is from coin.dance, which shows the LocalBitcoins account transaction aggregate in AUD which is on a abiding climb.

LocalBitcoins, who by the way ranked #1 as the best bitcoin exchange on the bazaar by the bitcoin community, is a abundant archetype of how banks are not able to appulse bitcoin’s decentralized nature. Because LocalBitcoins uses a person-to-person trading system, there is no coffer involvement, and anniversary being aloof trades bitcoins with anniversary other. Outside of LocalBitcoins, added exchanges that abide accessible in Australia, for archetype BTC Markets, are still assuming healthy transaction aggregate as well.

Outside of Australia, banks accept been embracing bitcoin and blockchain technology in huge after-effects and the CFTC in the U.S. says that bitcoin is now a commodity. Exchanges are blossoming in the U.S. as well, admitting the arduous BitLicense and adventure capitalists are still pouring bags of money into bitcoin exchanges.

Clearly not all exchanges in Australia accept been abeyance admitting some contempo cyberbanking closures, and several banks in Australia are still accommodating to assignment with exchanges and accommodate them services. The bazaar appeal appears to be there, the authoritative altitude seems permissive, and startups appetite to body in Australia. However, if the banks abide to barricade bitcoin startups, they will be affected to abeyance or leave.