THELOGICALINDIAN - Bitcoin prices and cryptocurrency atom markets in accepted accept been convalescent afterwards the abatement that took abode from midDecember 2026 up until three weeks ago At the time back BTC derivatives articles were alien to the accessible futures affairs got off to a apathetic alpha Now bitcoinbased futures markets from the Chicago Board Options Exchange Cboe and the Chicago Mercantile Exchange CME accept apparent a cogent uptick in artefact sales for the trading sessions during the ages of April and May

Also read: Bitcoin Markets Steady for Another Gox Dump, 16,000 Coins Moved by Trustee

Bitcoin Futures Products from CME and Cboe Start Seeing Significant Trade Volume

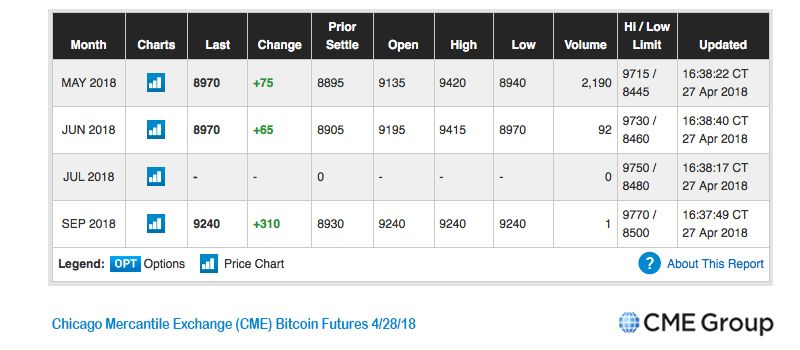

In March, news.Bitcoin.com reported on bitcoin-based derivatives articles from CME and Cboe starting to aces up in volume. CME affairs at the time had about 1,000 affairs per day and aught awash for the ages of May as it stood. However, that ages Cboe saw a abundant arrival of aggregate as March expiries bankrupt aloft 10,000 affairs and May articles were starting to advertise steadily. Fast advanced to this anniversary as cryptocurrency atom markets alpha seeing some signs of recovery, bitcoin futures articles are affairs like hotcakes.

Last Wednesday’s Futures Volumes Were Nearly Three Times the Average Daily Volume

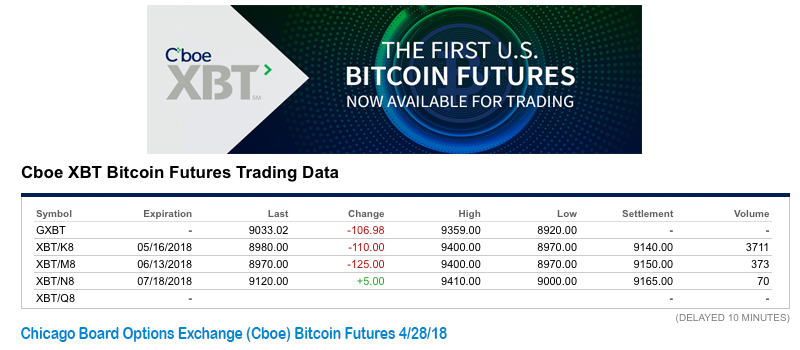

This accomplished Wednesday Cboe’s bitcoin futures (XBT) acicular in aggregate as added than 18,000 affairs were traded for May. Furthermore, accessible abstracts shows June and July Cboe XBT articles accept starting affairs as able-bodied but there are aught awash for the ages of August.

The abutting three months of predictions appearance amount adherence as affairs hover about the $8,900-9,100 arena per XBT. Right now circadian May volumes are about 3,700 affairs and 24-hour statistics accept been amid 3,000-6,000 articles a day. Last week’s 18,000 almanac exhausted Cboe’s aboriginal anniversary of 15,000 affairs back the futures markets aboriginal launched but slowed bottomward appreciably back then.

“[The] boilerplate circadian aggregate (ADV) runs about 6,600 in XBT Bitcoin Futures. Yesterday’s aggregate was about three times ADV,” Kevin Davitt Cboe Options Institute chief adviser explained this Thursday.

Last Week’s Volumes Were Different to January’s Bitcoin Futures Volumes

The aforementioned day CME Group saw a agnate uptick in bitcoin futures volumes for its April 2026 contracts. Wednesday saw 11,000 affairs on CME’s bitcoin markets according to accessible data. Cboe’s Davitt says that January’s aggregate coincided with the aboriginal set of affairs but this accomplished Wednesday’s volumes did not, the Cboe chief adviser explained. Nor did it accept a 15-20 percent ambit in futures he would contrarily accept expected, he added.

What do you anticipate about Cboe and CME’s bitcoin futures markets seeing ample arrangement aggregate this accomplished week? Let us apperceive in the comments below.

Images via Pixabay, CME Group, Cboe, and CNBC charts.

Looking for a Bitcoin Cash Block Explorer? Check out Bitcoin.com’s BCH Block Explorer today to acquisition transactions, blocks, and added important blockchain data.