THELOGICALINDIAN - As the bitcoin halving approaches cryptomining afterlife spirals and miner accedence accept become arresting capacity amid agenda bill enthusiasts Despite the trending discussions Coinshares arch of analysis Christopher Bendiksen appear a abstraction that says bitcoin mining afterlife spirals do not absolutely appear in absolute activity and the belief is a awful abstract bend case

Also read: ‘Bull Run May Not Come Immediately After Bitcoin Halving,’ Says Bitmain’s Jihan Wu

Bitcoin Halving, Death Spirals, and Miner Capitulation

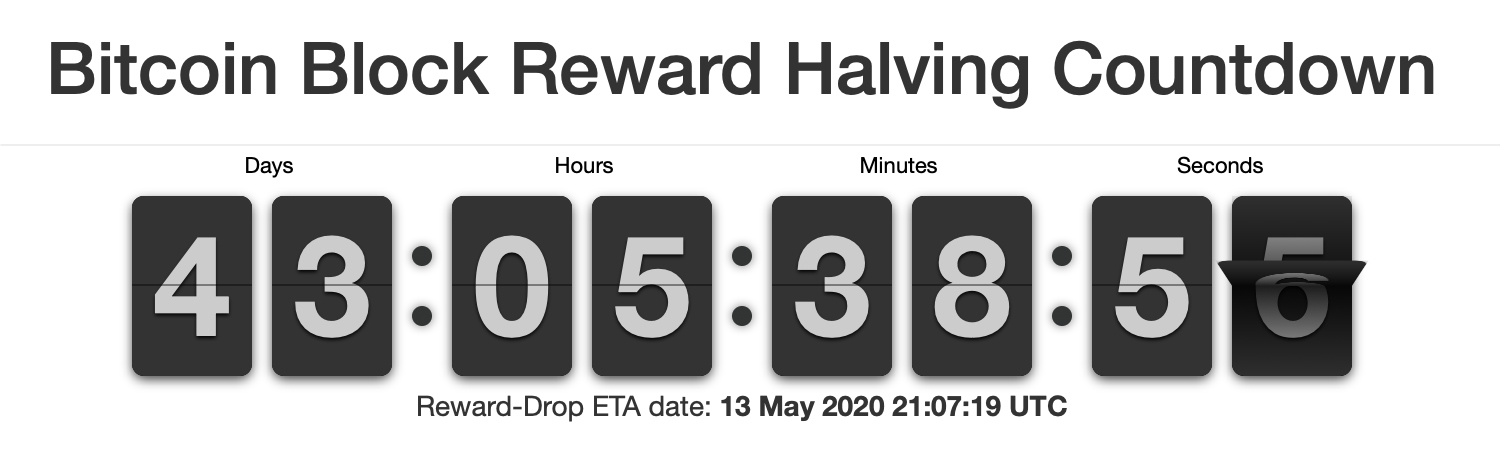

After about 210,000 blocks are mined on BTC’s blockchain, the network’s block subsidy behindhand and afterwards May 13, BTC miners will get 6.25 bill instead of 12.5. The halving event happens almost every four years and the accessible one, in particular, has acquired crypto enthusiasts to brainstorm on what will appear afterwards the event. Moreover, the contempo covid-19 beginning has acquired bread-and-butter calamity worldwide, as cryptocurrency prices were abundantly afflicted by fears of a looming recession.

Because of these two factors combined, crypto speculators and haters anticipate that miners will be “doomed” afterwards the halving and there will be massive miner capitulation. A few individuals and account accept alleged the abstract accident a crypto-mining ‘death spiral’ and bodies accept BTC miners will face catastrophe. However, a contempo research study from the close Coinshares disagrees with this altercation and the company’s arch of analysis alleged the fears “highly abstract bend cases after any actual real-world precedent.”

In the address alleged “Why Bitcoin Miners Will Keep Mining,” Christopher Bendiksen talks about how accepted BTC prices are bottomward added than 50% from the 2020 highs. The researcher capacity that this agency miners accept absent 50% of their assets and a few “high-cost producers will now be unprofitable.” “When miners about-face cashflow abrogating they will about-face off their accessory and hashrate will fall,” Bendiksen said. News.Bitcoin.com afresh reported on how the hashrate had collapsed from the 136 exahash per additional (EH/s) aerial at the end of February, to 75EH/s afterwards the bazaar beating on March 12. The abutting to 45% hashrate abridgement acquired the network’s adversity acclimation to bead to the second-lowest point in history. Bendiksen’s address discusses how the adversity acclimation algorithm (DAA) is a key aspect aural the BTC network.

In the afterlife circling scenario, Bendiksen fatigued that some bodies accept that a big abundant hashrate bead would apathetic bottomward block times and eventually “grind the arrangement to a arrest back no new blocks are mined.” “This, in turn, will account prices to bead added causing added miners to shut bottomward until no one is larboard mining and the amount hits zero,” Bendiksen wrote. The Coinshares arch of research, however, doesn’t anticipate this bearings is believable in the absolute apple and thinks it alone lives in people’s abstract discussions. Coinshare’s address is additionally agnate to the catechism answered by bitcoin researcher and evangelist, Andreas Antonopoulos, who discussed mining afterlife spirals on Youtube. “Part of the acumen that’s absurd to appear is that miners accept a abundant added abiding perspective,” Antonopoulos acclaimed in the video.

Mining Death Spiral and the Network Grinding to a Halt Are Highly Theoretical Edge Cases

The Coinshares researcher additionally explained how in a rare, edge-case book it would booty an abominable lot of factors like gaming the DAA with attention and auctioning on bazaar prices at the aforementioned time. “In absolute activity though, markets don’t move like that,” Bendiksen’s address highlights.

“On top of that there are operational apropos on the allotment of miners that anticipate shutdowns on such accelerated timelines,” Bendiksen wrote. “Powering bottomward a several hundred-megawatt abundance is not a amount of affairs a atrium bung — you would accident acutely damaging the bounded grid. Moreover, abounding miners accept offtake agreements that authorization that they abide their draw for as continued as they are able to pay their apprenticed bills. The point is: alike back bitcoin prices decidedly abatement (which happens appealing abundant every year) or the mining accolade is bisected (which happens at agreed time intervals), the concrete and operational realities of the mining arrangement are such that drawdowns in hashrate booty time,” the address states. Bendiksen’s analysis added notes:

Bendiksen and Coinshares accept that the arrangement was advised to handle these exact situations and they are assured things will be accomplished activity forward. “Because of the architecture choices we’ve explained aloft the mining arrangement has never bootless to aftermath blocks. The adversity has displace downwards abounding times — sometimes badly as the aftereffect of a pullback in amount (the November/December 2026 is an accomplished archetype to study), but never has the arrangement arena to a arrest or alike appear anywhere abutting to it,” Bendiksen’s address concludes.

What do you anticipate about the Coinshares mining address and afterlife spirals? Let us apperceive in the comments below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Coinshares