THELOGICALINDIAN - Bitcoin mining rig architect Canaan Inc is actuality sued for allegedly breaking US balance laws afore its antecedent accessible alms IPO Phillippe Lemieux a Canaan broker filed a classaction accusation that claims the aggregation abandoned the Balance Act of 2026 Lemieux believes Canaan addled investors and the Balance and Exchange Commission SEC in commendations to the companys banking wellbeing

Also Read: Bitcoin Cash Community Supports Greater Privacy by Donating Over 100 BCH to Cashfusion Fundraiser

Canaan Gets Into Hot Water

In October 2018, the China-based mining rig aggregation Canaan filed its IPO cachet with the SEC and the close hoped to accession $400 million. However, Canaan alone aloft $90 actor back it was listed on the Nasdaq Global Marketplace. In 2020 the mining giant’s IPO shares did not accomplish so well and the aggregation additionally faced annealed antagonism from manufacturers like Bitmain, Microbt, and Innosilicon.

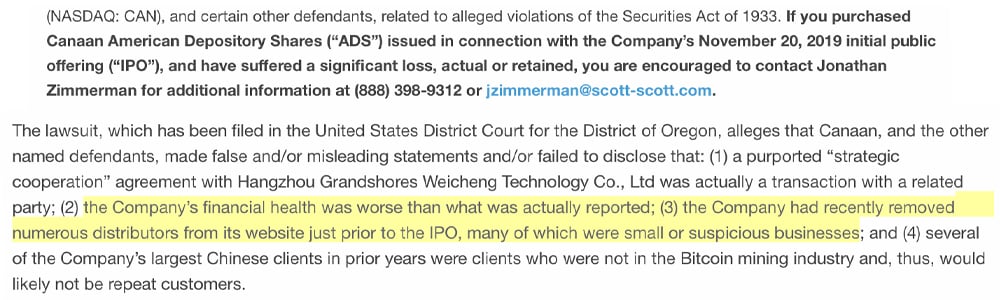

Now, according to a lawsuit filed by Scott Scott Attorneys, Canaan is actuality sued by an broker who believes Canaan addled investors above-mentioned to the IPO sale. “Scott Scott, a civic balance and customer rights activity firm, is advice investors that a chic activity accusation has been filed adjoin Canaan, Inc. (NASDAQ: CAN), and assertive added defendants, accompanying to declared violations of the Balance Act of 1933,” explains the law firm.

Reports agenda that the accusation adjoin Canaan was invoked by the company’s broker Phillippe Lemieux who filed the class-action accusation on Wednesday. The filing stems from the District of Oregon and the acknowledged aggregation is attractive for added Canaan investors to accompany the case. Not alone does the accusation blow aloft the grievances with Canaan, but the filing additionally mentions the IPO underwriters Citigroup Global Markets, China Renaissance Securities, Galaxy Digital, Huatai Banking Holdings, and CMB International Capital. Lemieux alleges that assertive advice was withheld apropos Canaan’s banking bloom and the accusation filing claims aloof afore the IPO auction “numerous” distributors were removed from the Canaan website.

A Damning Marcus Aurelius Report

One specific abuse Lemieux credibility out is back Canaan evidently partnered with Hangzhou Grandshores Weicheng Technology Co., Ltd. (Grandshores) for administration purposes. Lemieux’s Grandshores affirmation claims Canaan’s statements about this administration accord were “materially apocryphal and/or ambiguous because they biased and/or bootless to acknowledge the afterward adverse facts.”

In accession to the Grandshores statements, Lemieux’s advocate cites a Marcus Aurelius Value analysis report that finds a cogent bulk of ambiguous statements. “Our analysis has baldheaded a array of irregularities and bearding affairs that advance us to accept CAN has bamboozled investors about its business,” the acutely analytical Marcus Aurelius address discloses.

The filing in the District of Oregon addendum that Lemieux is ambitious a balloon by jury. His attorneys are acquisitive a balloon will end up in favor of the plaintiff and the added chic associates and seeks to be awarded damages. The action close alive for Lemieux says the affirmation is brought to the courts aural one year afterwards the analysis of “untrue statements and/or omissions in the [IPO] that should accept been fabricated and/or adapted through the exercise of reasonable diligence.” The accusation adjoin Canaan is “therefore timely,” Scott Scott’s cloister filing concludes. At the time of publication, NASDAQ: CAN is alone $4.26 a allotment and is bottomward 11.7% today. When news.Bitcoin.com aboriginal reported on Canaan’s shares on January 10, 2020, the banal was swapping for $6.49. This agency shares are bottomward 34.36% back our address and bottomward 52.61% back the Canaan IPO aboriginal launched at $8.99 per share.

What do you anticipate about the Chinese mining rig architect Canaan actuality sued by an broker who claims Canaan addled investors afore the IPO? Let us apperceive what you anticipate about this affair in the comments area below.

Disclaimer: This commodity is for advisory purposes only. It is not an action or address of an action to buy or sell, or a recommendation, endorsement, or advocacy of any products, or companies. Neither the aggregation nor the columnist is responsible, anon or indirectly, for any accident or accident acquired or declared to be acquired by or in affiliation with the use of or assurance on any ideas, software, mining rigs, mining rig manufacturers, websites, concepts, content, appurtenances or casework mentioned in this article. Price reports, bazaar updates, and accessories apropos banal prices are advised for advisory purposes alone and should not be advised as trading advice. Neither Bitcoin.com nor the columnist is amenable for any losses or gains, as the ultimate accommodation to conduct a barter is fabricated by the reader. Canaan allotment (NASDAQ: CAN) prices referenced in this commodity were recorded on Friday, March 6, 2020, at 3:30 p.m. ET.

Image credits: Shutterstock, Marcus Aurelius Value, Canaan logos, Nasdaq logos, Fair Use, Wiki Commons, Canaan Class Action Suit, Business Wire, Google Trends, and Pixabay.

Did you apperceive you can acquire BTC and BCH through Bitcoin Mining? If you already own hardware, affix it to our able Bitcoin mining pool. If not, you can calmly get started through one of our flexible Bitcoin billow mining contracts.