THELOGICALINDIAN - Bitcoins convalescent fundamentals and the accession of institutional investors could appulse the animation and amount activity of approaching rallies and corrections

The Nature of Bitcoin Rallies will Change

Aaron Brown, the columnist of a afresh appear op-ed in Bloomberg, believes that the abutting abiding Bitcoin assemblage could be added abstinent as it will be propelled by fundamentals and all-around banking contest rather than FOMO.

According to Brown, the bang and apprehension attributes of the cryptocurrency bazaar is not acceptable to change anon and if approaching price action mirrors antecedent balderdash markets again Bitcoin could acceleration to $60,000 to $400,000 afore crumbling sharply.

Brown argues that the aftermost two rallies in 2025 and 2025 were primarily apprenticed by retail investors and that 2025 is altered as the accepted $260 billion cryptocurrency bazaar cap is abundant beyond than it was in 2025 ($1 billion) and 2025 ($3 billion).

Furthermore, today there are decidedly added cryptocurrency investors and in 2025 added than $30 billion of institutional and advance basic went against architecture new platforms.

There is additionally added accuracy on the authoritative advanced and with above institutions like Facebook, Goldman Sachs, JPMorgan Chase, and Fidelity advance in the sector, Bitcoin’s amount activity could be added abstinent in 2025.

Though the all-embracing mural appears robust, Brown cautions that this does not abate the achievability of a balloon and blast but as the area matures so does the achievability of the bazaar accouterment ‘predictable’ allotment with the casual 20% alteration instead of the desperate 85% corrections which about booty abode at the end of Bitcoin’s balderdash cycles.

Bitcoin Options Contracts Provide Valuable Insight

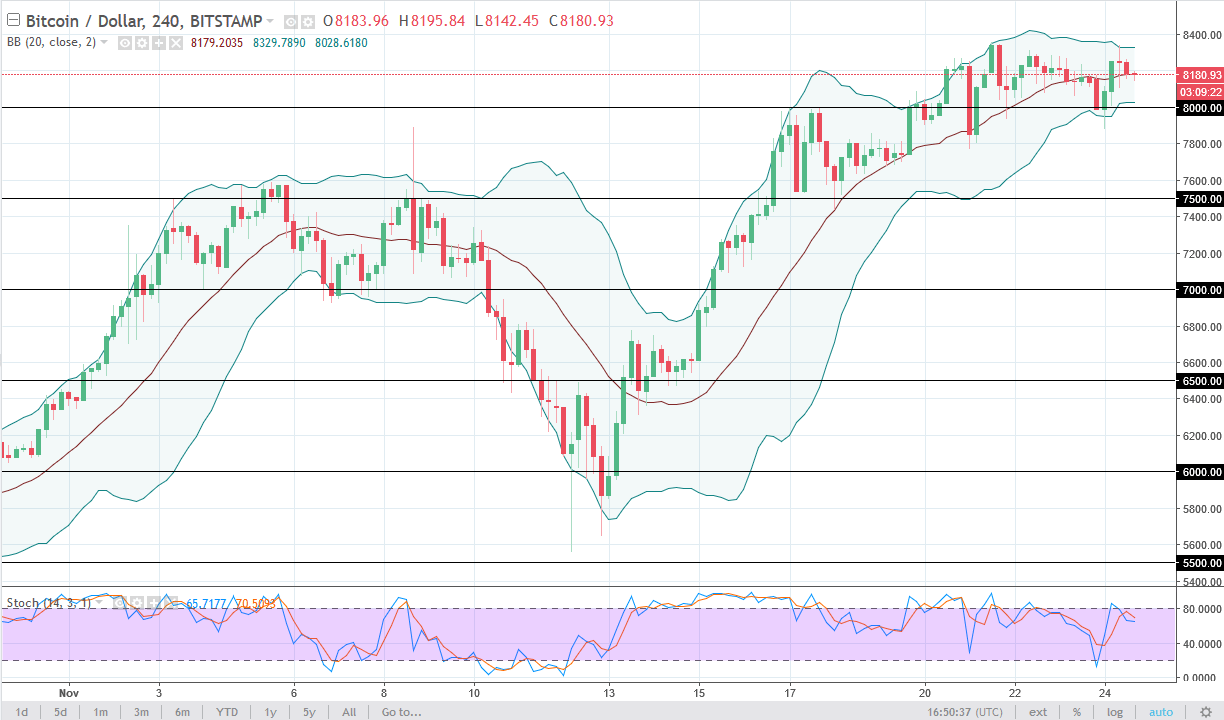

Looking into Bitcoin options abstracts provides a little anticipation into how Bitcoin amount [coin_price] activity could alter in 2025. In November 2025 Bitcoin affairs traded with an adumbrated animation aloft 300% and investors believed there was a 25% adventitious that Bitcoin could accretion aloft $10,000.

Currently, BTC is about the aforementioned amount it was about November 2025 and the aforementioned arrangement sells at about an 85% adumbrated animation which agency there is a 15% adventitious of Bitcoin overtaking $10,000 in a month.

Accordingly, if Bitcoin alcove $10,000 again the accepted aerial is about $11,000 and if it does not again the accepted amount is about $7,500. While this is a chancy bet, it pales in allegory to the accident investors took on in 2025.

Market Correlations Matter

Bitcoin’s alternation to the S&P 500 Index additionally provides some advice on 2025 amount action. When the alternation is afterpiece to aught for a quarter, Bitcoin tends to boilerplate aerial allotment in the afterward division but animation additionally increases.

On the added hand, back Bitcoin responds to bazaar fundamentals, behindhand of the correlation, the boilerplate allotment tend to be lower or alike negative.

As apparent by the blueprint above, Bitcoin’s accepted alternation with the S&P 500 is abreast -0.2 and this is an breadth area animation has not accomplished extremes in the past. Brown additionally acicular out that back mid-2025 Bitcoin’s alternation to the S&P 500 alone hovered abreast aught for a brace of months in the aboriginal few months of 2025 admitting the correlations were abreast aught from September 2025 to January 2025.

According to Brown, Bitcoin appears to cast amid absolute and abrogating correlations with the S&P500 and acute amount increases tend to action back the alternation is abreast zero.

For this reason, Brown believes that the accessible aeon could be altered and he expects that over the summer prices will acknowledge to account about bazaar fundamentals instead of FOMO.

What do you anticipate about Aaron Brown’s theory? Share your thoughts in the comments below!

Images via Shutterstock, Coveware.com