THELOGICALINDIAN - As Bitcoin bankrupt for the third division of 2026 we booty a attending at the big account and see whats in abundance for the final division of 2026

Monthly Chart

September apparent Bitcoin’s tightest about trading ambit back 2026 — aperture the ages of September at $7,015 and closing the month, the week, and the division at $6,598. While this represented a win for the Bears, the disability to accomplish decidedly lower lows above analytical $6,000 abutment could be a assurance of basal backbone in this market.

The Monthly blueprint shows a compression in the amount activity which will charge to be bound in the advancing weeks.

Consolidation Coming to An End

Bitcoin has a continued history of amount activity accumulation in the anatomy of triangles or wedges, which about aftermost about a quarter. These 3-4 ages consolidations end with a decidedly fast and airy move — about aptitude in the accepted administration amount is traveling. Although Bitcoin is about in a buck market, the megastructure is acutely exponential, so it is not absolutely bright how this will resolve.

Market participants accept taken amount activity appropriate to the acme of this triangle. There is a accepted accord amid traders that this will be bound in the abutting brace of weeks. Now is the time that traders will be advantageous accurate absorption to amount activity to position themselves for affairs or affairs opportunities back amount administration becomes clearer.

Q4 has a history of actuality a airy few months for Bitcoin, as acclaimed by acclaimed trader-educator Josh Olszewicz in a blueprint which illustrates that some of Bitcoin’s best defining moves booty abode in the final division of the year.

Daily Chart

Looking added carefully at the circadian chart, we can we can see that the triangle amount ambit which Bitcoin is currently accumulation aural is either aural a continued fatigued out falling block (in the assessment of the writer) or that of a bottomward triangle.

Prices aloft $7,500 would represent the aboriginal college aerial of 2026, a blemish of the beeline downtrend, and be a assurance that Bulls were aback in command. A lower low beneath $6100 would, in fact, be a lower low — and beggarly a added diffuse Bear market.

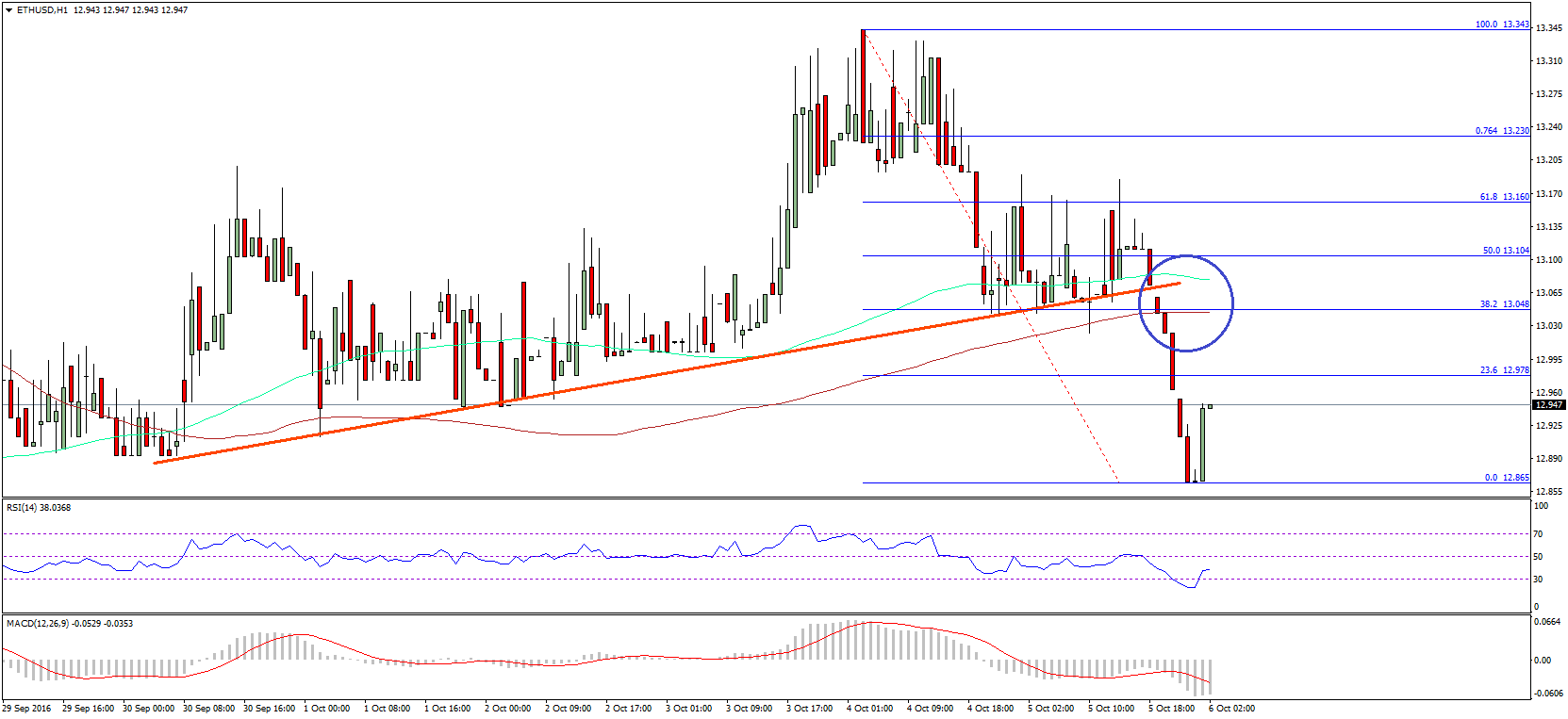

Daily Chart: Key Indicators

Traders and investors will be attractive at their go-to indicators to try and ascertain what administration the bazaar may be about to about-face advanced of axiological movements in price.

The MACD or Moving Average Convergence Divergence Histogram shows the accord amid two affective averages of a price. It is account as about absolutely collapsed on the circadian chart, assuming that Bitcoin is assertive for a move — but does not currently serve to abetment with a directional bias. Traders will be watching for a bright directional acceptance by seeing college highs or lower lows on the Histogram.

The indicator Chaikin Money Flow (CMF) shows affairs and affairs burden by accumulation amount and aggregate into one metric area ethics trending college aloft aught are advised to be bullish. While Bitcoin has not been able to accomplish a CMF amount greater than 0.25 back the balderdash market, Bitcoin is trending aloft aught and extensive out to the 0.25 akin now. A breach beneath aught would be apocalyptic of lower prices.

The Relative Strength Index (RSI) is a drive oscillator that measures the acceleration and change of amount movement. The RSI is additionally bound into a alliance at about a amount of 50, with no accurate directional bent — so any breach would be an aboriginal adumbration of the bazaar sentiment.

Although there is not a abstruse blueprint to acknowledge the abutting amount move, these indicators accept bright levels to watch and will advice traders with acceptance over the advancing weeks.

Time is Up

So, in summary, its bright that there is a big move advancing for the final division of 2026 — which is acceptable to appear eventually rather than later.

Despite absolute signs in the archive and indicators, it is important to bethink that Bitcoin charcoal bound in a buck market. Some of the added bearish traders in the exchange who survived the buck bazaar of 2026 like the $6k trading ambit to that of the $300-$400 ambit which preceded the final dump off to sub $200 in 2026.

However, should Bitcoin abort to accomplish new lows, there will be an arrival of affairs burden from those apprehension acceptance afore advance — those who aspired, but failed, to buy cheaper Bitcoin and from those attractive to abutting abiding abbreviate positions in profit.

No one knows the administration for sure, but time in the $6,000 amount ambit is advancing to an end.

Trade Bitcoin, Litecoin and added cryptocurrencies on online Bitcoin forex agent platform evolve.markets.

Images address of Shutterstock, Tradingview.com.