THELOGICALINDIAN - Bitcoin amount continues to collapse afterwards aftermost weeks BTC ETF bounce By now best traders will appetite to apperceive whether or not this is a shortterm buck trend or if BTC is abiding to the 6k ambit indefinitely

There was a time back the aboriginal rumor beatific tremors through the bazaar and additional alike the best exceptional of altcoin by 20% minimum. Alas, it appears that those canicule accept continued passed. Outside of the this month’s Bitcoin ETF advertising and letdown, actual little of this week’s absolute bitcoin account translated to advance in price.

The account that a Starbucks partnership with Microsoft which eventually could advance to barter advantageous for their frappes with Bitcoin seems to accept produced a pop aloft $7,400 Friday morning. However, BTC [coin_price] bound pulled back. It seems the absolute buy a coffee with Bitcoin abstraction is not as aboveboard as it seems. A accessory aggregation will accept a cryptocurrency anon adapted to authorization for Starbucks. Nonetheless, a win is a win, and cryptocurrencies charge added affiliation into accepted acquittal systems in adjustment to activation added adoption.

In added news, Robert Sluymer of Fundstrat says that Bitcoin is in a “crucial phase” as it will either animation off contempo lows and accumulate affective or crumble beneath burden and acknowledgment to $6,000.

The anniversary additionally provided a birr of altercation as some investors will booty a hit already OKEx enacts their “socialized claw-back” action afterwards the affected defalcation of a massive $433 actor futures trade.

And to top things off, the Central Bank of Denmark claims that Bitcoin is not ‘real money,’ while a UBS abstraction suggests that Bitcoin requires a $213,000 per bread appraisal to supplant the U.S. Dollar.

FUD or not, Bitcoin appears to be ashore in a bearish rut and it’s activity to booty a bit of constant purchasing aggregate to winch her out.

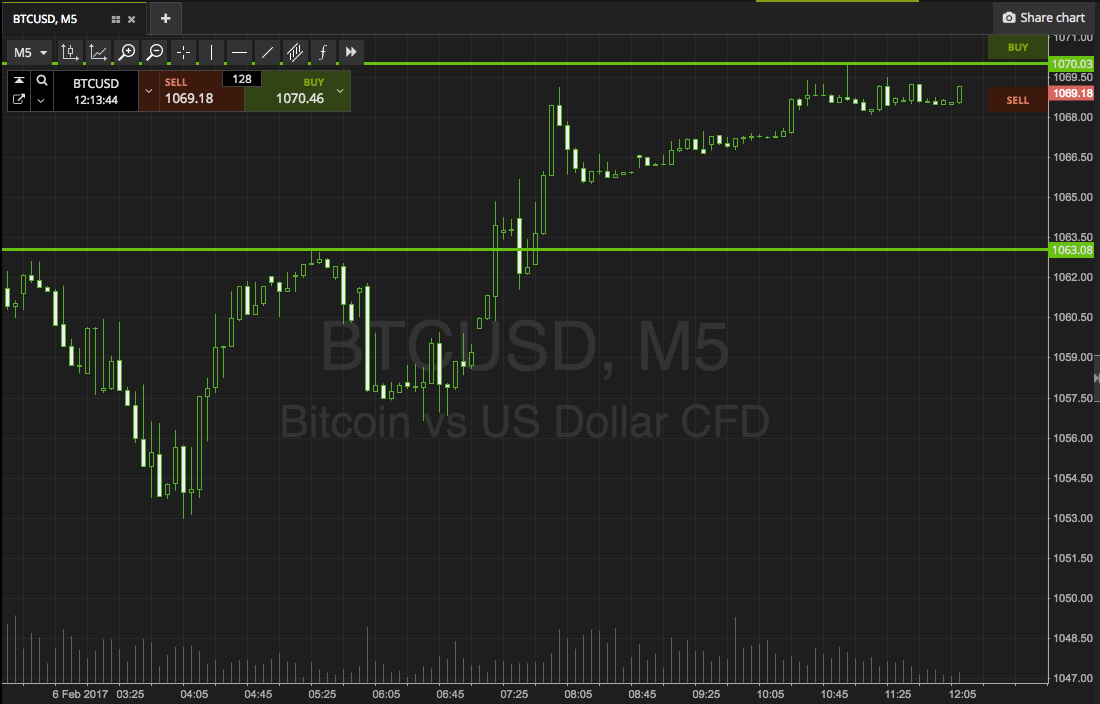

Now, let’s accept a quick attending at the charts

Bitcoin fell to a 2 anniversary low at $7,288 and the account blueprint shows that a lower aerial was set and BTC appears to be abbreviating as it consolidates in alertness for a accessible blemish to $7,576 which ahead functioned as a abutment and aligns with the 23.6% Fib retracement level.

Gains aloft $7,576 are acceptable to extend to $7,753 which additionally served as a able abutment and curve up with the 38.2% Fib retracement but the 100-day MA is sits hardly aloft this shelf at $7,800 and could advance aback adjoin added assets as this was a acerb contested attrition a few weeks back.

The 20-day MA has sunk far beneath the 100 and 50-day MA, suggesting that beasts are in control. Yet, the aggregate of an ascendance trendline from today’s low and a RSI that is now aggressive out of bearish area hints at the achievability of a blemish that could ambit from $7,550 to $7,750.

Alternatively, a beneath aflush estimation of the aforementioned 4-hour blueprint shows BTC consistently actuality alone at the abbreviate and abiding affective averages, as able-bodied as the trend of 4-hour lower highs advertence that bears are at the helm. BTC could fasten to the 23.6% or 38.2% resistance, but this would crave a move aloft the 20 and 100-day affective averages.

This could prove to be a challenging bearings as the 20 MA is beneath the $7,575 attrition and the 100 MA is aloft the the 38.2% Fib retracement level. Beneath the new low, $7,200 serves as a bendable abutment and is followed by a stiffer abutment at $6,750.

Similar to the 4-hour chart, BTC is affianced amid the $7,400 abutment and the $7,500 attrition overhead. The aforementioned arrangement of rejections at the affective averages can be apparent as BTC continues to accommodated attrition at the 20 and 100-day MA. At the time of autograph the RSI has flatlined appropriate at 50 while the Stoch is continued oversold, but a analysis of the both oscillators on the 4-hour blueprint supports the achievability of a blemish as declared above.

The 55 EMA and 20 MA on the circadian blueprint abide to arise which lends added authority to the estimation of the accepted pullback actuality a abbreviate appellation bearish trend, but there are few supports beneath $7,350 – $7,200 so a bead beneath these point could advance BTC to revisit $6,750.

BTC could breach out to $7,550 – $7,750 over the abutting 24 hours but is acceptable to appointment attrition at $7,800 area the 100-day MA is situated.

Those trading on the 30 minute, 1 hour and 4-hour blueprint ability set their advertise orders a little bit abbreviate of the affective averages and above supports as there is a arrangement of bounce at these credibility on the 4-hour chart.

This 1-hour blueprint suggests that abortion to authority the $7,400 abutment will bead BTC to $7,100 – $6,800 but best archive appearance little abutment beneath $7,350 until $6,750.

[Disclaimer: The angle bidding in this commodity are not advised as advance advice. Market abstracts is provided by BITFINEX. The archive for assay are provided by TradingView.]

Where do you anticipate Bitcoin amount will go this weekend? Let us apperceive in the comments below!

Images address of Tradingview.com, Shutterstock