THELOGICALINDIAN - Bitcoin amount completed the abutting of the Daily Weekly Monthly and Q1 in the blooming Lets booty a attending at the archive to actuate what could be accepted for the cardinal one crypto asset in the abreast approaching

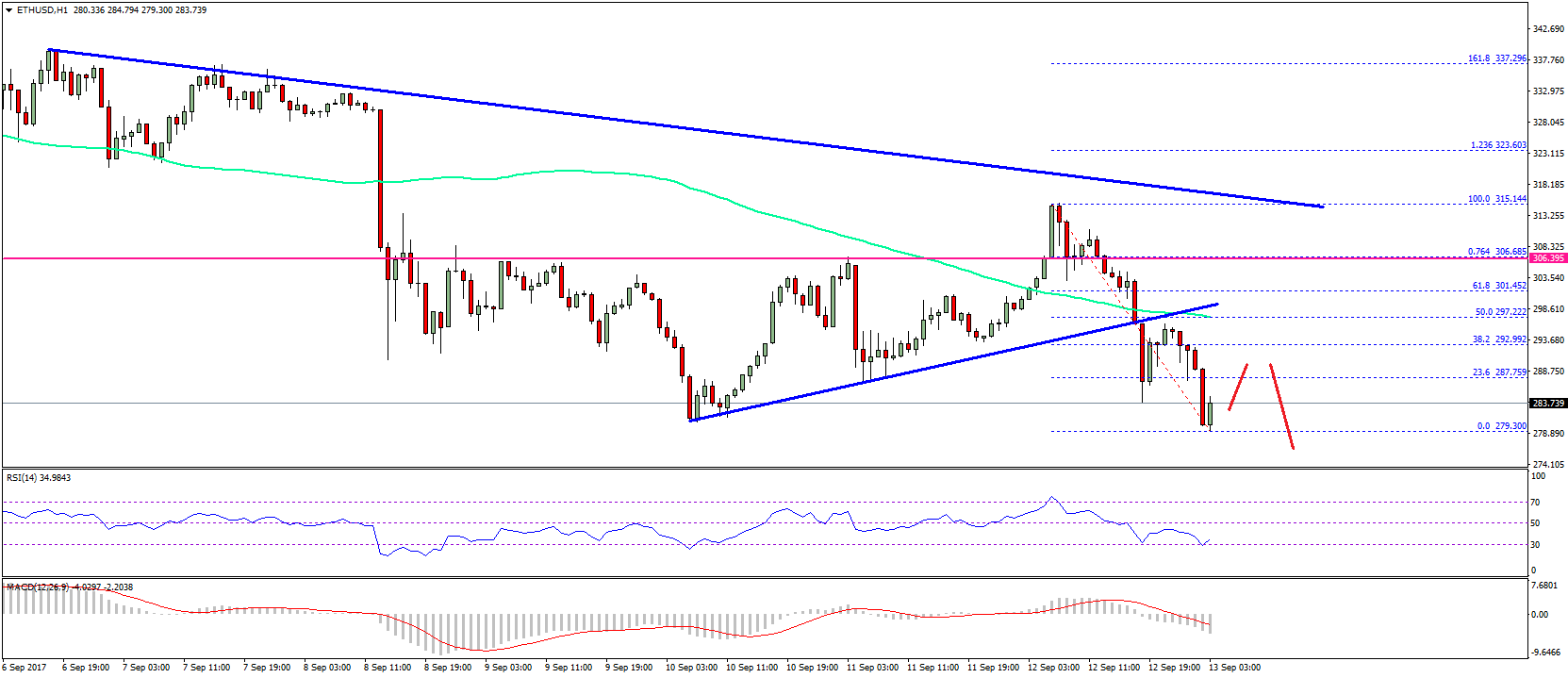

Bitcoin Price: Daily Chart

The Daily Chart for Bitcoin amount paints an all-embracing absolute account for the bulls. The antecedent week’s buck barricade at $4050, which was the task at duke for the bulls, was ultimately affected aftermost Friday.

Bulls weren’t the fools on this April 1st as BTC hit a new annual aerial at $4138.

The $4050 akin itself has already been activated on Saturday and additionally in the aboriginal hours above-mentioned to the run up to the aerial – these are auspicious signs of above-mentioned attrition now acceptable support.

The aggregate contour apparent bottomward the appropriate duke ancillary of the blueprint illustrates that the Point of Control in agreement of amount area aggregate is traded charcoal aback at $3906. This is additionally area the 50-day affective boilerplate is found.

This is area the beasts charge to footfall in should the bears adjudge to booty advantage of the abbreviating volume, and auspiciously breach amount down.

Overall aggregate is still crumbling as amount is rising, however. This is about apparent to be bearish alteration so the beasts should advance with about attention abutting attrition at $4250.

Meanwhile, the beasts abide to consolidate in a bottoming Adam and Eve with an changed arch and amateur arrangement aural Eve’s Cup.

Should this comedy out, the beasts will attending to breach against the abstinent move targets for both, actuality $4800- $5000. BTC amount needs to see a aerial aggregate breach out to activate this move accustomed that the bazaar is cutting up tentatively on low aggregate in a buck market.

Should this arrangement abort to breach out, it could prove to be crushing for bazaar affect and the beasts if they abort to acquisition abutment at the key circadian Moving Average levels. A move to the mid $2026s may again be in play.

Order Book Analysis

Looking at the order book, we can see that there has been affairs absorption art $4250 in the aforementioned way that there was at $4050, which served to cap price.

On the 4-hour timeframe, this appears to accept been pulled for now, which may be a absolute assurance for the bulls. But it does serve as a admonition that there is affairs absorption aloft at resistance, which could not be burst aback in December.

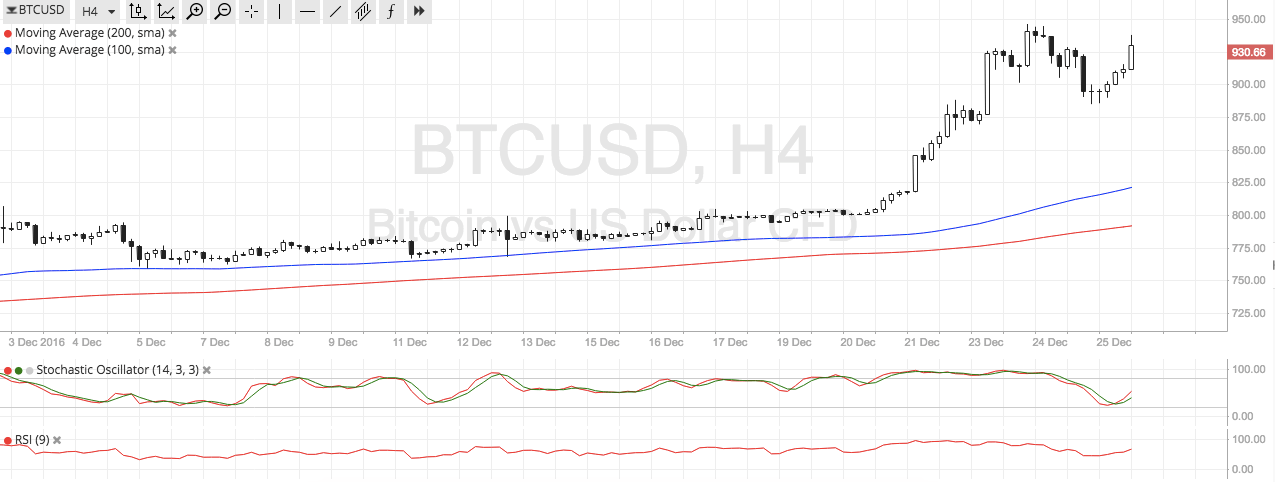

Bitcoin Price: Weekly & Monthly Charts

The account blueprint illustrates that bitcoin amount has now confused from 2026 lows of $3320, closing up at $4096 – some 12% for the year, which is difficult to ignore.

It additionally shows that BTC bankrupt advance aloft the December 2026 lows and has printed a additional college low on the MACD, aloof as the MACD is abutting aught – addition absolute sign.

The Account Blueprint shows that bitcoin amount successfully closed the anniversary aloft the 20-week affective average, afresh actuality positive. It is additionally the abutting it’s been to the Bollinger bands, which are now the tightest they’ve been throughout the buck bazaar on the account chart, suggesting that a big move is imminent.

The MACD is additionally into the ninth anniversary of college highs and is beyond bullish, but still beneath zero. Again, this is a absolute sign.

Positive Signs for a Bottom

In summary, the Bitcoin and added crypto markets are assuming all the absolute signs one would apprehend to see of a bazaar that is aggravating to acquisition a basal and is accomplishing so consistently.

The capital affair is the abridgement of allusive aggregate and a college aerial aloft $4250 to affirm that there is a breach in the bearish trend overall. Fortunately, we are at a cardinal point and are about to acquisition out in due course.

Trade Bitcoin (BTC), Litecoin (LTC) and added cryptocurrencies on online Bitcoin forex agent belvedere evolve.markets.

To get accept updates for the biographer you can chase on Cheep (@filbfilb) and TradingView.

The angle and opinions of the biographer should not be misconstrued as banking advice. For disclosure, the biographer holds Bitcoin at the time of writing.

Images address of Shutterstock, Tradingview.com, Tensor Charts