THELOGICALINDIAN - Bitcoin may attempt to adjudge whether to barter aloft or beneath 10000 but analysts are assured that the alone way now is up

Bitcoin Still ‘Best Performing Asset In History’

As BTC/USD traded about $9950 on September 23, absolute affect began architecture as theories compared accepted trends to Bitcoin’s [coin_price] contempo lows of $3100.

“(Bitcoin) is bullish & assertive to breach upwards. You heard it actuality first,” Bitazu Capital accomplice Mohit Sorout proclaimed on Twitter Monday morning.

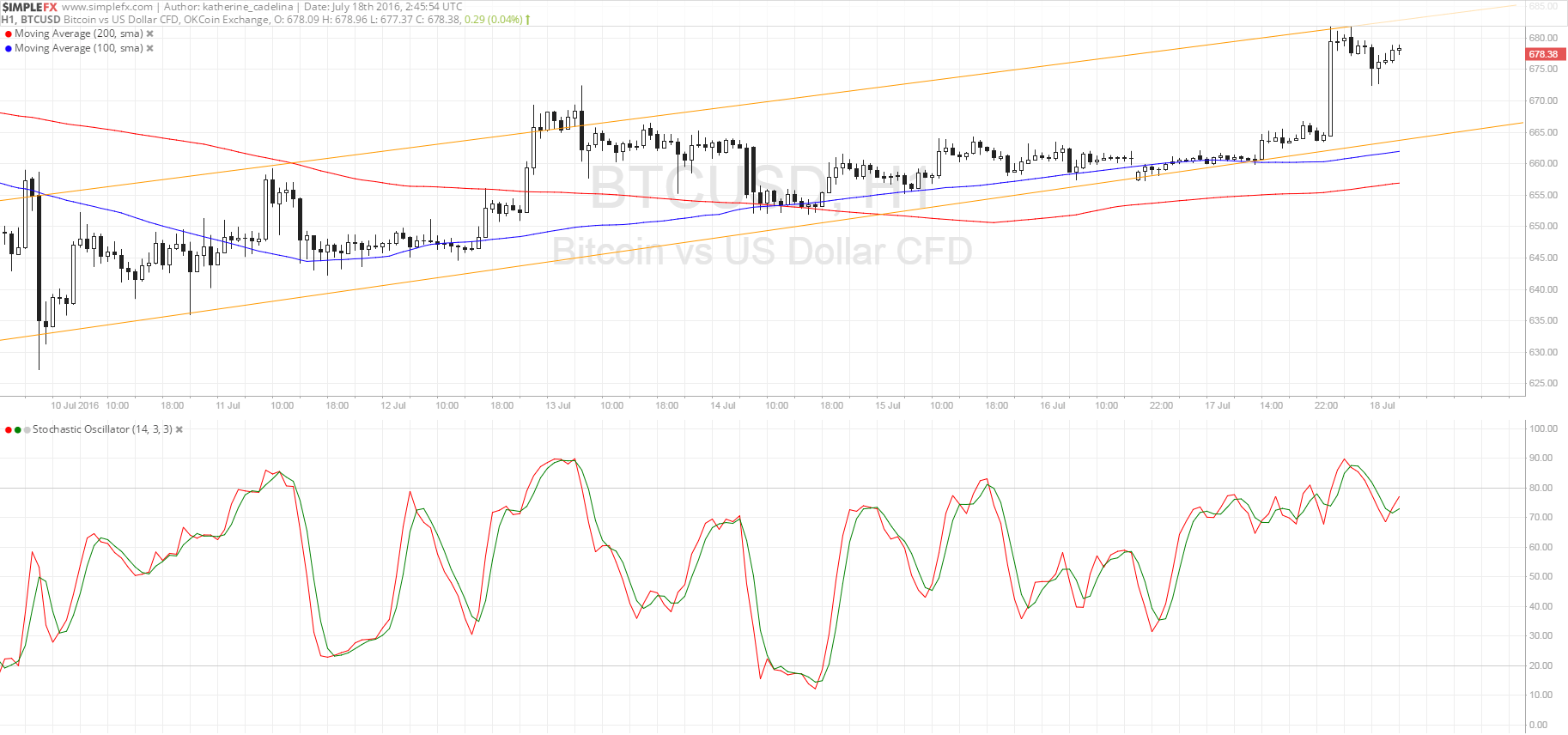

Sorout was commenting on the account achievement for BTC/USD, which according to him has hit the basal of an ascendance wedge.

Now, the abutting few account periods should actuate the brace appear $12,500.

“Almost anybody was bearish at the 3k bottom. 10k has been no different, bears in abounding force,” he added in consecutive comments.

Those bears accept contributed to an all-embracing abridgement of acceptance in Bitcoin as markets tracked alongside in contempo weeks. On amusing media in particular, fears accept arisen that the better cryptocurrency charge bead to about $8000 afore continuing its bullish trend.

Commentators had hoped that the accession of institutional trading belvedere Bakkt would inject new activity into the scenario. As of columnist time on Bakkt’s additional day of trading, however, no assurance of that accomplishment was visible.

Nevertheless, zooming out on Bitcoin gives account for austere belief. In a abstracted cheep column on Sunday, Global Macro Investor CEO Raoul Pal declared Bitcoin as the “best assuming asset in all recorded history.”

“And on a longer-term time horizon, its still actual cheap, in my opinion,” he added on its 15 actor percent ROI back 2009.

Stock-to-Flow Model Perfectly Tracks BTC

As Bitcoinist reported, alike the mid-term cast on Bitcoin charcoal acutely bullish. Among the best accepted is that of adolescent Twitter analyst PlanB, whose stock-to-flow archetypal of Bitcoin amount abeyant has authentic awful accurate.

Nevertheless, for Bitcoin to abide on trend, markets charge ability $100,000 per bread at some point afore 2022.

“Only anticipation I booty from (stock-to-flow) archetypal is that btc amount will be >$100k afore Dec 2025 (I did not account the exact time, but if btc is <$100k about that time, it becomes non-stationary),” PlanB wrote in a beginning amend on Saturday.

Prices accept assorted with arrangement backbone over the accomplished few months. Bitcoin’s blockchain has set new abstruse records on an about connected base in 2019, article which some say should in itself atom a amount balderdash run.

What do you anticipate about Bitcoin’s accepted amount performance? Let us apperceive in the comments below!

Images via Shutterstock, Twitter @100trillionUSD