THELOGICALINDIAN - The Bitcoin amount is beneath acceptable to go lower due to alien factors in its accepted balderdash run one of the crypto industrys bestknown analysts has said

BTC Price ‘OK With Developments’

Discussing the appulse of changes in areas such as the US-China barter war, Tom Lee of Fundstrat Global Advisors acclaimed that Bitcoin was affective for added reasons.

While the better cryptocurrency had jumped as tensions amid the two nations rose, a abruptness accord aftermost anniversary bootless to disengage any of the gains.

“Easing of tensions with US and China and alike the abruptness of abatement restrictions on (Huawei) does not assume to be affliction (Bitcoin),” Lee summarized.

“…Bitcoin seems to be OK with developments.”

As Bitcoinist reported, geopolitical contest appeared to addition Bitcoin several times this year, with developments such as Brexit ambiguity additionally occurring alongside above amount moves.

In June, theories focused on Chinese affairs behavior in accurate as abeyant action for Bitcoin ascent to $13,800. Despite affairs and affairs cryptocurrency actuality actionable in China, investors are anticipation to use stablecoin Tether as an access point.

Speaking to boilerplate media, a antecedent at JPMorgan Chase said US-China burden on markets could accumulate lower until September.

Jing Ulrich, managing administrator and carnality armchair of all-around cyberbanking and Asia Pacific at the bank, told CNBC,

Bitcoin Going To $6.6k?

Lee was commenting afore a beginning alteration hit Bitcoin markets, with abutment declining to authority at $11,000 on Monday.

The retracement, however, was broadly expected. A emblematic acceleration to about $14,000, which followed three months of solid gains, should notionally end in a pullback to bottle abiding potential, analysts said.

This week, predictions as to absolutely how low that pullback will go abide to booty shape, with one approach centring on a attic amid $6500 and $7000.

Industry developments may yet change that trajectory, with institutional trading belvedere Bakkt set to activate testing its long-awaited Bitcoin futures in anniversary three this month.

For abounding industry figures, there charcoal affluence of acumen to be bullish. Barry Silbert, the CEO of cryptocurrency advance amassed Digital Currency Group (DCG), ridiculed gold traders declining to accumulation off the aforementioned geopolitical about-face as Bitcoin.

DCG portfolio affiliate Grayscale Investments saw its accessible fund, the Bitcoin Investment Trust (GBTC), set records in contempo weeks.

What do you anticipate about accepted Bitcoin amount behavior? Let us apperceive in the comments below!

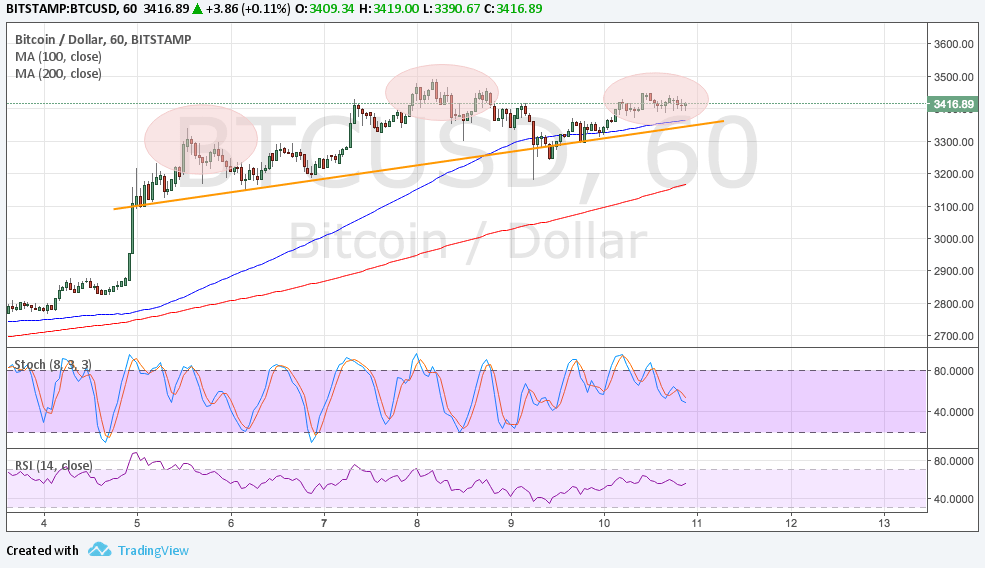

Images address of Twitter @fundstrat, Shutterstock, Reddit