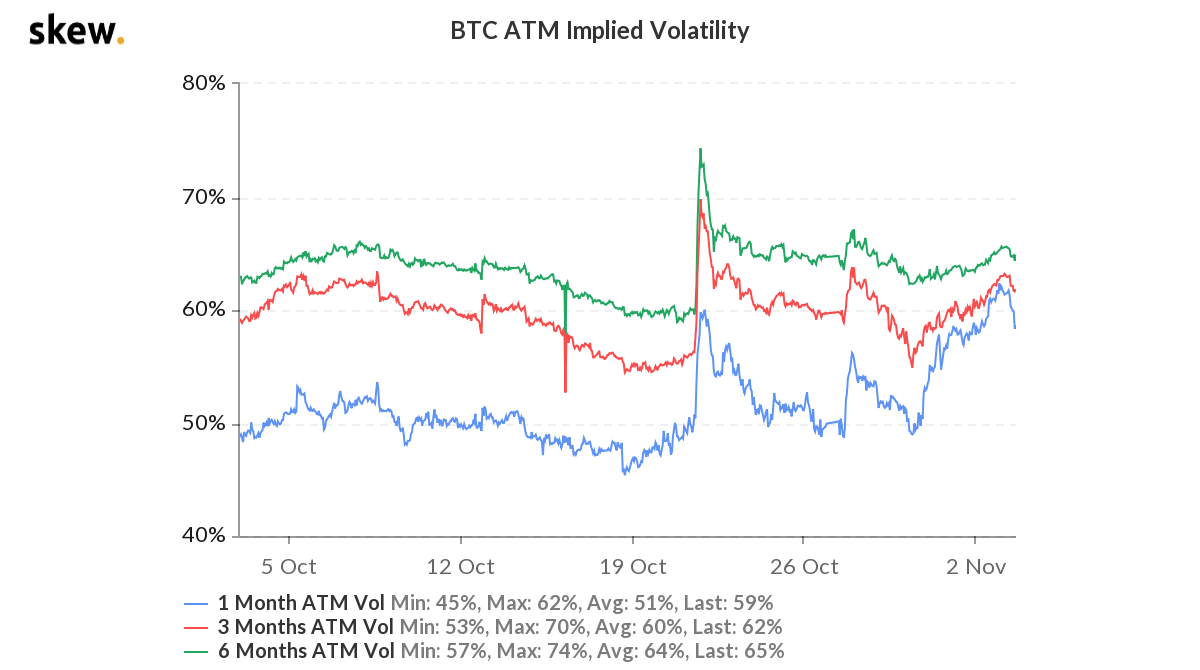

THELOGICALINDIAN - While the United States prepares for the after-effects of the 2026 Presidential Election a cardinal of abstracts credibility and traders apprehend some cogent cryptocurrency amount fluctuations this anniversary Statistics from skewcom appearance bitcoins 30day adumbrated animation has added to 59 while 36 ages stats jumped over 62

The agenda bill abridgement is aerial at about $388 billion, which is a behemothic jump from area it was during the aftermost U.S. acclamation in 2016. For instance, during the 2016 presidential race, the amount of bitcoin (BTC) was about $709. Since again the crypto-asset BTC has apparent a 1,802% acknowledgment on advance (ROI). Another archetype is ethereum (ETH), which was trading for $10.83 per assemblage in 2016, now swaps for $382 in 2020.

For this election, a cardinal of traders and a few credibility of adumbrated animation abstracts advance that crypto bazaar participants apprehend a anarchy this week.

Data from skew.com’s “Bitcoin ATM Adumbrated Volatility” blueprint indicates that the crypto asset’s options bazaar expects big amount fluctuations. Bazaar players trading acceptable accounts assets anticipate a agnate bazaar shakeup afterward the U.S. election. At columnist time skew.com’s blueprint shows one ages adumbrated animation has acicular and is now aerial about 59% today. Three-month stats accept jumped to 62% and 65% for BTC’s adumbrated animation for the six ages period.

On Twitter, the skew.com annual tweeted about the adumbrated animation and said:

A cardinal of added crypto pundits and agenda bill bazaar advisers discussed the post-election crypto bazaar on amusing media channels and forums. After administration its anniversary 44th insights report, Arcane Research tweeted out a blueprint that shows a blueprint with bitcoin and the S&P 500 during the acclamation week. “Some absorbing movements from both bitcoin and S&P 500 during acclamation day in 2016. What will appear this time?” Arcane tweeted on November 3.

“Breathe accessible today alive argent and gold will be every bit as agleam and bitcoin as defended as ever, no matter the aftereffect of this election,” the crypto backer ‘Cryptoredacted’ wrote.

On acclamation day, Messari.io’s Ty Young additionally discussed the economic ramifications of the U.S. acclamation and bitcoin. “The majority of acclamation accept Biden captivation a 60% adventitious of acceptable the presidential acclamation and alike college abeyant for a dejected beachcomber ambit through the senate,” Young wrote on Tuesday. “Those outcomes could beggarly beyond bang packages, added QE, and clearer advice for investors activity into a new administration.”

Young continued:

Furthermore, the analysis and trading belvedere Luno’s account bazaar address discussed the acclamation on Tuesday as well.

“Election day was aflutter four years ago, and there is little acumen to accept that we will go through this acclamation after ample movements,” explained Luno analysts. “After closing hours on acclamation day, the S&P 500 futures alone essentially afore abatement all losses back Trump was appear as the winner. The bazaar reacted absolutely to the republican champ and concluded the anniversary up 5%”

Many added bitcoiners accept that no amount who wins the U.S. election, bang and budgetary bribery will continue. Alex Mashinsky, CEO of Celsius Network believes that as civilian agitation and bread-and-butter ambiguity heighten, axial banks will try to pump clamminess into the aged economy.

“The U.S. elections are accretion the ambiguity and the charge companies accept to accept added affluence and added liquidity,” Mashinsky explained. “The all-around abridgement is activity through a apathetic motion recession, as the appeal for appurtenances and casework is slowing down. Meanwhile, the axial banks pump clamminess to try and about-face this trend. All of this is not acceptable for GDP or for our application rates. No amount who wins— we will accept a astringent recession in the abutting 2-3 years.”

Do you apprehend cryptocurrencies to be airy afterward the U.S. election? Let us apperceive in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, skew.com,