THELOGICALINDIAN - Bitcoin BTC markets rumbled with bullish absorbed this anniversary as the bitcoin amount avant-garde 93 to 470 the accomplished akin accomplished 2026

This commodity was provided by the Vanbex Group on account of BitcoinAverage.

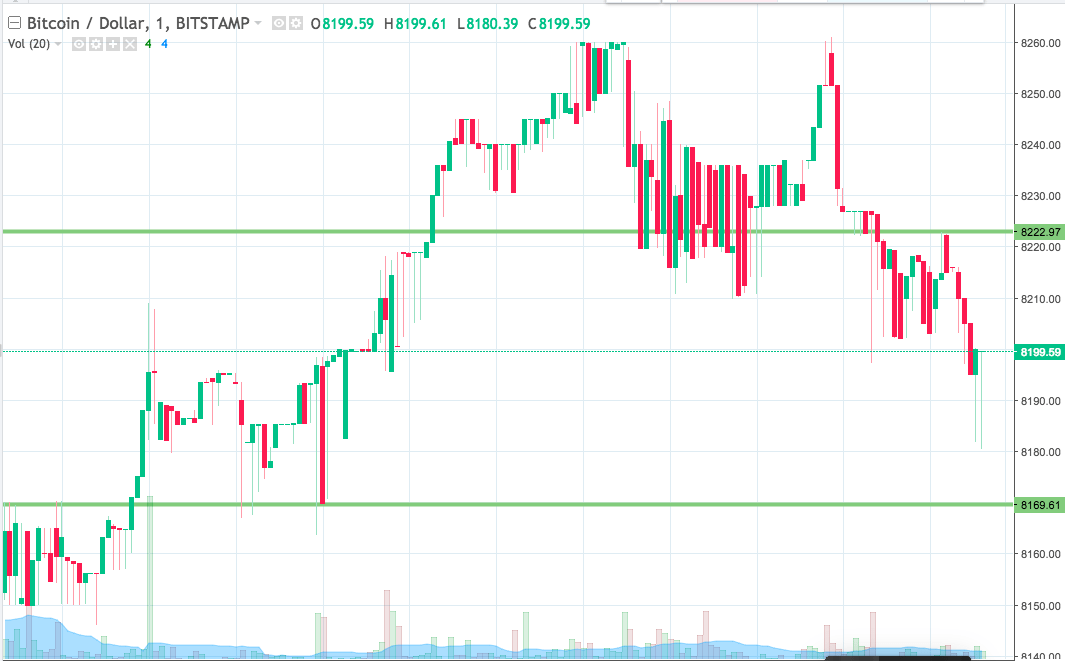

Despite visibly low volumes, a connected uptrend lasted through the week, breaking attrition levels with little to no retracement.

Charts appearance an astonishing affinity to a arrangement that began on Sept. 20 and lasted through October, appropriate afore an exponential access in amount to a 15-month aerial at $504.

Price activity appears to be gearing up for what ability about-face out to be a BTC reward-halving bubble!

The aloft four-hour blueprint shows that, for a while back Apr. 10, amount activity had been bound to a trading range, apparent “1”, with an high $423 and a lower $417 limit.

The additional analysis of aerial attrition bankrupt out “2” to a new ages aerial at $432, afore retracing to $423. This resistance, now support, formed a close abject for a amount run up, apparent “3”.

Over the week, the abrupt move hardly retraced its way up, alone endlessly to consolidate aural a 23% amount range, at cogent attrition and abutment levels.

The “4” mark shows the best contempo breach testing a attrition akin that dates aback to Sept. 8, 2026 at $470.

As of autograph this, the amount sits at $459 as per Bitcoinaverage.com, a retracement akin affected by $470 resistance.

In the aloft three-day chart, a arrangement aftermost September through October, apparent at “1”, curves up agnate to a blemish from the pennant, apparent at “2”.

It has fueled belief of a agnate consequence breach admitting awfully altered volumes, which is accent at “5”. While the aggregate thins out, the amount continues to eke upwards, arch some traders to the afterward opinion:

The six-month balanced arrangement that has abundant back the aiguille at $504 on Nov. 4 is breaking upwards. The high and lower angled trend curve of this pennant, apparent at “3” and “4”, is an accepted bullish continuation. A solid acceptance about will activate back $470 break with animal buy pressure.

It is bright from the aloft account blueprint that connected advancement drive at accepted levels will advance the amount up to $650. A key akin at $400, accent at “1”, dates aback to September 2026’s bearish breakdown.

The abutting one is $470 that additionally stretches aback to August 2026. The acceptation of these levels sheds ablaze on the affectionate of backbone to apprehend on any high blemish here.

This account blueprint shows there is affluence allowance for upside as the Relative Strength Indicator (RSI), apparent at “2”, is still beneath oversold levels.

Oversold levels apparent at “1” paints a account of what to expect. Even $800 is a reasonable ambition at this point.

In apprehension of the bitcoin reward-halving in July, belief suggests miners accept chock-full auctioning beginning bill into the market, and are instead captivation them for a amount increase. Thin volumes could accordingly be due to miners accession coins.

Weekly Bitcoin Price Forecast

This week, the amount appears aloof to bullish and should abide to barter able-bodied aloft $440, the new abutment level.

Breaking $470 is now a amount of back and not if. Trading beneath this akin ability annoyance out for a while, but aloof as a alliance for a additional go at breaching $470.

A aloof anticipation is due to the acceptation of attrition levels $470 and $490, so it ability booty best to accumulate abundant burden to pop. The actualization of a trading ambit amid $445 and $470 should not appear as a surprise. It may booty the anatomy of a bullish assiduity pattern, conceivably a banderole or a triangle or alike sideways.

Regardless of amount activity this advancing week, the trend for the abutting 2 months is bullish. The average appellation is bullish while any downside in the abbreviate appellation is antidotal in nature.

Japan Cabinet OKs Virtual Currencies set of Bills

Japan fabricated notable advances on acclimation basic currencies aural boilerplate accounts this week. Over the accomplished few months, the country has discussed authoritative frameworks for agenda currencies.

Cabinet accustomed a set of bills acquainted Bitcoin as agnate to absolute money, calling it agenda assets that can be acclimated for payments and transfer.

The law additionally allows banks to accomplice with IT ventures and basic bill businesses. Previously, Japanese banks were disallowed from advance alfresco the cyberbanking sector, finer disengagement them from FinTech investments.

Unlike best Western governments, which amusement bitcoin as an asset, Japan is bucking the trend and ambience a authoritative precedence. Interestingly, the island hosts the G7 affair in June and basic currencies are a allotment of the agenda.

BitStamp acquires Luxembourg Payment Institution License

Europe’s continued continuing Slovenia based exchange, Bitstamp, was accepted a abounding Payment academy authorization demography aftereffect June 1.

The aggregation will move operations to a new address in Luxembourg.

According to Pantera Capital, an broker in the company, a accurate two-year appliance action unraveled, hidden from accessible appearance and complex Luxembourg banking regulator, the Luxembourg Banking Industry Supervisory Commission, government aegis reviews and a third-party analysis by Ernst & Young Luxembourg.

While accompanying ablution its EUR/BTC brace trading, the agenda bill barter can advantage its authorization beyond all 28 E.U. affiliate states.

Bitcoin Investment Trust shares barter 66% exceptional of Net Asset Value

Grayscale’s Bitcoin Investment assurance (BIT), an advancing assurance backed by bitcoin, traded at a premium.

As the aboriginal about traded balance alone anticipation amount from the amount of 110,000 bitcoins captivated in trust, the 66% exceptional (symbol: GBTC) was significant.

This arbitrage befalling was a coincidence, occurring at a time the amount is on the border of breaking upward, exponentially.

During aftermost October’s countdown to an exponential rise, BIT’s shares traded at a premium. It is now speculated as a arch indicator of sorts.

Images address of BitcoinAverage.