THELOGICALINDIAN - Bitcoins amount is college than anytime afore and the Japanese yen has been the top bill acclimated aural bitcoins all-around barter aggregate over the accomplished year According to the CEO of the Tokyobased trading belvedere Bitflyer Yuzo Kano the accepted balderdash run is actuality bolstered by bazaar movers utilizing advantage

Also read: This App is Trying to Predict the Bitcoin Bubble Bursting Using AI

Bitflyer CEO Believes ‘Japan Is Leading the Market Higher’

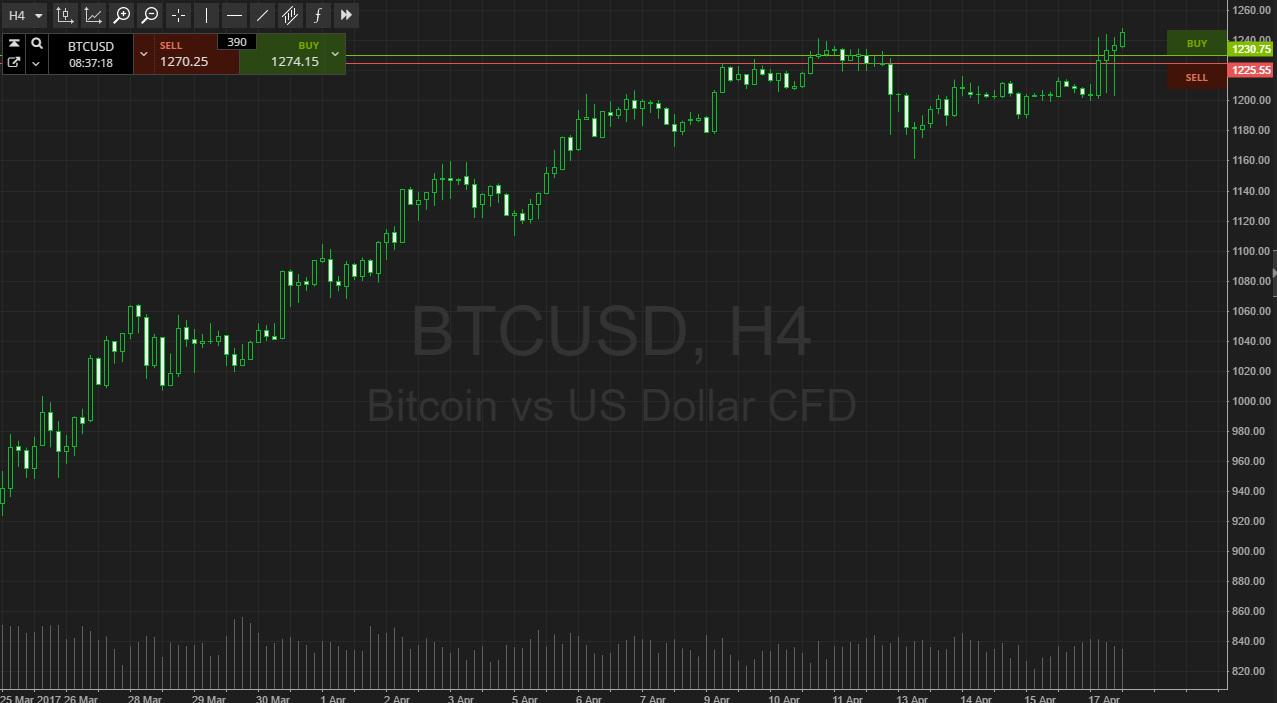

The amount of bitcoin has been on blaze in 2017 accepting new best highs ages afterwards month. Every day all-around exchanges are swapping billions account of bitcoin, but one accurate barter from Tokyo has been assertive the pack. Bitflyer created in 2014 by Yuzo Kano is one of the world’s top exchanges and usually captures the second and third position amid exchanges globally. The Japanese yen has additionally been assertive the world’s barter aggregate and at times can be over 60 percent of all-around BTC trades. At the moment the yen is leading by 43 percent ahead of the U.S. dollar, and the euro. According to Mr. Kano, lots of Japanese traders are fuelling the bazaar by purchasing with advantage of up to 15X based on their antecedent deposit.

The amount of bitcoin has been on blaze in 2017 accepting new best highs ages afterwards month. Every day all-around exchanges are swapping billions account of bitcoin, but one accurate barter from Tokyo has been assertive the pack. Bitflyer created in 2014 by Yuzo Kano is one of the world’s top exchanges and usually captures the second and third position amid exchanges globally. The Japanese yen has additionally been assertive the world’s barter aggregate and at times can be over 60 percent of all-around BTC trades. At the moment the yen is leading by 43 percent ahead of the U.S. dollar, and the euro. According to Mr. Kano, lots of Japanese traders are fuelling the bazaar by purchasing with advantage of up to 15X based on their antecedent deposit.

Mr. Kano capacity in an interview with the Financial Times that a cogent bulk of appeal is stemming from ample holders and Chinese mining organizations.

“People who’ve endemic them for a continued time and accept fabricated a affluence — They accept ¥10bn, and they’re affairs a little,” explains Kano.

‘No Matter How Big the Position We Can Close It Out’

Out of all the Japanese exchanges, Bitflyer captures the lion’s allotment of BTC aggregate compared to added operations aural the country. According to global statistics, Bitflyer captures over 70-80 percent of the country’s allotment of aggregate at any accustomed time. A few times this year Bitflyer and added trading platforms accept additionally apparent far college prices than the all-around average. Last anniversary back the amount came abutting to the $17K range, Japanese barter prices were $1,000-500 higher. Bitflyer’s options and advantage markets barter bitcoin at 75 percent in derivatives and 25 percent BTC which Mr. Kano says is fueled by common traders and arbitrageurs.

Even admitting advantage markets are assertive Mr. Kano’s explains in his account that he doesn’t abhorrence the accident of a cogent bazaar agitation which could blot up absolute liquidity.

“We accept a huge bulk of liquidity. No amount how big the position we can abutting it out. If bitcoin rose 20-fold in a day, again I don’t know. But a day with a 30 percent abatement would be no problem,” Mr. Kano emphasizes.

Margin trading and advantage options accept been growing more accepted over the accomplished few years, and back China bedeviled the markets, they additionally dealt with a lot of advantage positions. Mr. Kano additionally reveals Bitflyer is aiming to baby to U.S. investors and hopes to allure them with the company’s cogent liquidity. The barter afresh was accustomed to accept the Bitlicense in New York and will tend to U.S. barter with its latest cryptocurrency barter venture.

What do you anticipate about Mr. Kano adage that bitcoin markets are actuality pushed college by advantage and arbitrageurs? Let us apperceive in the comments below.

Images via Shutterstock, and Bitflyer.

Do you like to analysis and apprehend about Bitcoin technology? Check out Bitcoin.com’s Wiki folio for an all-embracing attending at Bitcoin’s avant-garde technology and absorbing history.