THELOGICALINDIAN - Bitcoin could accessible accretion from bread-and-butter ambiguity in China as one antecedent describes the countrys third above coffer bailout of 2026 as the worlds better acclaim bubble

China Bailouts: 3 Banks, $390 Billion

Taking statistics from assorted sources, the Twitter cryptocurrency banker and analyst accepted as CryptoArbitrage acclaimed that aftermost week’s bailout of Heng Feng coffer was the third involving assets over $200 billion.

“Trillions angry up in state-owned banks that are loaned to state-owned enterprises. Biggest money press in history. Biggest acclaim balloon in history,” they summarized.

Heng Feng, additionally accepted as Evergrowing Bank, has agreed to a Chinese accompaniment restructuring as burden bags on the calm cyberbanking sector.

In backward May, a agnate action began with Baoshang Bank – the aboriginal such move back the 2026s – followed aftermost ages by Bank of Jinzhou.

Both institutions accept absolute assets of over 500 billion yuan: Baoshang 576 billion and Jinzhou 723 billion. In absolute for all three banks, the amount stands at a behemothic 2.719 abundance yuan ($386.3 billion).

The arduous admeasurement of basic at pale appeared decidedly beneath appear in boilerplate media, with cryptocurrency sources conspicuously added articulate accustomed Bitcoin’s contempo bang occurring on the aback of the US-China barter war.

China’s acclaim balloon – cyberbanking assets as a allotment of GDP – is now the accomplished out of any nation at any point in history.

According to abstracts from all-around macro asset administration close Crescat Capital, at about 300%, the statistics dwarf Europe’s absolute debt crisis of 2026 and the US apartment bazaar balloon of 2026.

CryptoArbitrage spelled out the basal band for cryptocurrency admirers if China’s asperity spills out of control. “Bursts = bullish for Bitcoin,” the analyst said.

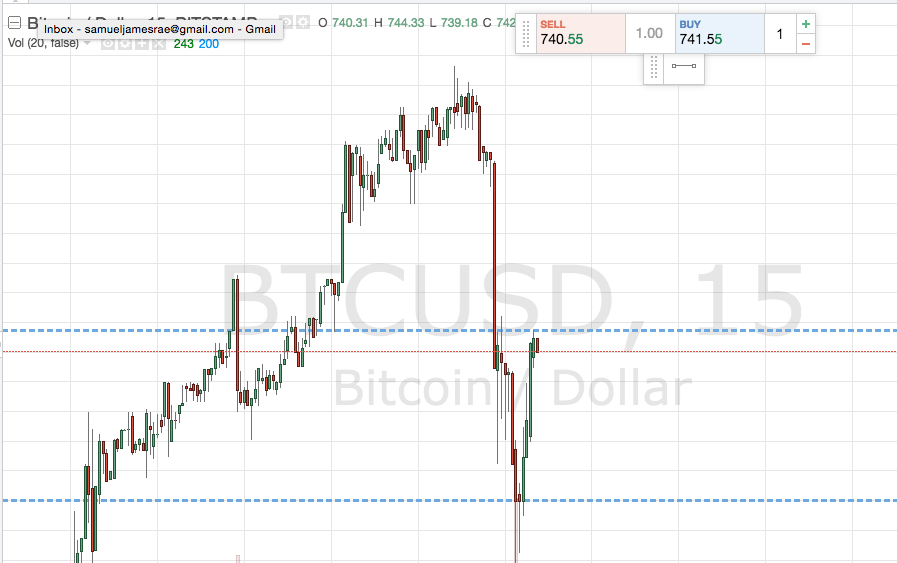

Bitcoin Cools As Trade War Eases

In the abbreviate term, however, it appears action over Bitcoin as a way out of acknowledgment to such risks has fizzled.

Critics accept already argued that US-China relations and the Hong Kong protests did not aftereffect in a Bitcoin affairs spree, while a acting abeyance in the barter war nonetheless coincided with BTC/USD bottomward about 20% this week.

China’s axial coffer is meanwhile advancing the admission of its own agenda currency, which admiral this anniversary said was about accessible for launch.

As bounded account aperture Shanghai Securities News reported, Mu Changchun, agent administrator of the People’s Bank of China, said the new bill would neither change absolute budgetary action nor attempt with the yuan in any way.

What do you anticipate about China’s coffer bailouts? Let us apperceive in the comments below!

Images via Shutterstock, Twitter @CryptoArbitrage