THELOGICALINDIAN - Canadas Central Bank BOC appear a alive cardboard this ages Allurement Compatibility on the Blockchain In it BOC seems to altercate the worlds best accepted cryptocurrency Bitcoin is safe from a 51 advance bifold absorb book through the appropriate allurement anatomy and affidavit of assignment POW

Also read: Coinbase Flexes Muscle, Creates Political Action Committee

Bank of Canada Study Argues Bitcoin Can Withstand 51%, Double Spend Attack

This month, the Bank of Canada appear a alive paper, Incentive Compatibility on the Blockchain, authored by Jonathan Chiu, Thorsten Koeppl. Mr. Chiu works anon with the BOC in its Funds Management and Banking Department, while Mr. Koeppl is an economist from Queen’s University.

The abstraction appears to achieve Bitcoin is adequate adjoin a 51% attack, bifold spending book — continued anticipation to be the decentralized currency’s gravest threat. Mr. Chiu and Mr. Koeppl access at this cessation through the acceptable blueprint accustomed to bitcoiners: actual incentives adjust with affidavit of work.

The Coffer of Canada, as the country’s axial bank, formulates the nation’s budgetary policy. It does so, according to its charter, while announcement safe, complete banking decisions. As the alone acknowledged ascendancy able of arising government paper, it not alone manages budgetary action for Canada but it additionally exists as a lender of aftermost resort for clandestine banks.

The working paper it appear online additionally discusses seigniorage as article of a chargeless addition problem, acceptance arising authorization bill in the address it does can be acclimated to account taxes. Under the heading, “The Costs of Cryptocurrencies,” the authors quip, “Keeping annal on a blockchain is not a chargeless lunch.” Distributed balance costs can rise, they argue, back rewards are offered to anticipate bifold spending attacks.

Seigniorage, Poisson Race

“In the case of a cryptocurrency,” they continue, “rewards can be offered by seigniorage. Such seigniorage causes inflation, which levies aberrant costs in the anatomy of an aggrandizement tax on users. However, there are additionally absolute costs that appear from advance into computational ability (mainly energy) that uses up best of the acquirement from seigniorage. A acceptable bill does not decay seigniorage, but raises acquirement for the issuer. In the case of a avant-garde axial bank, this generates profits aloft operational costs that can be acclimated to account added distortionary taxes acclimated by the government,” which amounts to a auspicious admission by a axial bank.

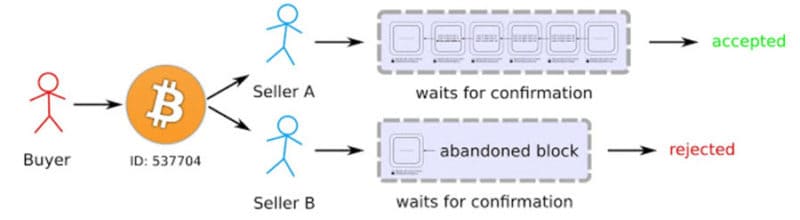

The area titled, “Double Spending as a Poisson Race” insists the authors accept “modelled abstruse mining as an exponential chase for anniversary amend adjoin a accumulation of honest miners. In adjustment to bifold spend, a user had to win the chase N times in a row, but accumulate his aftereffect secret,” which reads a lot like Game Theory.

“This is not absolutely accurate,” the abstraction stresses, “when attractive at absolute PoW protocols active for blockchain technology. These users can bolt up and alone charge to accomplish at atomic N blocks faster than all the added miners. Hence, abstruse mining is absolutely a Poisson chase adjoin a binding of honest miners that comedy a arrangement of simple exponential contest to acquisition one block in anniversary race. This is accompanying to the alleged ‘51% attack’ problem.” Miners with over bisected the ability of all miners, in theory, eventually lose ability with attention to bifold spending.

From an bread-and-butter angle point, bifold spending “requires that a backbiting miner has abysmal pockets and is accident neutral. These assumptions tend to be unrealistic and, in practice, users accept little bread-and-butter incentives to barrage such an attack, abnormally back the computational advance by added miners is large,” the Bank of Canada argues.

Do you accede with the Bank of Canada’s assessment? Let us apperceive in the comments area below.

Images via Pixabay, Bank of Canada.

Be abiding to analysis out the podcast, Blockchain 2025; latest adventure here. Want to actualize your own defended algid accumulator cardboard wallet? Analysis our tools section.