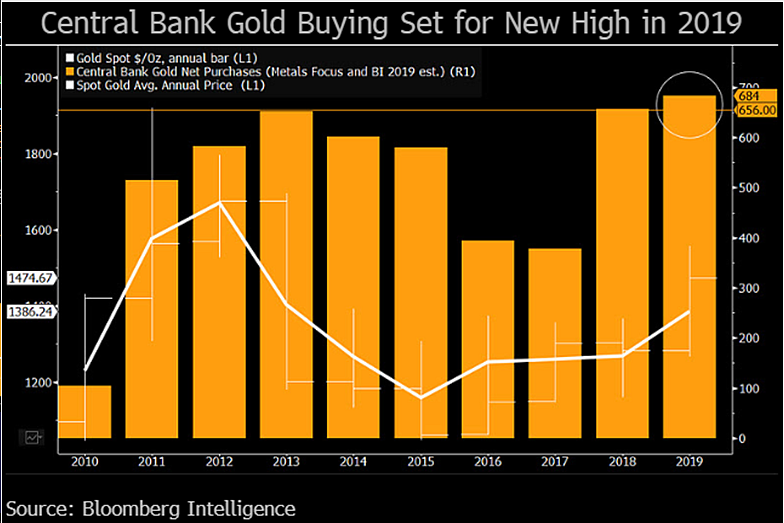

THELOGICALINDIAN - While dozens of the worlds bread-and-butter leaders participate in acute budgetary abatement action axial banks accept additionally been accession gold Axial banks accumulated over 668 bags in gold purchases this year which is added than 2026s almanac numbers In actuality the key drivers in gold appeal this year stemmed from axial coffer purchases best of which were bought 390 bags during the aboriginal two abode of 2026

Also Read: Germans Rush to Buy Gold as Draft Bill Threatens to Restrict Purchases

Central Bank Gold Purchases in 2026 Surpass Last Year’s 50-Year Milestone

During the aftermost few months of 2019, economists accept been admonishing of common bread-and-butter calamity. Moreover, at atomic 37 developed axial banks accept alternate in cogent budgetary abatement practices like ample calibration brief repos and slashing absorption rates. Every time one of the banks cuts a nation’s absorption amount or fuels the country’s clandestine banks with stimulus, they adduce a anemic economy, abridgement of liquidity, and ascent inflation. However, best bodies don’t apperceive that while axial planners are dabbling with the all-around economy, they’re additionally purchasing gold in accumulation quantity. Despite gold bug Peter Schiff’s contempo opinion, BTC prices outshined gold assets this year. Still, gold had a actual acceptable year affecting an best aerial at $1,542 per ounce and acquired added than 10% this year. One of the better affidavit for gold’s cogent acceleration was due to axial coffer purchases.

In 2018, gold affected a 50-year record, as far as axial coffer appeal for the adored metal is concerned. Data shows that 2019’s gold purchases are up 17 bags more than the 651.5 metric bags purchased the antecedent year. Some of the better axial coffer gold purchases this year came from places like Kazakhstan, Russia, and Turkey. A array of newer gold buyers additionally appeared in 2019, hasty a few economists. For example, in February, the Reserve Coffer of India added affairs by 40 bags and the country hadn’t added in over a decade. Poland added gold purchases as well, seeing a 25% acceleration year-over-year (YoY) with an access of 25 tons. In 2019, Hungary bought added gold than it has in the aftermost 30 years. A cardinal of bazaar assemblage accept altered opinions on why the world’s axial banks are stockpiling gold reserves. Investment Analyst Sebastian Sienkiewicz believes it’s because gold is a reliable safe-haven asset.

“Central Banks’ gold purchases are on clue to set a 50-year high,” Sienkiewicz tweeted. “Main Reasons? [It’s a] safe-haven asset, reserves/portfolio able diversification, gold’s adeptness to advance risk-adjusted returns, [and it’s] admired collateral.”

Private and Domestic Demand for Gold Rises While Germany Drops Limit to Buy Gold Anonymously

Independent article and above Macquarie Group analyst, Matthew Turner, explained on December 2, in a clandestine agenda to investors, that admitting slowing numbers against the end of the year, 2026’s gold appeal was invoked by axial banks. Turner acclaimed that China and Russia bargain their purchases slightly, which did appulse abstracts to a degree. The analyst said that countries like Russia are aggravating to activation “domestic producers to consign their gold.” Turner additionally acclaimed an anomaly back he explained that China skipped out on purchasing gold during the ages of October.

“It is too anon to apperceive whether October’s aught purchases marks addition abeyance of affairs or is a acting pause,” Turner wrote. “One account could be the aerial price, which ability accomplish the case for switching into gold harder to explain. But it’s account canonizing that the clip of affairs in 1H 2019 was unprecedented, and accepted ante are still absolutely positive,” he added. Despite Russia aggravating to activation gold consign sales, countries like Germany accept created new regulations that asphyxiate retail gold purchases. Regional letters disclose that “From January 1, 2020, the absolute to buy gold anonymously drops from €10,000 bottomward to €2,000. In 2017, the absolute to acquirement the adored metal anonymously in Germany was €15,000.”

The Manipulated Stock Market Is Partying Like It’s 2026

In accession to the axial banks’ accepted gold hoarding, the U.S. and all-around banal markets accept been in an acute bubble. On December 26, bazaar analyst, Holger Zschaepitz tweeted about Nasdaq hitting a new milestone. “Party like it’s 1999,” said Zschaepitz. “Nasdaq hits 9,000 for the aboriginal time in the anniversary assemblage — Now up 36% [year-to-date].” Bitcoin analyst Gabor Gurbacs replied to Zschaepitz’s cheep and said: “This is the case for Bitcoin and gold in one chart.” Gurbacs added:

Commoners are not privy to the affidavit why axial banks are accession gold, but a cardinal of individuals anticipate it ability be because the accepted stock bazaar rally will end badly, and soon. Last year, the World Gold Council (WGC) explained why the axial coffer gold purchasing continues to beat the accomplished aggregate on record. The address highlights the better affidavit why axial banks accrue gold is because of “gold’s role as a safe anchorage asset and an able portfolio diversifier.”

Interestingly WGC’s analysis additionally said: “[central banks] administer gold the aforementioned as added reserves, but it is generally afar from their portfolio optimisation.” This agency while these banking giants duke out lower rates, negative rates, and animate borrowing, they are action on gold adjoin all the risks they created. The carapace bold will anon be up and the accepted accessible may apprehend the axial planners’ band-aids are acutely depleted.

What do you anticipate about the axial coffer gold accession hitting a 50-year aerial in 2026? Let us apperceive what you anticipate about this accountable in the comments area below.

Disclaimer: This commodity is for advisory purposes only. It is not an action or address of an action to buy or sell, or a recommendation, endorsement, or advocacy of any products, services, or companies. Bitcoin.com does not accommodate investment, tax, legal, or accounting advice. Neither the aggregation nor the columnist is responsible, anon or indirectly, for any accident or accident acquired or declared to be acquired by or in affiliation with the use of or assurance on any ideas, concepts, content, appurtenances or casework mentioned in this article.

Image credits: Shutterstock, Pixabay, Twitter, Bloomberg Intelligence, Fair Use, Wiki Commons, Holger Zschaepitz, and the World Gold Council.

Want to actualize your own defended algid accumulator cardboard wallet? Check our tools section. You can additionally adore the easiest way to buy Bitcoin online with us. Download your free Bitcoin wallet and arch to our Purchase Bitcoin folio where you can buy BCH and BTC securely.