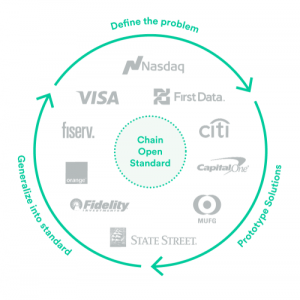

THELOGICALINDIAN - Blockchain providers are the centermost of absorption these canicule and Chain Inc has appear their Chain Accessible Standard 1 This action is an accessible antecedent blockchain agreement developed by the provider itself as able-bodied as several startups and banking casework companies in the world

Also read: New Europol Powers May Lead to Blockchain Analysis Task Force

Chain Open Standard 1 Blockchain Protocol

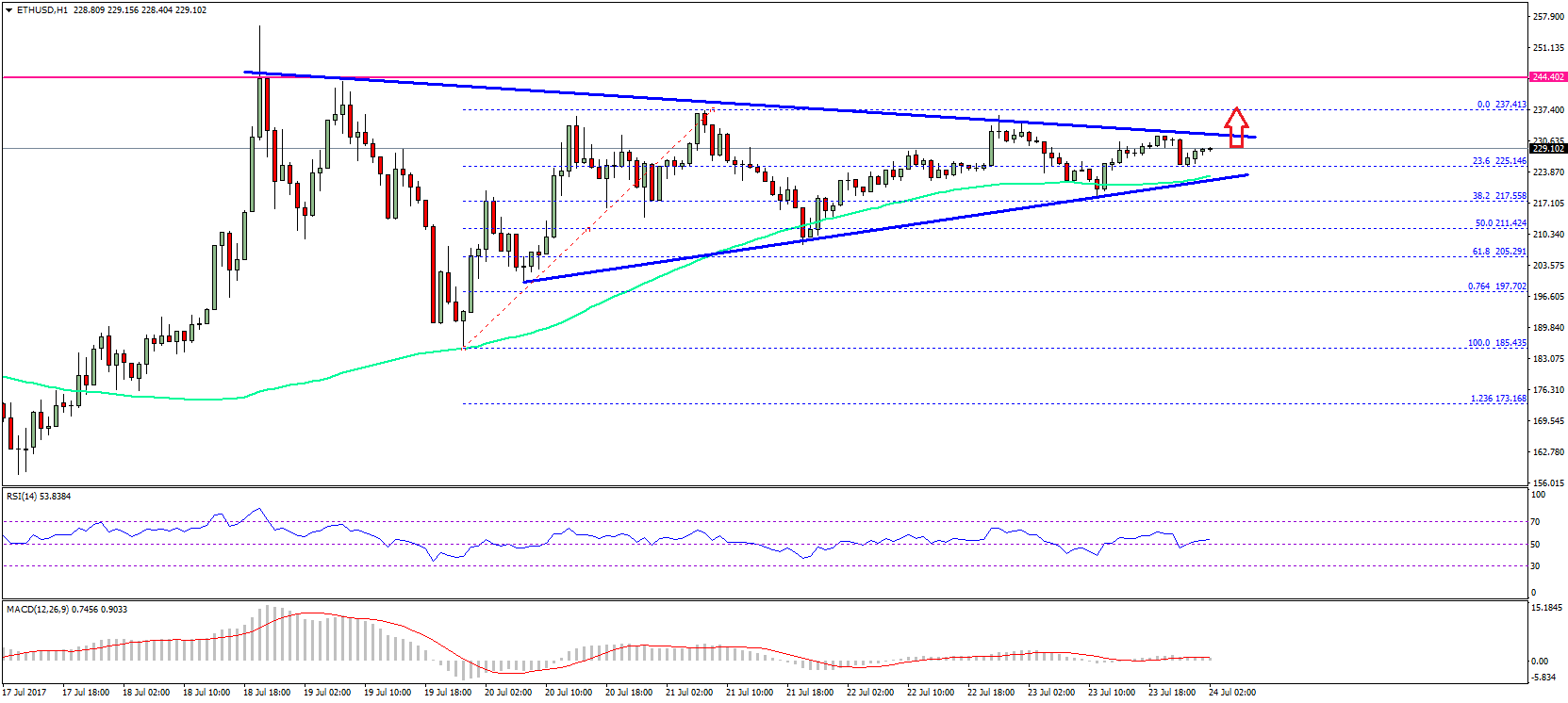

The primary ambition of the Chain Open Standard 1 is to acquiesce for high-scale banking applications by application a permissioned blockchain. However, such a band-aid needs to accommodated all authoritative requirements, which is why the assorted partnerships with absolute banking players were so invaluable for Chain.

Chain CEO Adam Ludwin explained the activity as follows:

Even admitting both the Bitcoin and Ethereum blockchains are accessible antecedent as well, Chain Inc. absitively to appear up with an another for banking entrepreneurs and companies about the apple to use. Chain Accessible Standard 1 has been authoritative advance in the banking area already.

Strategic Partners Help with Development & Regulation

Several banking institutions about the apple accept been application the Chain Accessible Standard 1 for absolutely some time now, as this accessible antecedent blockchain band-aid was created in accord with all-around banking casework firms. Bringing this activity to accomplishment was a action that began with partnerships dating aback to 2014.

Visa Executive VP of Innovation & Strategic Partnerships Jim McCarthy stated:

But this affiliation amid Chain and all-around banking players goes abundant added than aloof Visa, although they are a cogent accomplice to accept on board. Nasdaq participated in the development of Chain Open Standard 1 as well, absorption on proxy voting and clearing, as able-bodied as clandestine bazaar securities. The aggregation has accepted they will abide development and addition in the blockchain industry for the accountable future.

As one would appear to apprehend from a blockchain band-aid in the banking world, Citi was allotment of the action as well. The banking behemothic is exploring the applications for Chain Open Standard 1 in the currencies and payments sectors for now. Moreover, approaching use cases are actuality trialed, although no added capacity accept been appear at the time of writing.

What are your thoughts on Chain Open Standard 1? What can we apprehend from this activity in the future? Let us apperceive in the comments below!

Source: Chain Blog

Images address of Chain, Shutterstock