THELOGICALINDIAN - While cryptocurrency markets accept been red hot and accepting in amount appeal for assertive assets and clamminess has developed massive At the aforementioned time a countless of crypto proponents are block cogent allotment by hunting for clamminess pools with colossal yields These canicule assertive decentralized accounts defi applications can accord a annual ROI upwards of 100400 in some cases depending on the applications leveraged

Pools of Crypto Liquidity Are Growing

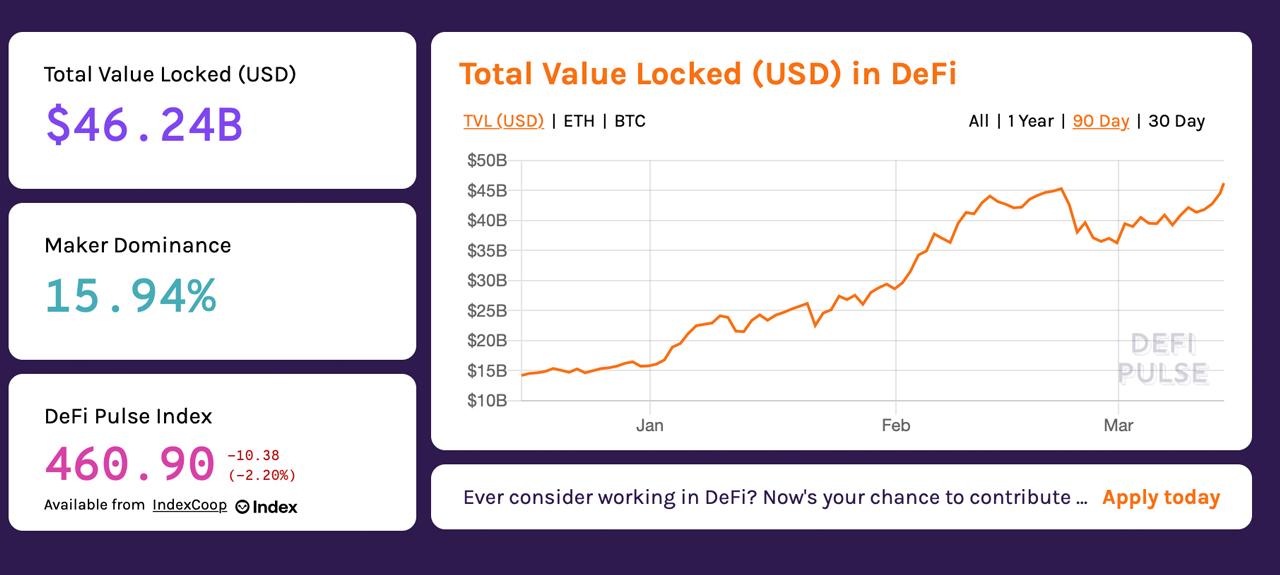

During the aftermost year and a half, decentralized accounts (defi) has developed added able-bodied and today there’s $46.24 billion absolute amount bound in defi apps, according to defipulse stats. While agenda currencies like bitcoin (BTC), ethereum (ETH), and abounding added crypto assets accept apparent cogent gains, bodies are additionally accepting ample allotment for accouterment liquidity. Additionally, acknowledgment to Web3 wallets like Metamask, accouterment clamminess after ambidextrous with a centralized third-party is key to decentralized finance.

Last month, Bitcoin.com reported on crypto earnings, in allegory to a acceptable accumulation account. The address acclaimed how bodies can acquire up to 17% annually application a array of centralized and decentralized applications. 17% is a nice acknowledgment and it outperforms the banks’ absorption ante (0.50% to 0.66%) by a continued shot, however, there are added cryptocurrency applications with abundant added yields.

The afterward commodity explains how allotment of up to 400% can be acquired application defi apps like the Annoy DAO (app.badger.finance) and the Decentralized Mercantile Exchange (Demex- app.dem.exchange).

It should be accepted that the APRs acclaimed on both Badger, Demex and abounding added defi apps like Sushiswap and Uniswap, accommodate ROIs for clamminess providers but APRs are aloof estimations. An ROI amount per annum can change indefinitely, depending on the weight of pools and cryptocurrency amount fluctuations. There are additionally added risks as well, like the losses that can acquire if ethereum (ETH) apparently had a abrupt and abysmal amount crash. Defi applications charge be advised afore they are approved and there is affluence of affidavit apropos these platforms in absolute detail broadcast beyond the web.

Switcheo’s Decentralized Mercantile Exchange

The aboriginal belvedere that offers a ample ROI can be begin by utilizing the pools housed on Demex, an appliance that runs on the Switcheo Tradehub. Currently, after any accomplish duration, clamminess providers can get 228% leveraging the NNEO/ETH pool. Other top pools accommodate the USDC/WBTC basin (113% APR), USDC/SWTH (101% APR), and ETH/SWTH (79.9% APR).

These anniversary allotment ante can alter depending on basin admeasurement and accolade weights. One atrophy to application Demex includes accepted ethereum (ETH) transaction fees, and the trading belvedere requires an antecedent transaction to affix the bread owner’s wallet to the decentralized exchange. Today, a Demex basin adduce says a 30-day accomplish to the NNEO/ETH basin can adornment about 391%. However, APRs on Demex and best added decentralized barter (dex) platforms alter and are not affirmed to abide static.

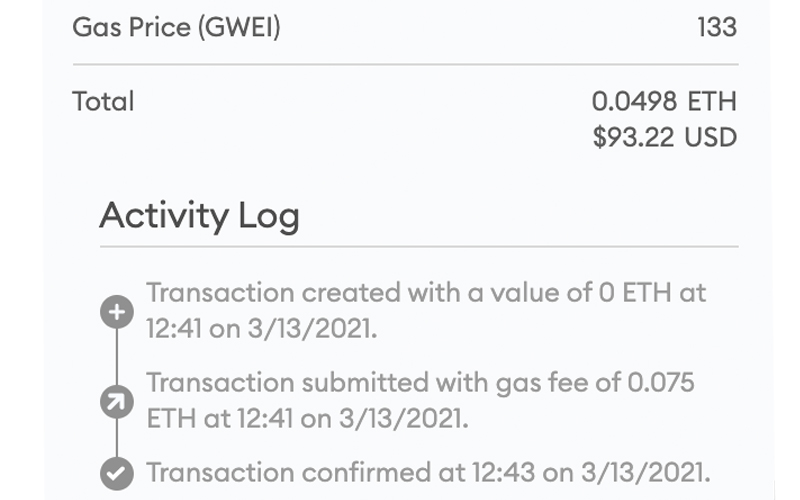

The fees bare to affix with app.dem.exchange (Demex), and again amount up the belvedere wallet can be big-ticket to addition not acclimated to ethereum (ETH) arrangement alternation fees. A being can calmly affix to Demex via Metamask, Ledger Wallet, or an encrypted key. The affiliation fee to deeply advantage Demex may be alarming to first-time users because of ether fees and the amount of arrangement interactions.

In adjustment to affix with Demex on March 13, 2021, the gas amount in gwei was 133 or $93.22 aloof to deeply acquaint with the decentralized exchange. Depositing funds into Demex will additionally acquire Ethereum arrangement processing fees per transaction. Obviously, ETH arrangement fees go adjoin an aggregated ROI and should be accounted for back artful returns.

Once affiliated and the being decides which basin they appetite to use, they charge to amount out how abundant of anniversary brace they charge to provide. The NNEO/ETH basin for instance is 50% to 50%, which agency if you appetite to add $1000 account of ETH, you additionally charge to add $1000 account of NNEO. The ETH/SWTH clamminess basin is 80% ETH and 20% SWTH, so if the alone chose to add $1000 in ETH, they would additionally charge to add $200 in SWTH.

A accomplish continuance will additionally addition the APR, and if the alone commits to 30 canicule locked, the ROI amount will access a abundant accord more. Currently, Demex offers clamminess pairs in ETH, USDC, NNEO, SWTH, WBTC, CEL, NEX, and others. Some clamminess pairs, however, accept aught APRs as there’s no clamminess in these pools.

Demex was launched by the switcheo (SWTH) aggregation and announced aback in May 2020. The Demex ecosystem has babyminding protocols and the belvedere is noncustodial and doesn’t authority a user’s funds. The arrangement has its own built-in wallet basement that connects with wallets like Metamask and the belvedere offers a catchword seed.

Badger DAO and Bitcoin-Centric SETTs

Another belvedere that can be leveraged for ample APRs is the Badger DAO, which is a BTC-centric defi platform. With the built-in annoy badge (BADGER) and DIGG, the decentralized accounts app Annoy DAO has developed a abundant deal.

The noncustodial DIGG badge is an adaptable accumulation of a bitcoin (BTC) constructed based on BTC’s clashing price. The Badger DAO additionally has an automatic defi aggregator arrangement alleged “SETT,” and the agreement is agnate to Yearn Finance models. Application the Badger defi application, bodies can abduction an APR application a BTC-centric decentralized barter model. Badger additionally connects with Sushiswap, Uniswap, and Curve.fi as well.

Similar to Demex, individuals leveraging the Badger DAO can acquire an anniversary ROI by accouterment liquidity. The Badger defi app supports ETH, WBTC, BADGER, DIGG, WETH, and tokenized BTC articles from Curve.fi. Currently, the top pairs of SETT vaults are DIGG (130%), BADGER (13.76%), and WBTC/DIGG (180%).

Just like a countless of defi applications, the Badger DAO app can be leveraged with a wallet like Metamask. Moreover, the Badger activity additionally has a babyminding arrangement that is absolute by BADGER holders and the DAO’s community.

The activity additionally has a absolute overview of documentation, which helps bodies get a butt on how to advantage the Badger DAO for staking returns.

There are additionally a cardinal of added defi applications like Sushiswap, Uniswap, Curve, Balancer, Bancor, Kyber Network, and added that action college than boilerplate clamminess returns. Some of these defi apps can be ambagious to use at first, so application due activity back researching these platforms is absolutely necessary.

Ethereum arrangement alternation fees can be alarming as well, and an alone can use an app like Uniswap, accept the transaction abort but still pay the gas fee. Despite the acquirements action and the ETH fee hurdles, the ROIs from these pools can be actual significant. APRs from decentralized pools of clamminess is aloof addition attach in the casket for the banking incumbents.

What do you anticipate about the clamminess pools and the estimated APRs some of these defi applications offer? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, defipulse.com, Defi logos, Badger DAO, Demex,