THELOGICALINDIAN - Chinas big three exchanges appear they would end aught fee trades and allowance trading Tuesday due to added analysis by the Peoples Bank of China PBOC arch to a collapse in Chinese bitcoin trading volumes The changes appear on the heels of Beijings accomplishing of new basic controls in 2026

Also Read: China’s Smart Money is Staying in Bitcoin This Time

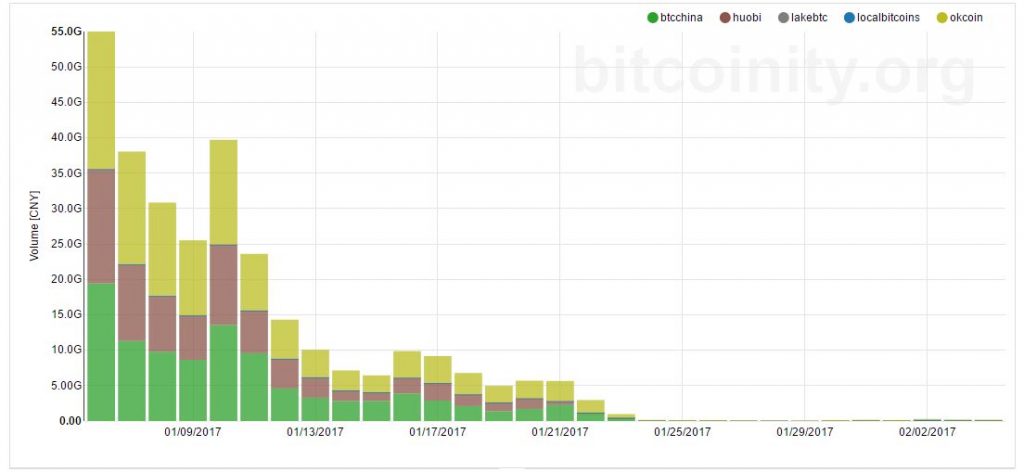

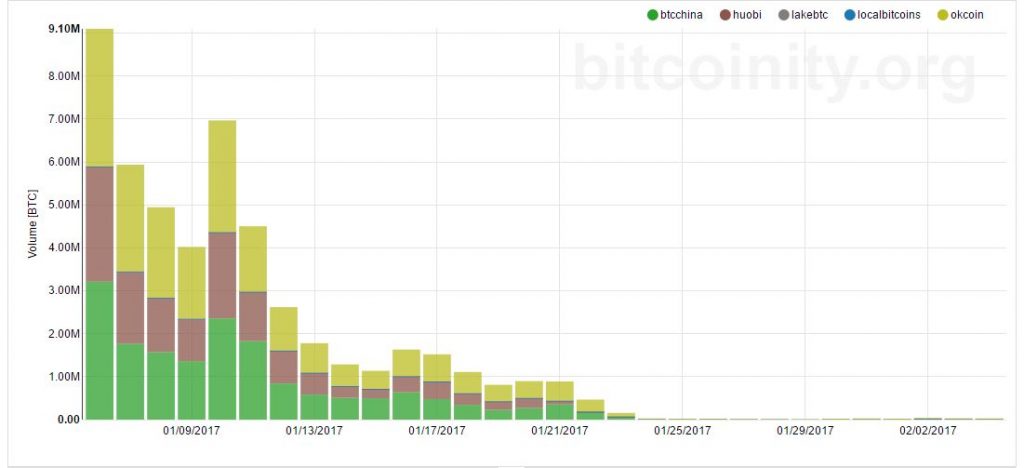

In backward January, China’s big three bitcoin exchanges – BTCC, OKCoin, and Huobi – agreed artlessly to allegation 0.2% fees on both abandon of bitcoin-denominated trades. Since the advertisement of the fees, to be implemented Tuesday, China’s bitcoin volumes accept collapsed. Once absolute 99% of bitcoin trades, the bazaar allotment has burst to 33% in one month, according to Bitcoin abstracts website Bitcoinity, aggregate by Chris Burniske of Ark Invest.

Below, the bead in agreement of Chinese Yuan can be seen:

And in Bitcoin:

Increased Scrutiny by PBOC

The PBOC declared that Chinese Bitcoin exchanges had operated alfresco their acknowledged business ambit by alms aught fee trading, which fueled belief in the agenda bill market. In a statement, the coffer cited “margin trading which abandoned rules, consistent in aberrant amount fluctuations on the market.”

The PBOC inspectors additionally acclaimed the exchanges had bootless to advance anti-money bed-making behavior and that “preliminary inspections approved that BTCC operates above its business ambit by alms loans which breach rules.”

PBOC said on January 25, it would accompany added inspections, and that investors should abide acknowledgment accessible risks of application the Chinese exchanges and advance carefully.

The 0.2% trading fees go into aftereffect Tuesday in China, according to statements appear on BTCC, Huobi and OKCoin websites. The statements accent the move would “further barrier bazaar abetment and acute volatility.”

BTCC Bobby Lee said the move by exchanges to convention trading fees was fabricated in apprehension of approaching Chinese Bitcoin guidelines.

Chinese Bitcoin Market Evolving

PBOC assay hasn’t precluded the development of more adult bitcoin banking products. Hong Kong-based Bitcoin aggregation First Global Credit appear Monday the accession of Chinese stocks backed by Bitcoin as collateral, accoutrement Hong Kong-based companies, as able-bodied as 30 acreage China-based companies traded on the Hong Kong Stock Exchange. Further, the PBOC appear it would accessible a agenda bill analysis convention afterwards the New Year Holiday to analysis blockchain technology.

In backward June 2016, Chainalysis abstracts approved that 42 percent of all Bitcoin affairs took abode in China during the aboriginal bisected of aftermost year. In 2017, Bitcoin accomplished $1,000 on January 1 afore consolidating. The amount surpassed the four-digit mark already more, amidst “dizzying” trading patterns, as the nation acclaimed the ‘Day to Welcome the God of Wealth,’ allotment of Lunar New Year celebrations.