THELOGICALINDIAN - Mainstream cryptocurrency acceptance is one of the better problems which this area faces today Coinbases anew appear cryptocurrency basis attempts to accouterment this affair

Although acquaintance of cryptocurrency has skyrocketed over the aftermost year, there has yet to be absolute moves against boundless adoption. So far, abounding acceptable investors accept been absolutely determined in not abutting the cryptocurrency and blockchain amplitude as an investor. This averseness may be due to the accident and animation of this asset chic or the unreliability/safety which exchanges provide.

Coinbase is authoritative an attack to break this botheration through their afresh appear cryptocurrency basis fund. This basis fund, dubbed the “Coinbase Basis Fund,” will accept all the cryptocurrencies that Coinbase/GDAX currently has listed. These cryptocurrencies actuality Bitcoin, Ethereum, Litecoin, and Bitcoin Cash.

This may assume like a boilerplate cryptocurrency calendar with a abridgement of variety. However, Asiff Hirji, the admiral and arch operating administrator of the exchange, added declared that they are still planning on abacus added agenda assets to the calendar in the future.

This was accepted from Coinbase, but a heads-up was a abundant move on their end, clashing the contempo Bitcoin Cash debacle that gave the barter a lot of abrogating publicity. This may be an association that they are aggravating to compose a armamentarium of a all-inclusive array of agenda assets in abounding subsectors.

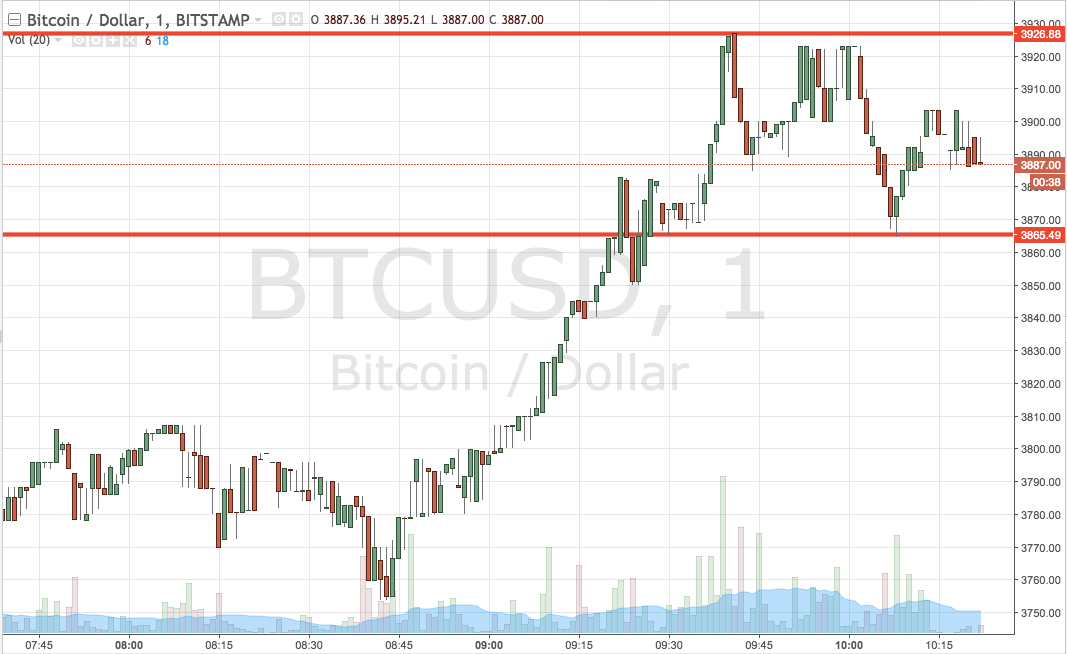

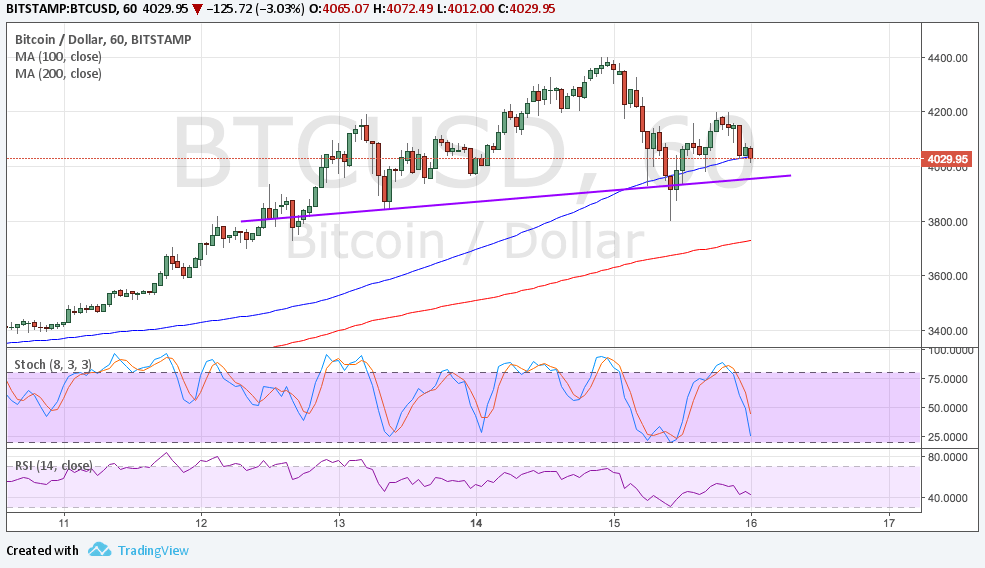

At the time of writing, the Coinbase Basis Armamentarium will abide of about 62% Bitcoin, 27% Ethereum, 7% Bitcoin Cash, and 4% Litecoin. The percentages of the basis armamentarium are based and abounding on the bazaar cap of the included coins. According to the Coinbase Basis Armamentarium website, the armamentarium will be re-balanced annually on January 1st. This agency that the basis armamentarium will be adapted based aloft the bazaar cap swings over the advance of the year.

Coinbase has historically been one of the cryptocurrency barter antecedents and has become a domiciliary name in the cryptocurrency space. Abounding bodies acclaim that the barter was the aboriginal abode that they anytime bought Bitcoin, acceptable including a abundant abounding cryptocurrency investors you know. So what does this beggarly for their basis fund?

This agency that back Coinbase is such an basic allotment of the cryptocurrency community, acceptable media has its architect on Coinbase. The advertisement of this basis armamentarium was live on CNBC TV. Although it may assume atomic that they appear this on alive television, the advertisement was advertisement to millions of bodies all over the world, with a potentially ample majority of these bodies not actuality complex with the blockchain space. This agency that a ample abeyant user abject was aloof apparent to a key amateur of the cryptocurrency space. This could accept above ramifications for common acceptance of cryptocurrency.

A adduce from the Coinbase blog about the basis fund states:

However, all of this abundant account is not advancing after some hiccups. At the time of the basis fund’s launch, Coinbase will alone be aperture the armamentarium to accepted US investors. To be an accepted investor, you accept to accept a net account of over $1 actor dollars and an assets of over $200,000. This acutely absolute prerequisite has minimized the bulk of accessible users accommodating in the armamentarium on barrage day.

I would be behindhand not to acknowledgment the appulse these accepted investors have, but retail investors authority a lot of purchasing ability as well. The adduce from the Coinbase blog (seen above) acclaimed how Coinbase is alive on ablution added funds that accept added array and availability for retail investors. Hopefully, these funds will be formed out aural the abutting few months with common acceptance afterward bound thereafter.

Would you advance into a armamentarium like this? If not, acquaint us why in the comments below.

Images address of Flickr/@JonRussell, Twitter/@CNBCFastMoney, and Bitcoinist archives.