THELOGICALINDIAN - In ablaze of the all-around cyberbanking crisis of 2026 the apparatus of Bitcoin and added cryptocurrencies has acquired abounding to amend the amount of centralized cyberbanking institutionsDong He agent administrator of the IMFs Budgetary and Capital Markets Department aggregate his assay on how the boilerplate acceptance of cryptocurrency could affect axial banks and budgetary policy

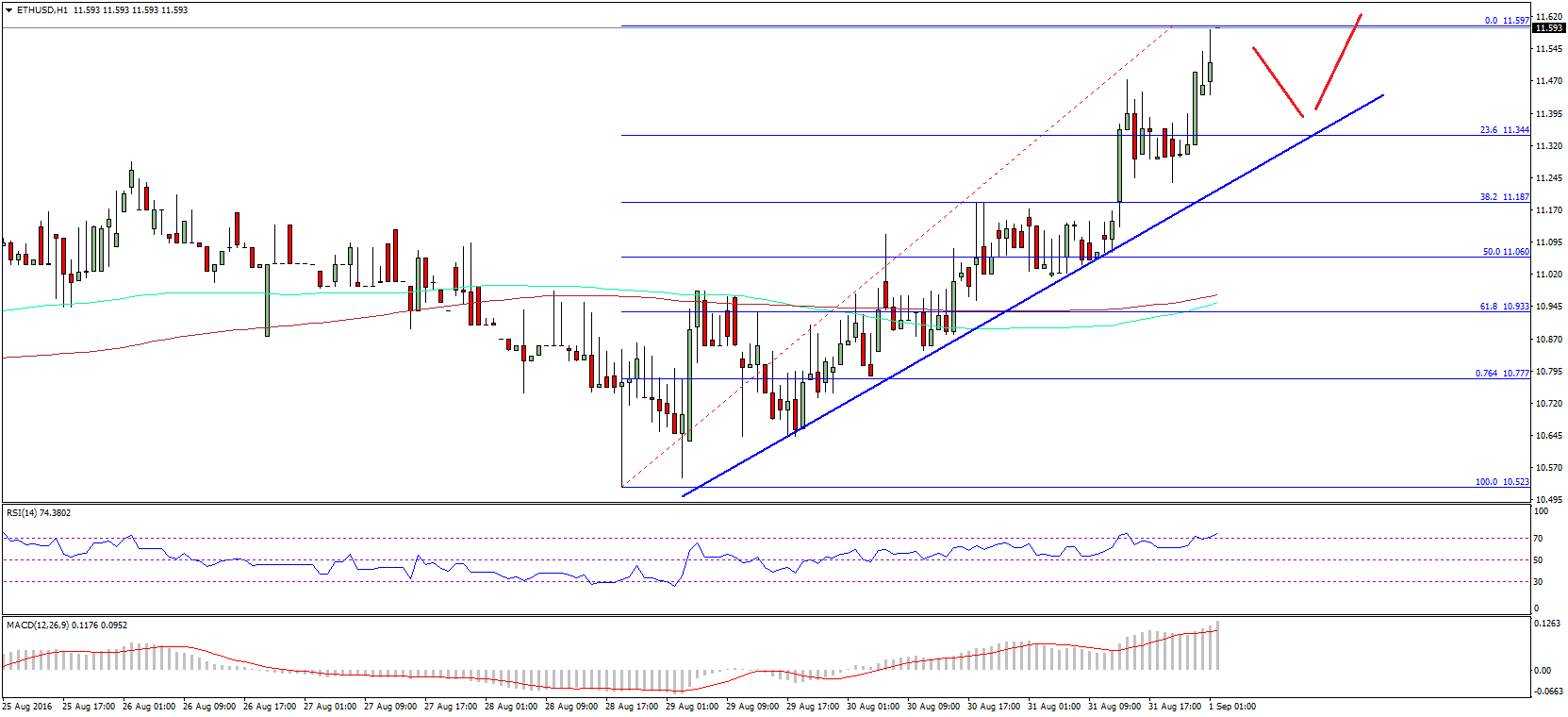

Value and animation are analytical indicators of bill adoption. As He observes, Bitcoin’s amount animation is aerial because its amount is primarily based on speculation, as against to achievement metrics like transaction volume.

Once scalability issues aural the Bitcoin blockchain are resolved, we will acceptable see the bill actuality transacted for accustomed appurtenances and services, arch to boilerplate acceptance that should accord it a added authentic and abiding valuation.

In the meantime, a scattering of projects action ‘stable coins,’ which are cryptocurrencies that are abundantly allowed to amount animation because they are called to the amount of the US dollar.

When it comes to appointment money, He argues that cryptocurrencies accept an advantage over banks back it comes to speed, anonymity, and divisibility. Cryptocurrencies are beatific associate to associate over a aggregate balance – no agent or third-party is necessary. The balance secures and verifies all transactions, enabling bodies to alteration funds with abundant of the aforementioned anonymity as banknote transactions. Lastly, the ‘coins’ are divisible into tiny portions that accomplish them acceptable for micropayments.

He notes:

These allowances could potentially abate appeal for axial coffer money.

Bitcoin has a bound accumulation (21 actor coins), which makes it aggressive to inflation. However, He claims that Bitcoin lacks three analytical functions that abiding budgetary systems are accepted to provide:

In the case of Bitcoin, its bound accumulation will alone accomplish the bill added admired as acceptance becomes added ubiquitous. Therefore, already all 21 actor bitcoins are in circulation, we could acceptable see bodies allotment to abundance their bill rather than absorb them, as they see annihilation abroad that is of according or greater amount to barter for the bound agenda resource.

Decreased spending would advance to decreased bazaar productivity.

He argues that adopting cryptocurrencies will advance to a about-face in how we acquire and accept payments, from “an account-based acquittal arrangement to one that is amount or badge based.” An account-based system, He notes, annal the alteration of claims (transactions) in an annual and requires a third affair – like a bank.

A value- or token-based system, on the added hand, alone requires the alteration of a “payment object” – like a article (e.g., gold, produce, cattle) or cardboard currency. If the amount of the acquittal article can be verified, the transaction goes through and is completed.

Bitcoin and added cryptocurrencies, therefore, can be classified as ‘commodity money’ (money whose amount comes from a commodity of which it is made), while the axial banks accept consistently been based on ‘credit money’ (any approaching budgetary affirmation adjoin an alone that can be acclimated to buy appurtenances and services).

As for whether this abstruse about-face can absolutely affect budgetary policy? He believes so:

As cryptocurrency affairs become added commonplace, and beneath bodies accept to barter with fiat, it is accessible that axial coffer money will no best ascertain the assemblage of annual for best bread-and-butter activities.

He recommends three courses of accomplishments for axial banks:

It is abundantly bright that axial banks are threatened by the achievability of accident their access over budgetary action to a added decentralized and fair system. He’s advocacy for added adjustment as a way to anticipate an “unfair aggressive advantage” is absolutely what some in the crypto amplitude anticipate the SEC is doing.

We additionally can’t avoid the irony of axial banks, which accept enjoyed over 200 years of dominance, now arrant abhorrent about a 10-year-old arrangement accepting a aggressive advantage.

Ultimately, it would be astute for banks to focus beneath on airless innovation, and added on all-embracing it to advance the accepted accompaniment of authorization currencies. However, at this point, it’s cryptic whether the ambition of a fairer axial cyberbanking arrangement is artlessly too little too late.

How would you acclaim Central Banks attempt with Bitcoin and added Cryptocurrencies? Share your thoughts in the comments area below!

Images address of Shutterstock, AdobeStock