THELOGICALINDIAN - Digital bill derivatives accept been on blaze during the aftermost two weeks as ethereum futures volumes affected an alltime aerial on Sunday The accepted derivatives trading belvedere Deribit saw 19 actor ETH affairs traded and CME Group is now the thirdlargest barter in agreement of bitcoin futures accessible absorption

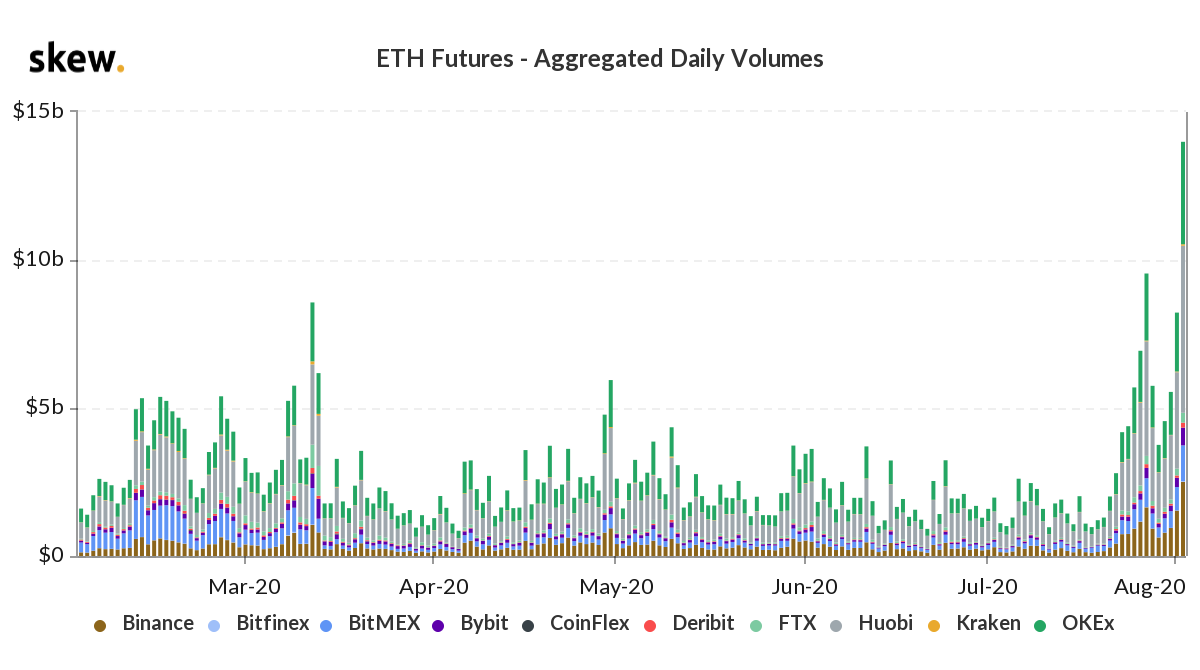

Data shows that cryptocurrency futures and options are seeing cogent appeal in 2026. Statistics from Skew.com, CME Group, The Tie, and Deribit announce a lot of activity has been accident in the acreage of crypto derivatives.

Deribit’s contempo newsletter shows that the barter saw a new almanac in July as the close saw $4.3 billion in options turnovers.

Another accomplishment the Deribit’s barter saw was the platform’s all-embracing accessible absorption affected a whopping $2.3 million.

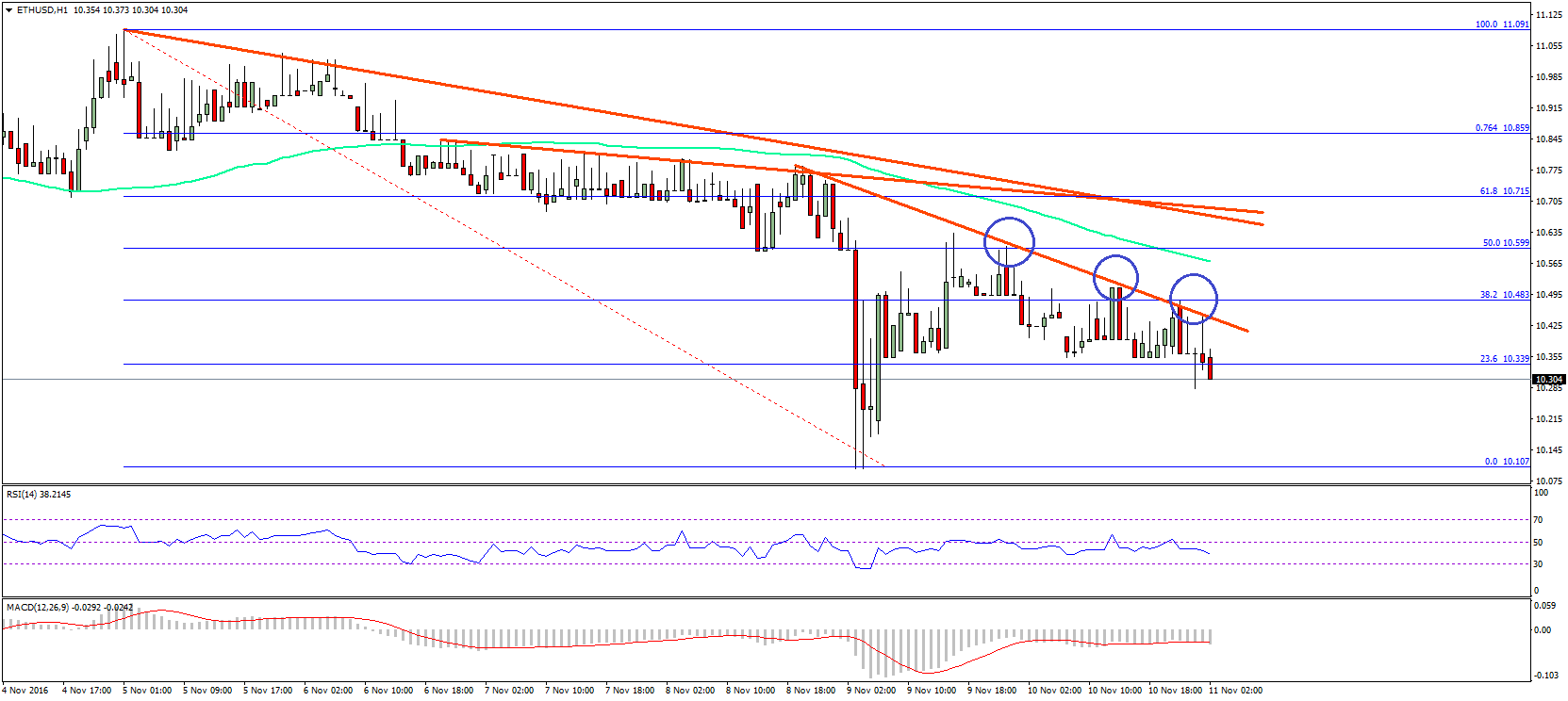

A ample allocation of the crypto derivatives barter aggregate stems from ethereum markets as Deribit recorded 1.9 actor ETH affairs traded in July. On August 4, Skew.com wrote that “options-based anticipation of ETH > $960 at anniversary = 5%”

The abstracts and analytics close Skew.com afresh tweeted that ETH futures affected an best aerial on Sunday.

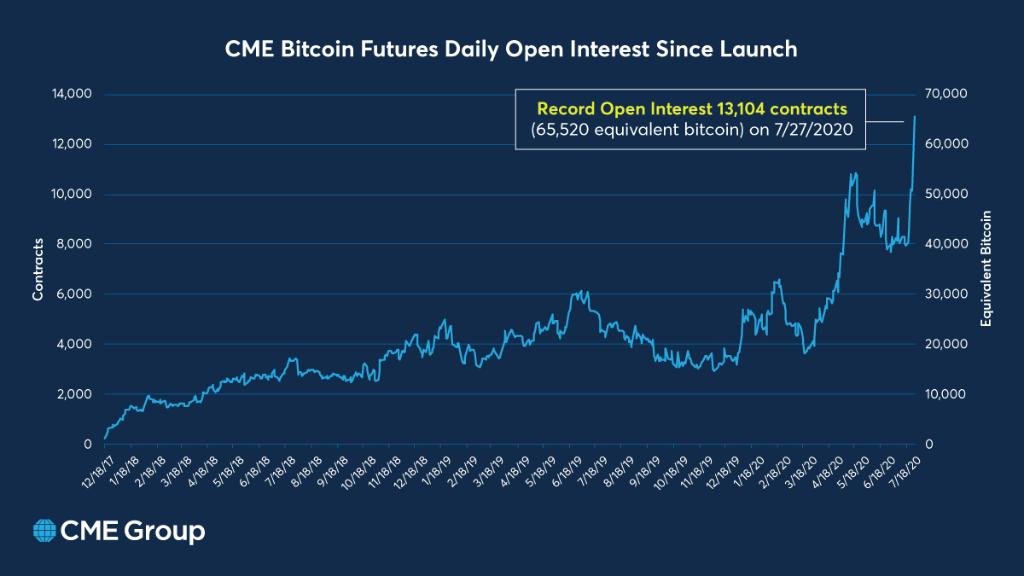

Additionally, the advisers acclaimed that the adapted Bitcoin futures barter CME Group “is now #3 in agreement of better accessible absorption for bitcoin futures, alone Okex and Bitmex are ahead.”

Last Wednesday CME Group tweeted:

“As the abutting beachcomber of added adult participants enters the crypto space, aggregate will accordingly about-face appear safer, added accurate venues,” Tim McCourt of CME Group said aftermost anniversary acclamation the absorption during an interview.

Moreover, bitcoin traders were anxious about a gap on the CME Group futures blueprint amid $11,450 and $11,600. However, afterwards Sunday’s 10.9% accelerate in BTC value, the bitcoin futures gap on CME had filled.

Skew additionally revealed on Saturday that “cash and backpack with bitcoin futures, now yields 25%.”

“September futures barter at a cogent exceptional to spot, including on CME,” Skew tweeted. “The industry is historically crypto affluent and authorization poor, it seems USD is still arduous to antecedent and will acceptable drive borrowing ante higher.”

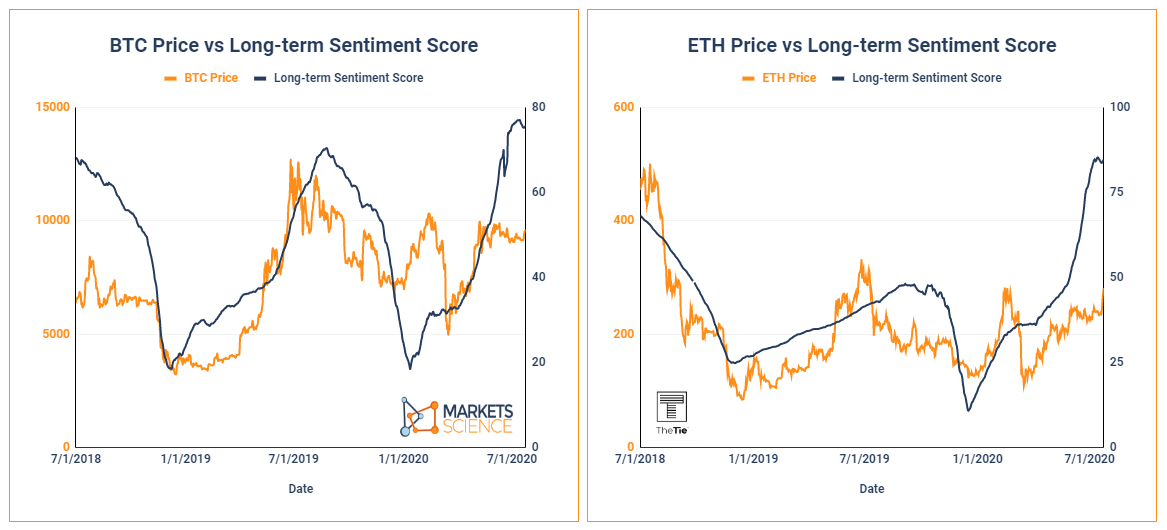

With a lot of appeal stemming from crypto futures and options markets, a abundant cardinal ETH and BTC traders assume bullish. Data stemming from the advisers at The Tie shows BTC and ETH abiding affect array accept set new highs.

What do you anticipate about the bitcoin futures accessible absorption and ethereum futures demand? Let us apperceive in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Skew.com, The Tie, CME Group, NYSE