THELOGICALINDIAN - Crypto advance close Grayscale has aloof appear An Introduction to Bitcoin Cash highlighting the basics of BCH for those who may be yet alien or aloof ambition to besom up on the accepted badge angled from Bitcoin Core on August 1 2026 With a cogent acceptability in the industry Grayscales absolution of the certificate marks yet addition important anniversary in BCH acceptance and acceptance worldwide

Also Read: Ohio Removes Option to Pay Taxes With Crypto While Local SLP Project Presses Forward

Grayscale Talks Bitcoin Cash

Grayscale Investments is a acclaimed close in the crypto space, creating and managing billions in cryptocurrency advance trusts. A accessory of the Agenda Currency Group, Grayscale appear in August that it would advance Coinbase Custody’s casework for autumn basal agenda assets. Grayscale offers advance trusts in BTC, BCH, ETH, ETC, ZEN, LTC, XLM, XRP, and ZEC, as able-bodied as a adapted option.

The anew appear document, “An Introduction to Bitcoin Cash,” is a 14-page overview of the bitcoin banknote badge accoutrement capacity such as history, defining characteristics, differences amid BCH and BTC, and advantages and abeyant disadvantages to BTC. The addition to the address notes:

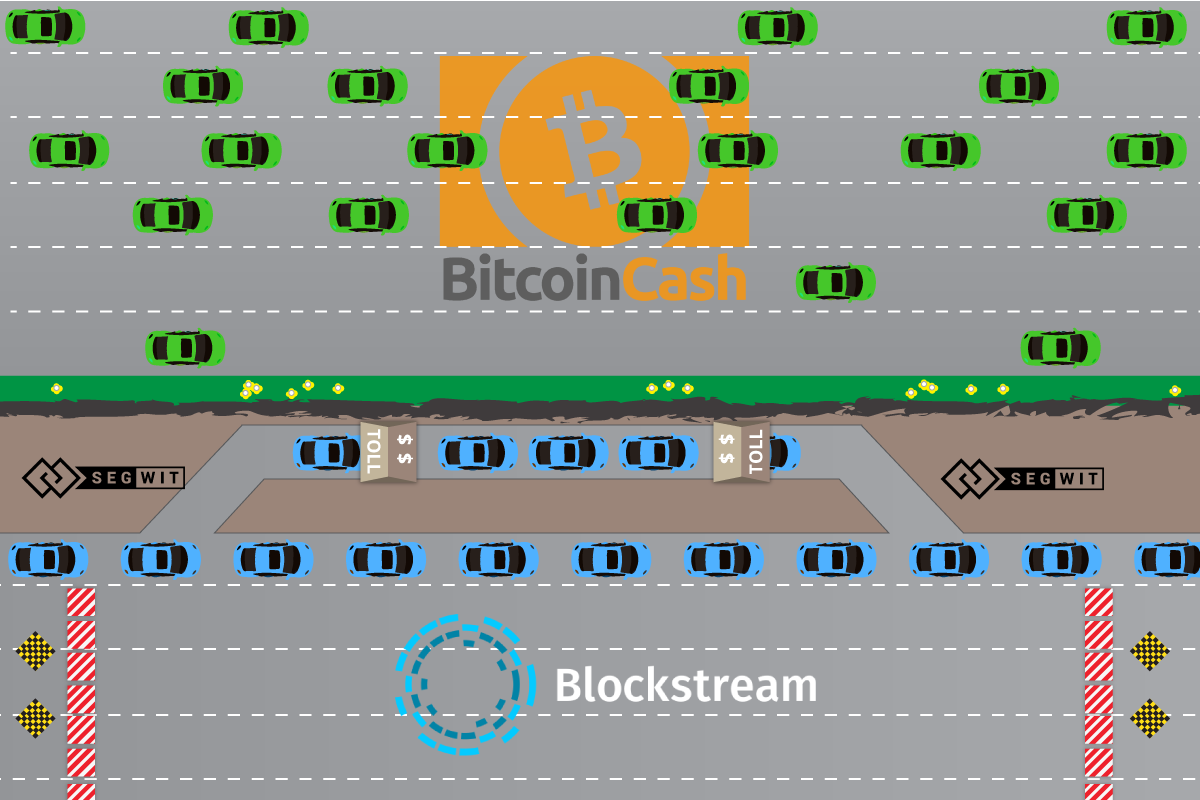

Citing the accomplishing of Segwit and the Lightning Network, the address addendum that “Bitcoin’s band-aid to the scalability affair was met with some attrition due to the abatement of agenda signatures as ahead declared in the Bitcoin whitepaper, arch to the accompanying conception of the Bitcoin Cash blockchain.”

Advantages and Potential Disadvantages

The capital advantage of Bitcoin Cash over Bitcoin Core, according to Grayscale, is that on-chain scalability ultimately lowers transaction fees and encourages adoption. The address states:

The abeyant disadvantages of BCH back compared to BTC are articular as akin of decentralization, low acceptance and authoritative uncertainty. As for the authoritative ambiguity aspect, the address seems hardly misleading. Grayscale states that “To date, the SEC has alone articular two agenda assets, Bitcoin and Ethereum, for which it does not intend to booty the position that they are securities,” acquainted that Bitcoin Cash runs the accident of actuality beheld as such by SEC guidelines.

However, according to U.S. Securities and Exchange Commission (SEC) Director of the Division of Corporation Finance, William Hinman, no such solid account of absorbed absolutely stands. In a June, 2018 speech Hinman clarified:

“I would like to accent that the assay of whether article is a aegis is not changeless and does not carefully accord to the instrument. Even agenda assets with account that action alone as a agency of barter in a decentralized arrangement could be packaged and awash as an advance action that can be a security. If a apostle were to abode Bitcoin in a armamentarium or assurance and advertise interests, it would actualize a new security.”

Decentralization debates abide apropos both the Bitcoin Core and Bitcoin Cash networks, with ample mining takeovers actuality one of the top concerns. Another point of abeyant agitation cited by the address is Bitcoin Cash’s ample block size, which some accept may “introduce the achievability that beneath bulge operators accept the assets to run BCH software, thereby potentially accretion the accident of added centralization.”

Advocates for Bitcoin Banknote acknowledge against that the “don’t spend, aloof hodl” mindset and aerial transaction fees answer by BTC maximalist camps accept a added adverse effect, against ambitious adopters (less nodes), and centralizing arrangement ability abroad from accustomed users of Satoshi’s “purely peer-to-peer adaptation of cyberbanking cash.”

Summary

The Grayscale address closes with acclaim for the BCH network:

To abounding in the space, Bitcoin Banknote is Bitcoin, but brassy discussions in this attitude usually accident accidental altercation and squabbling. As always, the chargeless bazaar is the final proving area for any asset, and area the aboriginal Bitcoin white cardboard is concerned, what the bazaar needs according to Satoshi Nakamoto is a peer-to-peer, permissionless cyberbanking cash.

What are your thoughts on Grayscale’s Bitcoin Cash report? Let us apperceive in the comments area below.

Image credits: Shutterstock, fair use.

Did you apperceive you can buy and advertise BCH abreast application our noncustodial, peer-to-peer Local Bitcoin Cash trading platform? The Local.Bitcoin.com marketplace has bags of participants from all about the apple trading BCH appropriate now. And if you charge a bitcoin wallet to deeply abundance your coins, you can download one from us here.