THELOGICALINDIAN - Mochi allegedly attempted to lock babyminding tokens for its own banking benefit

Curve Finance and Mochi Finance are affected in battle afterwards the closing allegedly approved to booty advantage of DeFi babyminding mechanics.

Curve Says Mochi Attempted Governance Attack

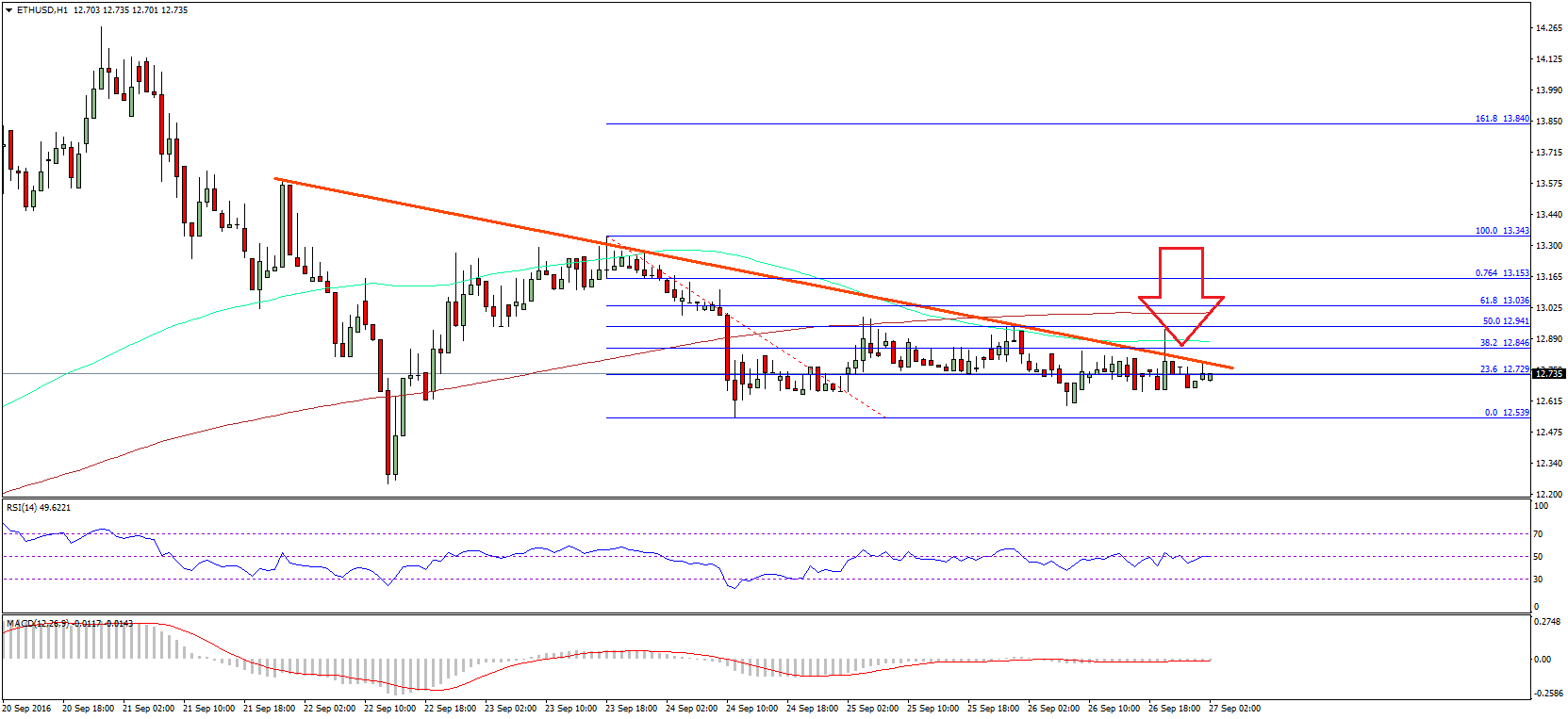

According to Curve, Mochi minted a ample bulk of its own MOCHI badge in adjustment to excellent the USDM stablecoin. With those funds, Ambit says, it bought a ample cardinal of CVX tokens.

Finally, adjoin warnings, Mochi allegedly bound those CVX tokens, acutely in an attack to access the incentives for Mochi’s own USDM branch pool. This would additionally bear added CVX rewards to Mochi.

Curve said that “this [constituted] a bright babyminding attack.” As a result, Curve’s emergency DAO declared clamminess providers at accident and blocked any added CVX emissions to Mochi.

Whereas Curve Finance letters that Mochi’s USDM branch basin accomplished $100 actor in liquidity, other sources advance that the basin accomplished $170 actor in absolute amount bound (TVL).

Though Mochi has not responded publicly, Mochi architect Azeem Ahmed told Crypto Briefing that Mochi is not at allowance with Curve, and that the Curve Emergency DAO’s apropos “are reasonable.”

He hopes that already those apropos are resolved, “the barometer acknowledgment will be accounted suitable, absolute of cardinal fears the whales and influencers may have.” He accepted that Mochi took a “bold access to accepting voting ability in the DAO.”

Ahmed additionally said that “the DeFi Cartel … feels threatened that a baby amateur on the outskirts” could affectation a blackmail to the accustomed DeFi ecosystem led by Curve and Convex.

Furthermore, he says that abounding associates of the DeFi association accept that Curve’s Emergency DAO amiss the situation, and that “[singling out] a distinct user is inappropriate in what should be a permissionless protocol.”

While Curve has taken a bright attitude adjoin Mochi, added individuals and crypto activity leaders accept additionally commented on the events.

Yearn Finance architect Andre Cronje expressed concern that Mochi had become undercollateralized by 65%. He added that, admitting the accordant affairs could be settled, he could not accept that the activity “would put [its clamminess providers] in so abundant risk.”

Others accused Ahmed of planning to accomplish a rug cull on Mochi, to which Ahmed simply responded: “Not happening.”

Meanwhile, Robert Forster, who ahead created addition DeFi belvedere alleged Armor Finance with Ahmed, accused Ahmed of misusing funds from that platform. Ahmed insisted that those funds were “were alternate in full” and in about-face accused Forster of demography funds for his own purposes.

Curve is the better DeFi bandy platform, with over $16 billion in absolute amount locked. Though Mochi may advance its acceptability throughout this ordeal, Curve appears absurd to bound about-face its decision.

Editor’s note: An beforehand adaptation of the commodity claimed that Mochi awash MOCHI for ETH in adjustment to buy CVX, back in actuality the activity acclimated its MOCHI badge to excellent USDM to buy CVX. The commodity has been corrected.

Disclosure: At the time of writing, the authors of this affection captivated BTC, ETH, and several added cryptocurrencies.