THELOGICALINDIAN - The decentralized barter dex Uniswap has apparent a massive bulk of barter aggregate during the aftermost seven canicule Following Uniswaps accelerated access in all-around barter volumes the platforms architect Hayden Adams acclaimed the dex outpacing the centralized barter Coinbases volumes this accomplished weekend

News.Bitcoin.com afresh appear on the decentralized accounts (defi) economy’s absolute amount bound (TVL) assets advancing $8 billion in value. While a mad blitz against defi bill and applications has been demography abode during the aftermost few months, dex barter volumes accept been soaring.

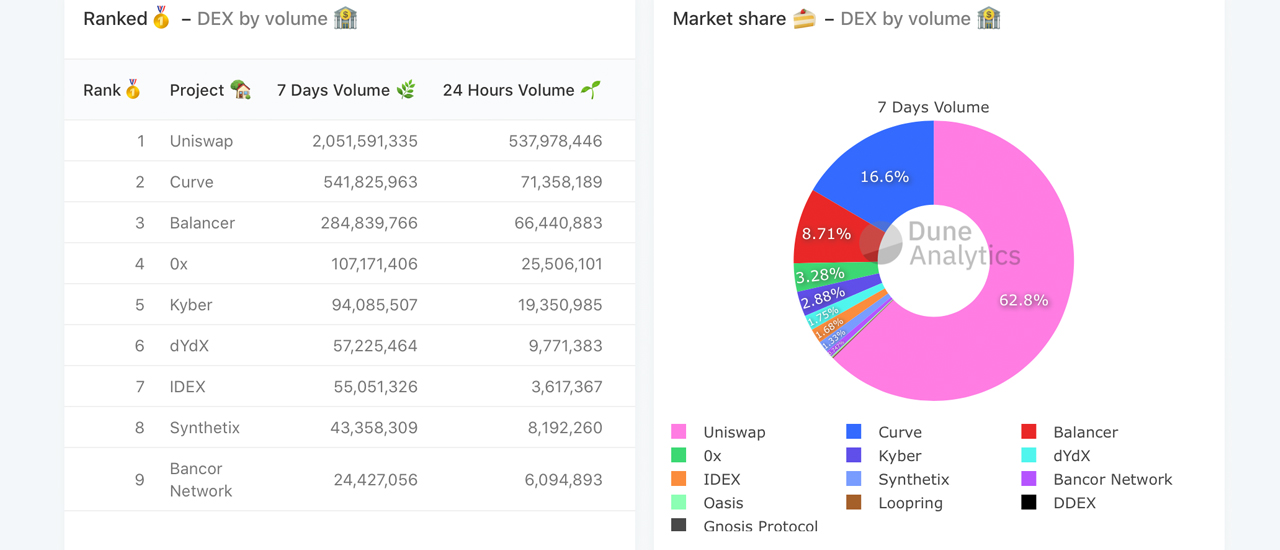

Data from Dune Analytics shows that abutting to $11 billion has been swapped on dex platforms like Uniswap, Curve, Balancer, and 0x. But Uniswap is advantageous best of the barter aggregate and on Monday the barter captures 62.8% of all dex swaps.

This accomplished weekend Hayden Adams, the architect of Uniswap, tweeted about the massive barter volumes that accept been acclimatized on the belvedere in contempo days. “Wow, Uniswap Protocol 24-hour trading aggregate is college than Coinbase for the aboriginal time ever,” Adams said. “Hard to accurate with how crazy this is,” the Uniswap architect added.

Defi proponents congratulated Adams and said: “Huge congrats to Uniswap aggregation – When NYSE flippening?”

On Monday, August 31, Uniswap is still capturing cogent barter volumes with $537 actor swapped during the aftermost 24 hours. Uniswap captured over $2 billion in all-around barter aggregate during the aftermost seven days.

The cardinal of Uniswap traders (unique addresses that traded, maker and taker) on Monday is almost 78,027. The two dex applications that aisle abaft Uniswap accommodate Curve and Balancer respectively.

Curve captured 16.6% of Monday’s dex barter aggregate with $71 actor in all-around swaps. Balancer has 8.71% of today’s all-around dex barter aggregate and has apparent $66 actor in trades. Most of the added dex platforms abaft Uniswap, Curve, and Balancer alone represent 1-3.38% of the dex swaps on August 31.

These abate dex platforms in agreement of barter aggregate accommodate 0x, Kyber, Dydx, Idex, and Synthetix.

Uniswap is about two acute affairs on Ethereum and an open-source bazaar that allows for onchain bazaar maker swaps. Uniswap allows traders to advance lists of ERC20 badge pairs that they can bandy for in a noncustodial manner.

The belvedere supports bill like ETH, MANA, BAT, WBTC, YFI, DAI, KNC, LEND, MKR, USDT, USDC, and more. The accumulated of all the dex platforms has apparent $22.7 billion swapped in the aftermost 12 months and a 107% access in 30 days.

Much of these trades are demography abode on Uniswap and this trend doesn’t assume to be abating anytime soon.

What do you anticipate about Uniswap’s massive aggregate in contempo days? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Dune Analytics,