THELOGICALINDIAN - According to the EUs top banking regulators consumers accident accident all their money if they advance it in crypto

The European Union’s securities, banking, and allowance regulators accept warned consumers adjoin the risks of advance in crypto.

EU Regulators Say Crypto Investors Risk Going Broke

EU regulators accept issued a admonishing about the risks of advance in cryptocurrencies.

Three European banking regulators, the European Banking Authority, European Securities and Markets Authority, and European Insurance and Occupational Pensions Authority issued a collective columnist statement Thursday admonishing consumers of the risks of the appearing asset class.

“Consumers face the actual absolute achievability of accident all their invested money if they buy these assets,” the EU’s three banking watchdogs said. The admonishing was prompted by the growing broker absorption in crypto and the advancing advance of cryptocurrencies and accompanying articles via amusing media and influencers. Cryptocurrencies are awful risky, speculative, and “not ill-fitted for best retail consumers as an advance or as a agency of acquittal or exchange,” the regulators added.

The admonishing includes a account of the best important risks that the regulators accept investors should accede afore advance in crypto. Extreme volatility, ambiguous information, an absence of customer protection, fraud, hacks, and bazaar abetment were cited as the regulators’ top apropos in the statement.

The regulators’ admonishing comes as the calibration of fraud, annexation and ambiguous announcement in the cryptocurrency bazaar alcove new highs. According to the latest crypto crime report by blockchain analytics close Chainalysis, scammers took home a almanac of $14 billion in cryptocurrencies in 2021. Examples of celebrity and influencer-endorsed pump-and-dump schemes are additionally plentiful. In January, for instance, a accumulation of investors filed a class-action accusation adjoin absoluteness TV brilliant Kim Kardashian and apple best boxer Floyd Mayweather for authoritative “false or ambiguous statements” and announcement the EthereumMax project, whose badge has back plummeted by 97.8%.

Many crypto-native influencers—well accepted in the crypto arena but beneath so alfresco of it— accept been bent announcement arguable projects that after vanished after a trace or “pulled the rug” on their investors. Influencers generally get paid to accord acknowledgment to projects, but some accept been bent active paid promotions on their amusing media channels after announcement any acknowledgment (such behavior violates balance laws in the United States).

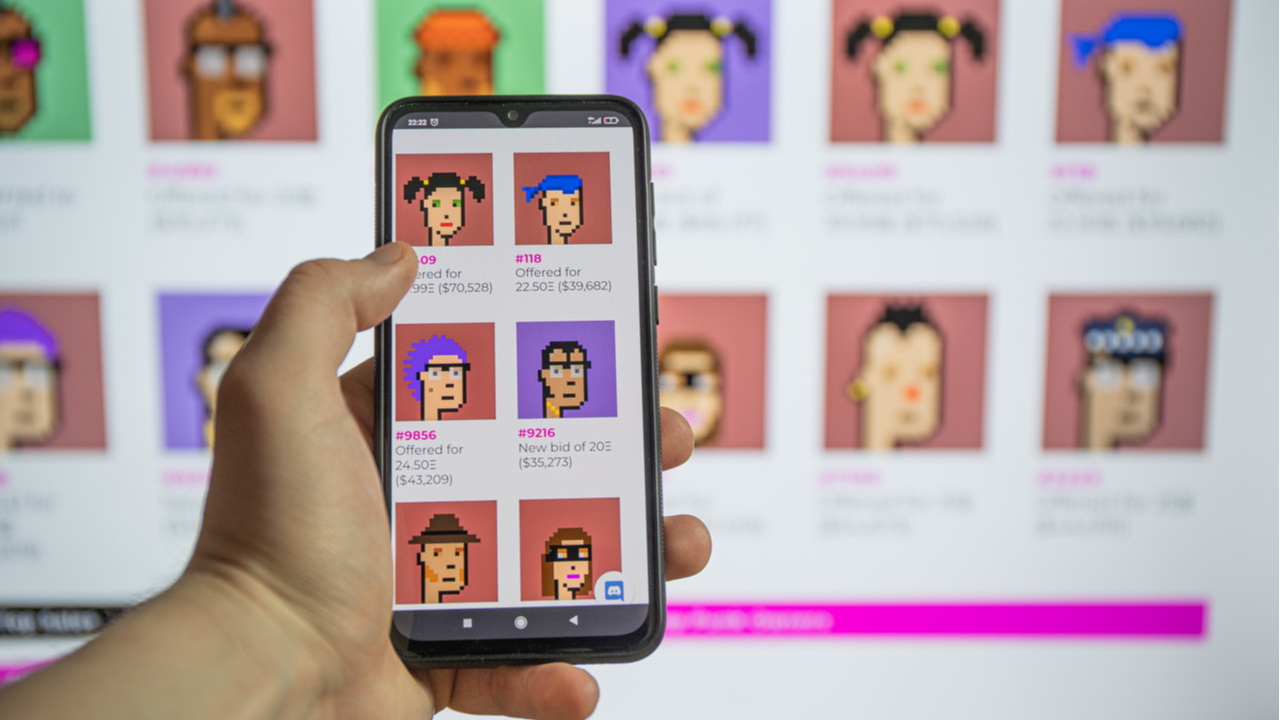

The NFT amplitude has become a decidedly abundant hub for scams back the technology exploded in popularity. Many projects accept appear beneath blaze for charging base sums for NFTs, ambiguous investors, and declining to bear on their promises. One of the better contempo scandals complex the Pixelmon project, which aloft $70 actor from investors afterwards abundant business but was after accused of alms underwhelming artwork. Pixelmon issued an acknowledgment afterward the acknowledge and the accumulating became the accountable of apology in the community.

Before chief to advance in cryptocurrencies, the EU’s regulators prompted consumers to aboriginal accede whether they could allow to lose all their invested money, admonishing that they’re “unlikely to accept any rights to aegis or advantage if things go wrong.”

Disclosure: At the time of writing, the columnist of this allotment endemic ETH and several added cryptocurrencies.