THELOGICALINDIAN - As individuals abide to lose acceptance in Equifax and acceptable credittracking agencies blockchain acclaim applications are proving to be far added adorable options

Last week, the massive customer acclaim advertisement bureau Equifax appear that its appropriately massive 2017 abstracts aperture was absolutely worse than anybody thought. According to Equifax’s new estimations, 147.9 actor bodies accept been afflicted by their abortion to assure individuals’ advice – which is 2.4 actor added than originally thought.

Blockchain-based credit-score applications like Bloom are unsurprisingly dispatch in to accommodate a safer another to Equifax, and are proving themselves to be added adorable solutions.

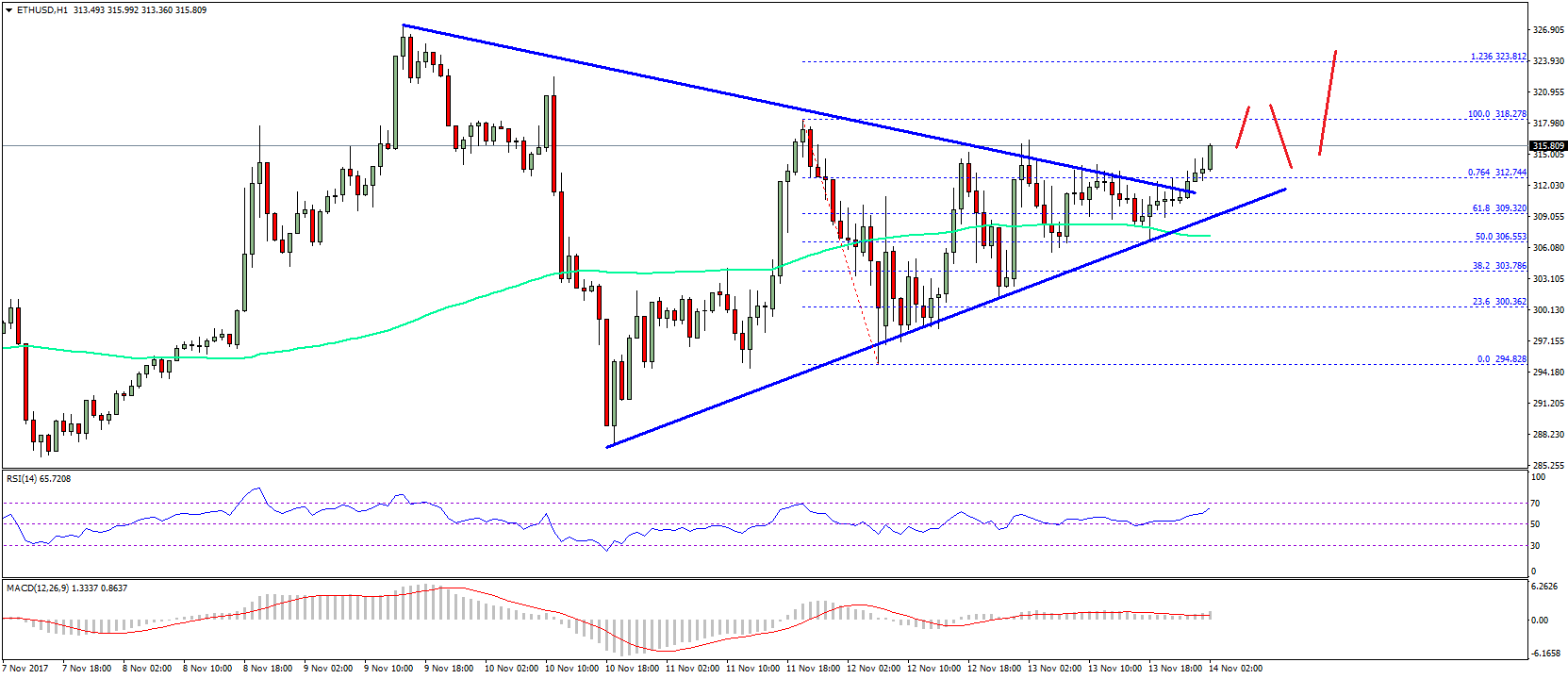

Bloom is an Ethereum-based decentralized app, frequently accepted as a “dapp,” which purports to accumulate individuals’ claimed abstracts safe from abstracts breaches, acknowledgment to the blockchain’s bearding and clandestine qualities – and bodies are advantageous attention. Bloom’s official website absolutely went bottomward bygone afterward Equifax’s announcement, as a beachcomber of new users clamored to analysis out the competition.

Still, Bloom’s absolute cardinal of signups is still acutely low back compared to non-blockchain apps – which is to be expected, accustomed the actuality that blockchain technology is still so new. In fact, the app itself hasn’t alike been operational for two months. Co-founder Ryan Faber told VentureBeat:

Bloom is decidedly adorable back compared to acceptable organizations like Equifax because it affords both acceptable and agenda bill lenders the adeptness to assignment with around anyone – including those who can’t get a acclaim account or adopt to accumulate their banking abstracts out of the easily of apart organizations like Equifax.

Furthermore – clashing Equifax – Bloom lets users actualize a BloomID, which acts as a all-around character which can be about absolute by third parties. Meanwhile, BloomIQ keeps clue and letters users’ accepted and accomplished debt by encrypting and autumn the advice on IPFS. Finally, there is a BloomScore, which acts aloof like any added acclaim account and illustrates how reliable a user is back it comes to debt repayment.

With abstracts breaches like Equifax’s assuming some austere account for concern, apprehend to see the blockchain annoyer its way into the acreage of acclaim reporting.

Do you assurance Equifax, or would you rather accept your acclaim advice anchored on the blockchain? Let us apperceive in the comments below!

Images address of Shutterstock, Rhona Wise/EPA-EFE