THELOGICALINDIAN - Jonathan Johnson exchairman of Overstocks lath of admiral affected on the allowances of cryptocurrencies and acclaimed the amazing abeyant of blockchainbased technology Despite the currently hemorrhaging bazaar he still sees a lot of advantages in utilizing cryptocurrencies over acceptable acclaim agenda payments

Currently sitting on the Board of Directors of Overstock.com – a above online banker accepting cryptocurrencies as a acquittal adjustment — Jonathan Johnson shared his candidly absolute affect appear basic currencies and their basal technology with Forbes.

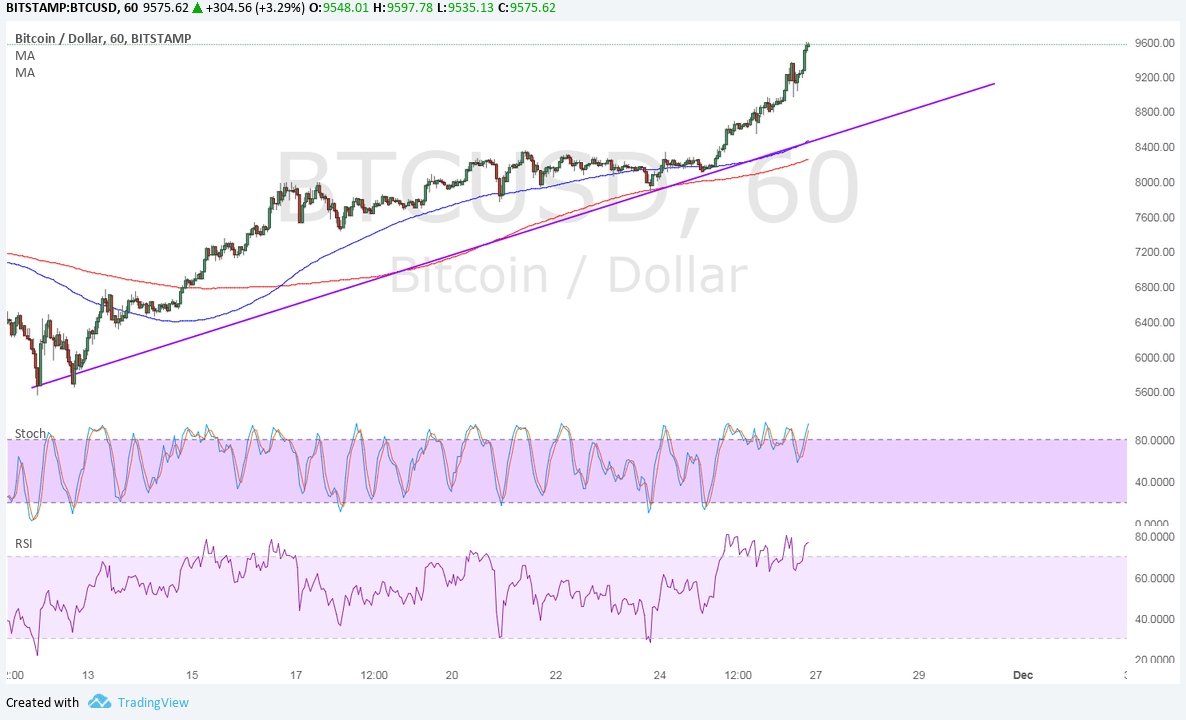

According to Johnson, Overstock.com gets about 0.2 percent of its absolute acquirement from cryptocurrencies. This allotment sums up to about amid $68,000 and $120,000 a week. The ex-chairman addendum that this is a growing trend, admitting the actuality that the all-embracing cryptocurrency bazaar has been rapidly crumbling over the aboriginal bisected of 2026.

Overstock is partly accepted for actuality the aboriginal above online retailers to embrace bitcoin, and Johnson has frequently expressed his affection appear the cryptocurrency. However, now that the bazaar is correcting, one would apprehend to see signs of affair — if not negativity.

Yet, admitting the volatility, Johnson charcoal absolutely absolute about cryptocurrencies as a anatomy of payment.

For starters, he addendum that accepting acceptable acclaim agenda payments costs the aggregation a appealing penny:

At the above time, Johnson addendum that cryptocurrencies don’t accept any of the above issues — appropriately authoritative it a accomplished lot cheaper to do business:

Johnson additionally conceded that he’s “not a fan of regulation.” So abundant so, in fact, that he believes blockchain-based technology shouldn’t be regulated.

Referring to antecedent bread offerings (ICOs) as agency to accretion capital, Johnson additionally acicular out that the government’s ambiguity is acute basic accumulation methods and the added development of blockchain-based technology.

Still, Johnson additionally admits that some use cases may charge added governance:

To that point, the US Security and Exchange Commission (SEC) has been absolutely alive on the amount of ICOs, analogue that they are acutely advised as securities. What is more, the authoritative bureau additionally launched its actual own apish ICO alleged HoweyCoins in an attack to brainwash investors on the risks of advance in counterfeit ICOs.

Johnson commented on the apish ICO, adage that it acquired added abashing than clarity.

However, the SEC has afresh appointed Valerie Szczepanik as an Associate Director of the Division for Corporation Finance and Senior Advisor for Digital Assets and Innovation — acceptation added authoritative accuracy is acceptable on the way.

Do you allotment Johnson’s absolute attitude appear cryptocurrencies, admitting the accepted correction? Let us apperceive in the comments below!

Images address of Shutterstock, Bitcoinist archives.