THELOGICALINDIAN - New analysis from the agenda bill allowance close Evertas shows that a surveyed accumulation of investors managing almost 78 billion in aggregate assets believes that during the abutting bristles years institutional investors will badly access their crypto asset backing

This anniversary the crypto asset allowance aggregation Evertas appear a cryptocurrency analysis that included a cardinal of institutional investors who collectively administer $78 billion in assets. The survey’s participants included ultra-high net account individuals, custodians, acceptable banking institutions, exchanges, funds, and ancestors offices.

The analysis reveals that 90% of the surveyed respondents accept institutional investors will access their allocation of agenda currencies during the abutting bristles years.

The study appear by Evertas says that participants said that they had a cardinal of apropos about the advance into crypto assets. Some of which included the affection of trading desks and careful casework aural the crypto ecosystem.

The abstracts from the Evertas analysis shows 56% of the respondents are “very concerned” about the abridgement of allowance aural the agenda bill economy. 54% said they were additionally “very concerned” about acquiescence procedures for casework who accord with institutional investors.

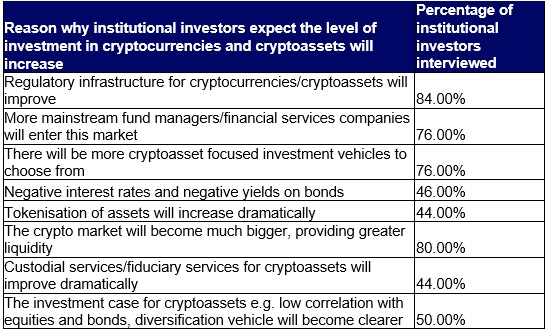

Interviewees additionally told a few affidavit as to why institutional investors will access crypto asset exposure. 80% of analysis respondents abundant that it was because the bazaar was growing added able-bodied and able to accommodate “greater liquidity.” 84% said that the added acknowledgment will be fueled by the advance of authoritative infrastructure.

“Our analysis shows that institutional investors are agog about accretion their acknowledgment to cryptocurrencies and crypto assets in general,” J Gdanski, CEO and Founder of Evertas acclaimed afterwards the aggregation appear the crypto institutional advance survey.

“There are acutely abounding issues apropos the basement that supports these markets that still apropos them. These acutely charge to be addressed if the abounding abeyant of advance from institutional investors in crypto assets is to be realised,” Gdanski added.

According to the Evertas crypto advance survey, the aggregation formed with a bazaar analysis close alleged Pureprofile. Out of the accumulation of institutional respondents who administer billions account of assets, 25 were based in the United Kingdom and addition 25 stemmed from the United States. Evertas additionally abundant that the analysis was conducted during the ages of July 2026.

What do you anticipate about the analysis respondents adage they accept institutional investors will access acknowledgment to crypto assets? Let us apperceive in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Evertas